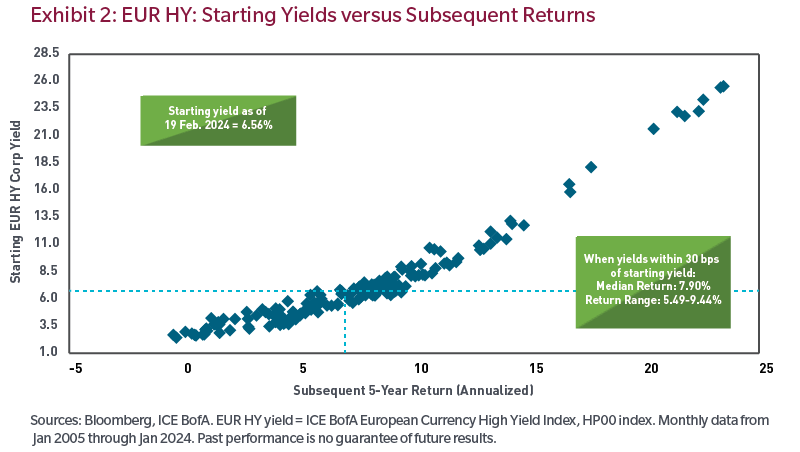

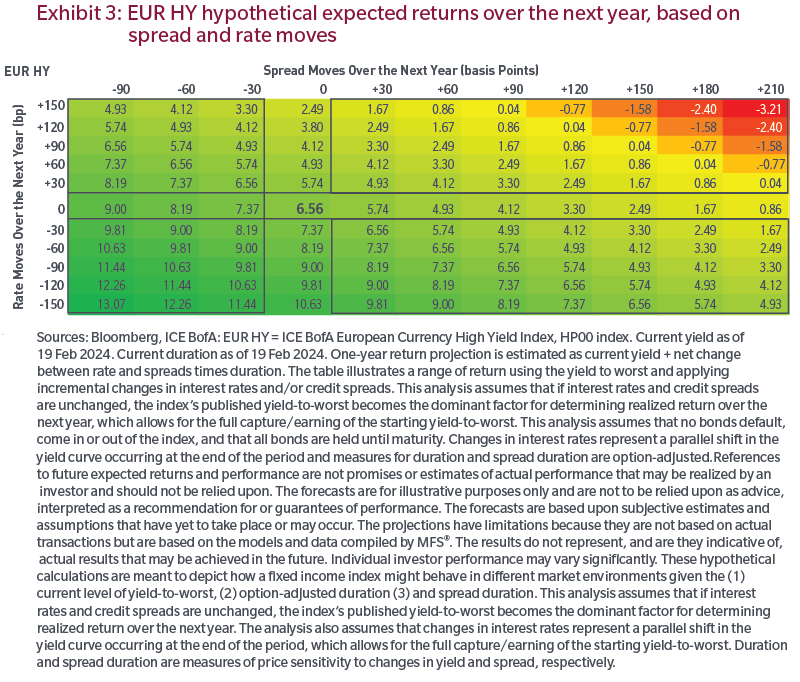

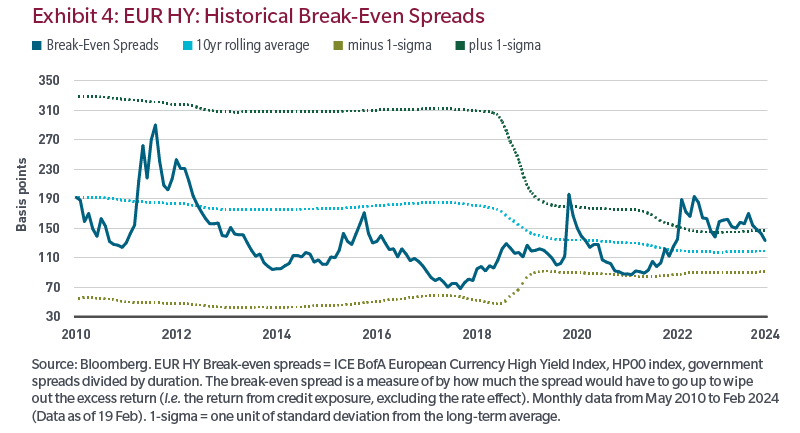

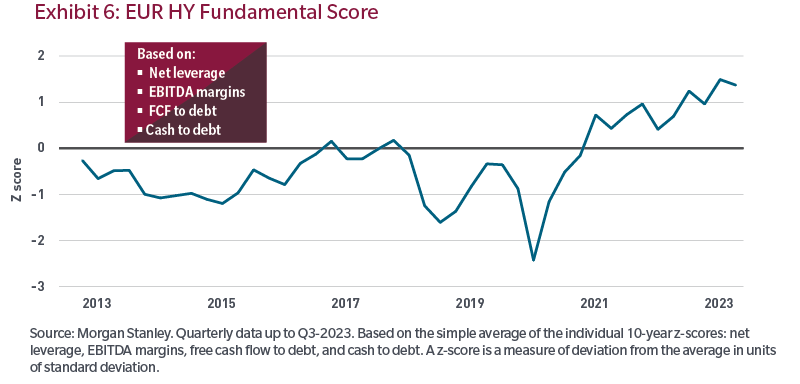

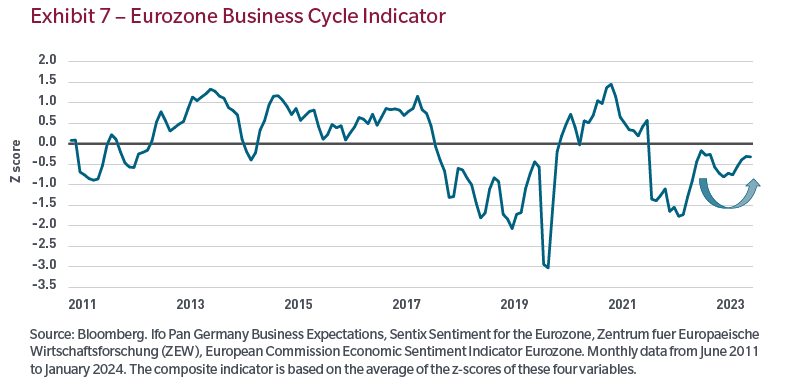

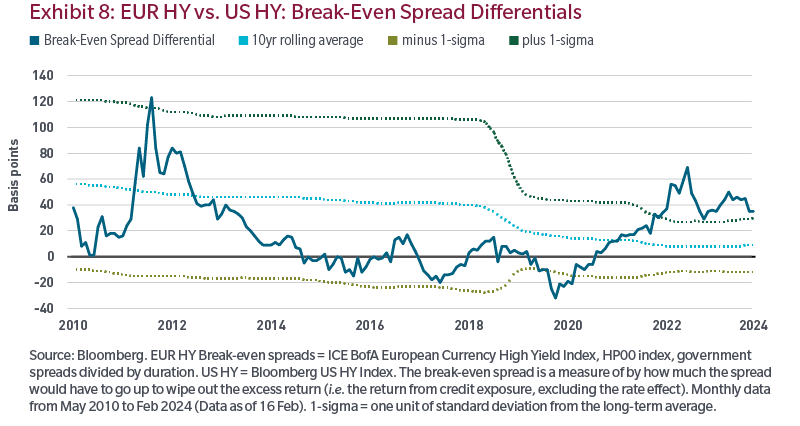

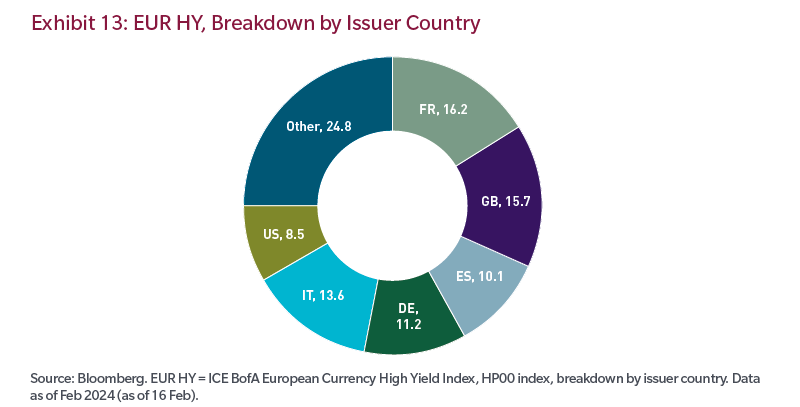

Overall, we believe that EUR HY is an asset class that deserves to be on investors’ radar given its attractive valuation characteristics, fundamental strength, favorable technicals and long-term performance record relative to comparable asset classes.

Investments in debt instruments may decline in value as the result of, or perception of, declines in the credit quality of the issuer, borrower, counterparty, or other entity responsible for payment, underlying collateral, or changes in economic, political, issuer-specific, or other conditions. Certain types of debt instruments can be more sensitive to these factors and therefore more volatile. In addition, debt instruments entail interest rate risk (as interest rates rise, prices usually fall). Therefore, the portfolio's value may decline during rising rates.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affi liates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The views expressed herein are those of the MFS Investment Solutions Group within the MFS distribution unit and may differ from those of MFS portfolio managers and research analysts. These views are subject to change at any time and should not be construed as the Advisor’s investment advice, as securities recommendations, or as an indication of trading intent on behalf of MFS.