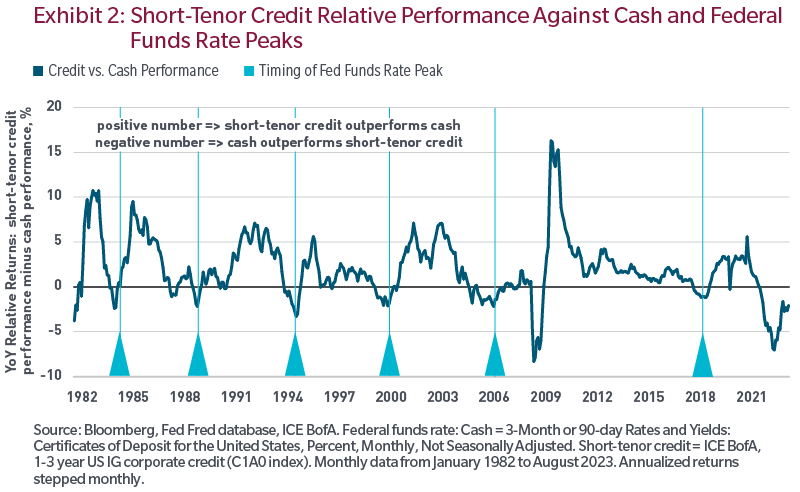

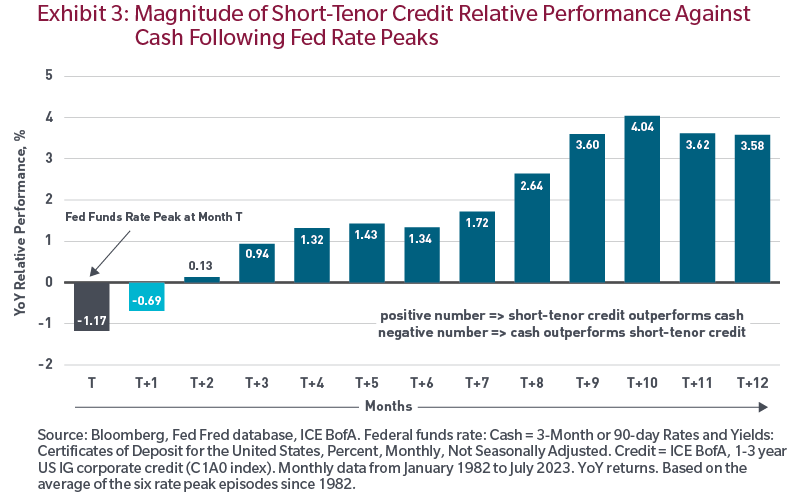

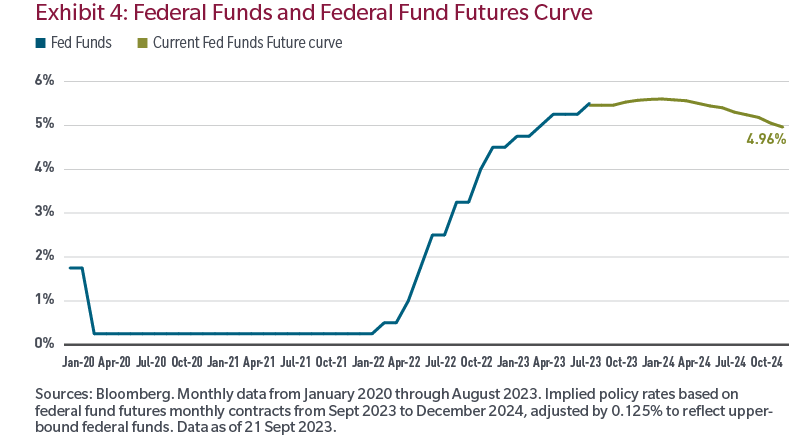

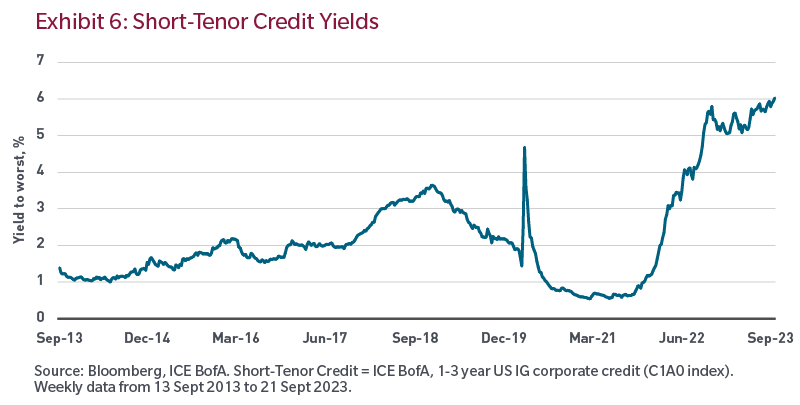

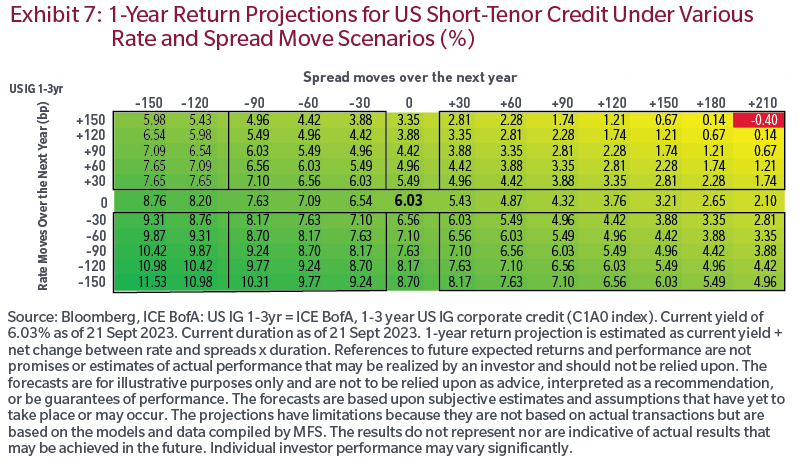

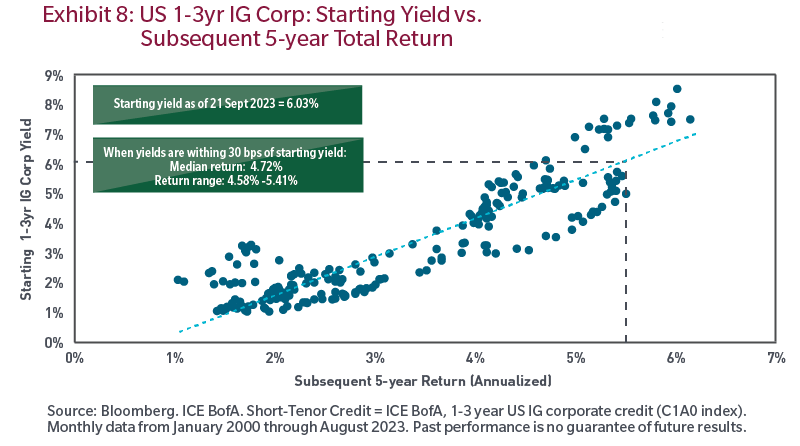

Overall, with the end of the Fed’s tightening cycle upon us, we believe it may be time to retire the CD player. Indeed, we believe cash is likely to underperform short-tenor credit in the period ahead. We are constructive about deploying some credit risk as an alternative to the cash allocation, reflecting the attractive valuation, the improved growth backdrop and the favorable inflation dynamics

Endnotes

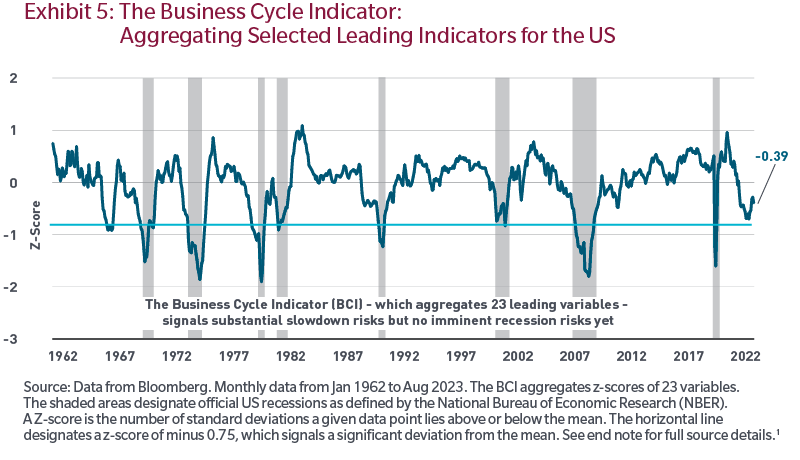

1 The BCI incorporates the following variables: Initial jobless claims (Department of Labor), Building permits (US Census Bureau), Philadelphia Fed business outlook survey diffusion index (Philadelphia Fed), New home sales (US Census Bureau), Consumer sentiment index (University of Michigan), Consumer sentiment index Conference Board), Capex expectations index aggregated from the Fed regional surveys (New York, Richmond, Dallas, Kansas City, Philadelphia), ISM new orders (Institute for Supply Management), Corporate profit margin changes (Bureau of Economic Analysis), Corporate profit growth (Bureau of Economic Analysis), Corporate profit margin level (Bureau of Economic Analysis), Output gap (Congressional Budget Office), US Consumer Price Index – Energy (Bureau of Labor Statistics), Empire State manufacturing survey (New York Fed), National Association of Home Builders Market Index (NAHB), NFIB Small Business Optimism Index (NFIB), Housing starts (Census bureau), Senior Loan Officer Opinion Survey, Net % of Domestic Respondents Tightening Standards for C&I Loans for Small Firms (Fed), ISM manufacturing (Institute for Supply Management), ISM Services (Institute for Supply Management), Investment ratio: Fixed investment as % of GDP, transformed into monthly series through interpolation (Bureau of Economic Analysis), Compensation Ratio change. Personal Income Compensation of Employees Received as % of GDP. 12-month change in the ratio (Bureau of Economic Analysis), Unit labor cost (Bureau of Labor Statistics).

*The Big Mac, which is a hint at big macro, is a periodic global fixed income note that discusses relevant topics in the global fixed income/global macro environment.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affi liates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The views expressed are those of the MFS Investment Solutions Group within the MFS distribution unit and may differ from those of MFS portfolio managers and research analysts. These views are subject to change at any time and should not be construed as the Advisor’s investment advice, as securities recommendations, or as an indication of trading intent on behalf of MFS.