Conclusion

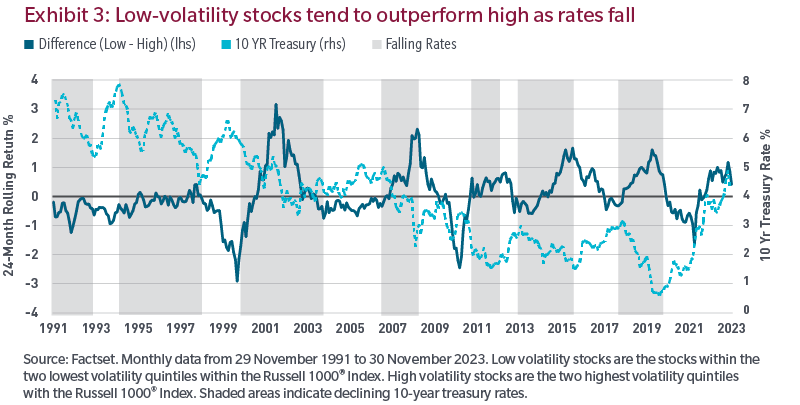

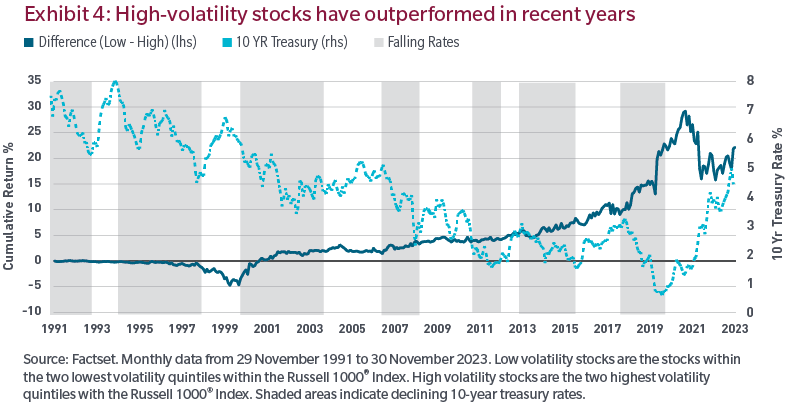

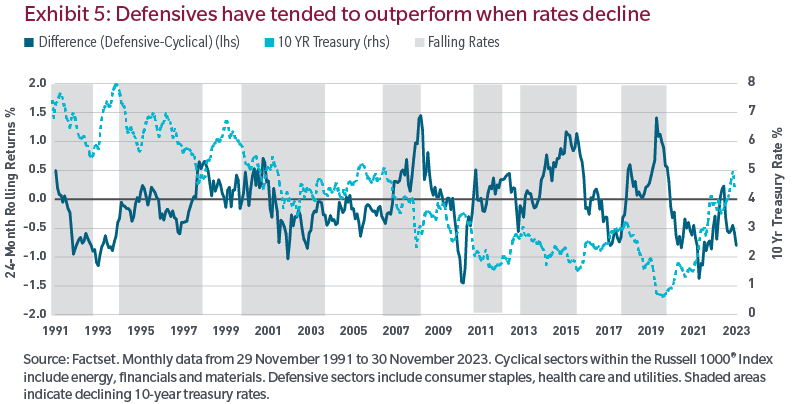

Our analysis was conducted to address how low volatility stocks may perform considering the market consensus rate assumptions, which currently anticipate rate cuts, and a declining rate environment for 2024. For this environment, recent cycles suggest that low volatility stocks have typically outperformed higher volatility stocks and, going forward, may provide diversification to portfolios with exposure to higher volatility and cyclical stocks.

Frank Russell Company (“Russell”) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed. Past performance is no guarantee of future results.