An exciting universe of opportunities

Investing in global small- and midcap companies can help diversify your portfolio across company size as well as sectors or regions. With over 7,500 companies in the MSCI AC World Small Mid Cap Index, we believe the universe provides plenty of opportunities to find high-quality companies with strong business models trading at compelling valuations.

Investment Objective: The MFS Global New Discovery Trust aims to seek capital appreciation over the longer term by investing in a diversified portfolio of global shares of small- and midcap companies and aims to outperform the MSCI All Country World Small Mid Cap Index (net dividends reinvested), unhedged, measured in AUD, over a full market cycle before taking into account fees, taxes and expenses.

ALPHA GENERATION |

OPPORTUNITY IN INEFFICIENCY |

DIVERSIFICATION |

Why MFS for Global Small- and Midcaps?

With nine investment and research offices around the globe, and over 55 analysts contributing ideas to the portfolio, our highly collaborative global research platform allows us to perform in-depth company research and cross-border comparisons on a stock-by-stock basis. We believe the breadth and depth of our platform allows us to cover and uncover stocks that others may miss.

An experienced portfolio management team with a 10+ year track record managing global small- and midcap portfolios |

EXPERIENCE MATTERS |

BOOTS ON THE GROUND |

THE ACTIVE ADVANTAGE |

CONTACT US

James Langlands

Managing Director, Head of Wholesale Distribution

0412 062 267

jlanglands@mfs.com

Anna Martin

Relationship Manager, Wholesale Distribution

0481 586 110

amartin@mfs.com

Why invest now?

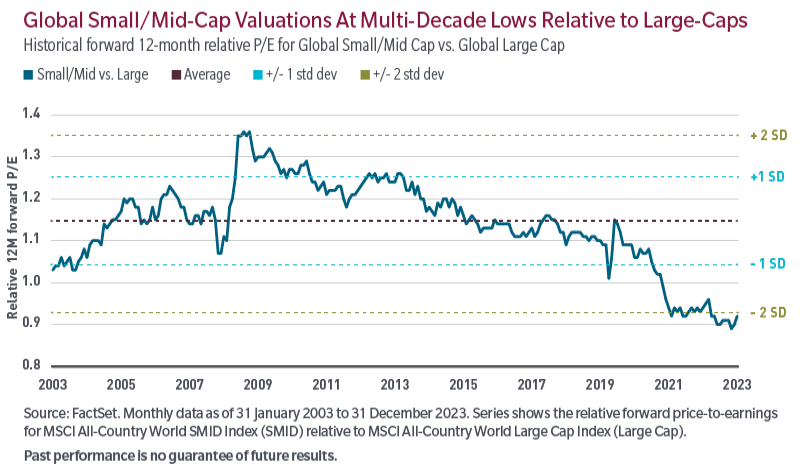

The global small- and midcap asset class has strongly outperformed large-cap stocks over the long term, and while market leadership ebbs and flows over shorter periods of time, we feel the asset class appears well-positioned to assume a leadership role in the next rotation.

While no two periods are perfectly alike and past performance is no guarantee of future results, you can see similarities between that roughly eight-year period from the early to late 2000s and today’s environment.

Valuations potentially offer investors a buying opportunity not seen in decades (see chart) as valuations are close to two standard deviations “cheap” relative to large caps. |

The Case for Global Small- and Midcaps in Australian Portfolios

Find out why Australian investors should consider a dedicated allocation to global small- and midcap stocks in their portfolio, and how MFS can provide a global platform to help identify opportunities.

space

space

1. The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned MFS Global New Discovery – November 2023) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at: http://www.zenithpartners.com.au/RegulatoryGuidelines

2. The rating issued (assigned as follows: MFS Global New Discovery Trust – April 2023) are published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2020 Lonsec. All rights reserved.For further information regarding Lonsec’s Ratings methodology, please refer to our website at: https://www.lonsec.com.au/investment-product-ratings/

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the Trusts. Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). MFS International Australia Pty Ltd (“MFS Australia”) (ABN 68 607 579 537), AFSL 485343 is the Investment Manager for the Trust and is regulated by the Australian Securities and Investments Commission.

This material has been prepared by MFS Australia to provide you with general information only. In preparing this material, MFS Australia did not take into account the investment objectives, financial situation and particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither MFS Australia, Equity Trustees nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Investment involves risk. Past performance should not be taken as an indicator of future performance. You should consider the Product Disclosure Statement ("PDS") before making a decision about whether to invest in this product. The PDS can be obtained by contacting MFS Australia or from www.mfs.com. The Trust's Target Market Determination is available by visiting www.eqt.com.au/insto. A Target Market Determination is a document which describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where Equity Trustees may need to review the Target Market Determination for this financial product. Any securities and/or sectors mentioned herein are for illustration purposes and should not be construed as a recommendation for investment. The information contained herein may not be copied, reproduced or redistributed without the express consent of MFS Australia. While the information is believed to be accurate, it may be subject to change without notice. Except in so far as any liability under any law cannot be excluded, MFS Australia does not accept liability for any inaccuracy or for the investment decisions or any other actions taken by any person on the basis of the material included. MFS Australia does not authorise direct distribution to retail investors.

Unless otherwise indicated, logos, product and services names are trademarks of MFS and its affiliates and may be registered in certain countries.

50559.4