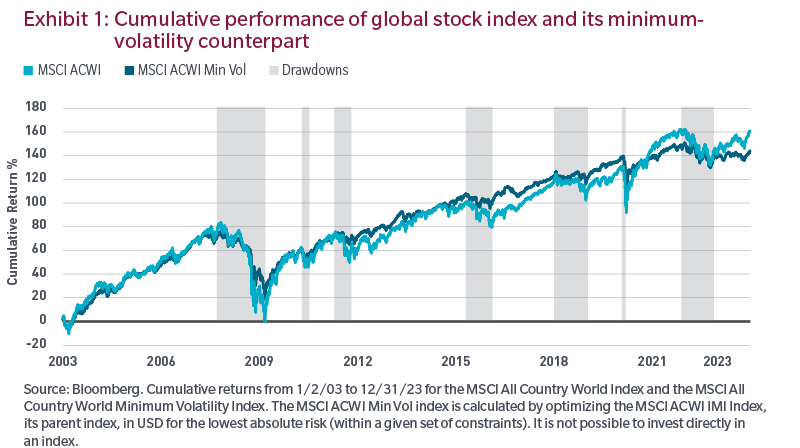

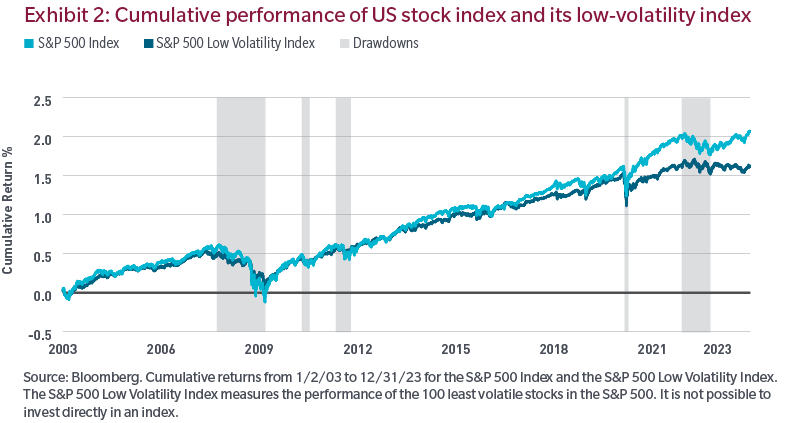

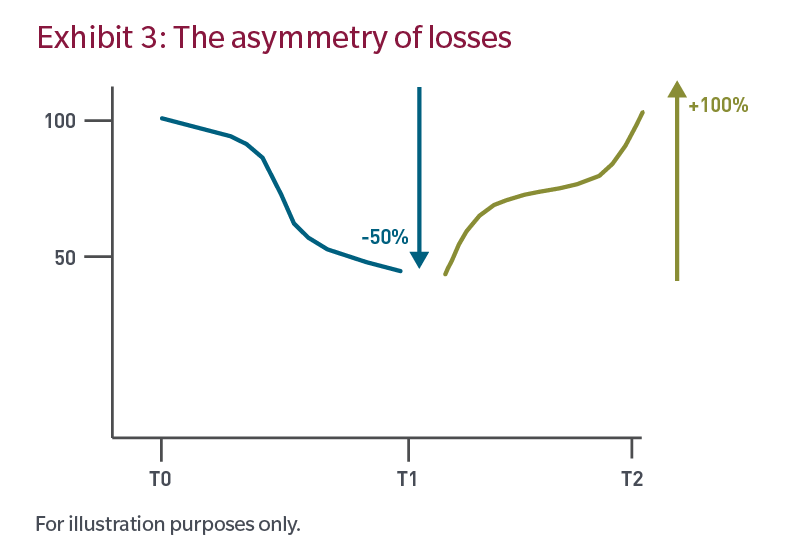

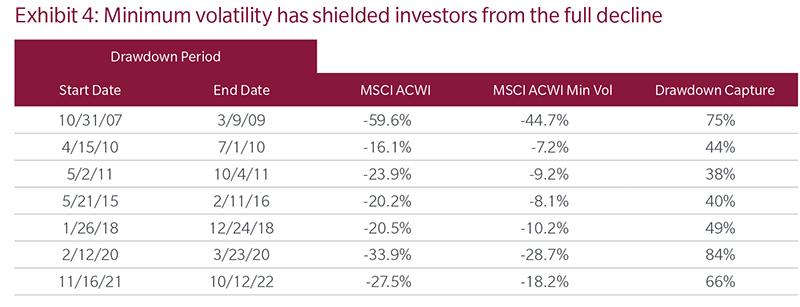

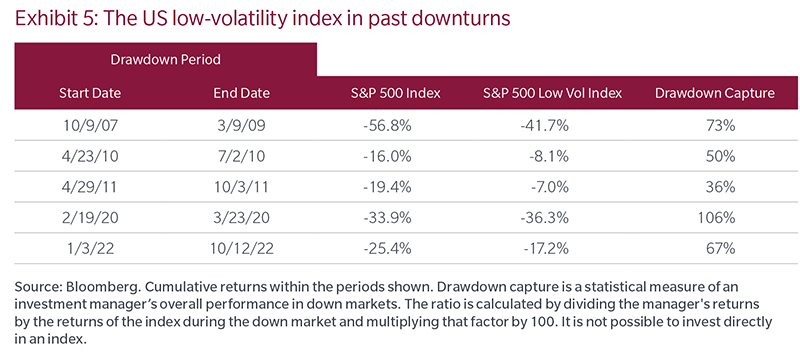

In conclusion, we believe that lower-risk strategies highlighted by minimum- and low-volatility indices have managed to keep up with their cap-weighted counterparts while also meeting expectations to provide downside protection in the most severe drawdowns, the early 2020 drawdown being the exception. We believe that a low volatility investment approach may provide solid risk-adjusted returns and a smoother ride to solid long-term capital appreciation. Over a full market cycle with ups and downs, a low volatility portfolio that avoids big losses should compound capital at a higher rate, and in doing so, it may “win by not losing”.

Endnotes

1 Source, Factset, as of 12/31/22.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Index data source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or fi nancial products. This report is not approved, reviewed or produced by MSCI.

“Standard & Poor’s®” and S&P “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS’ Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affi liates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affi liates make any representation regarding the advisability of investing in such products.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.