Who stands to benefit?

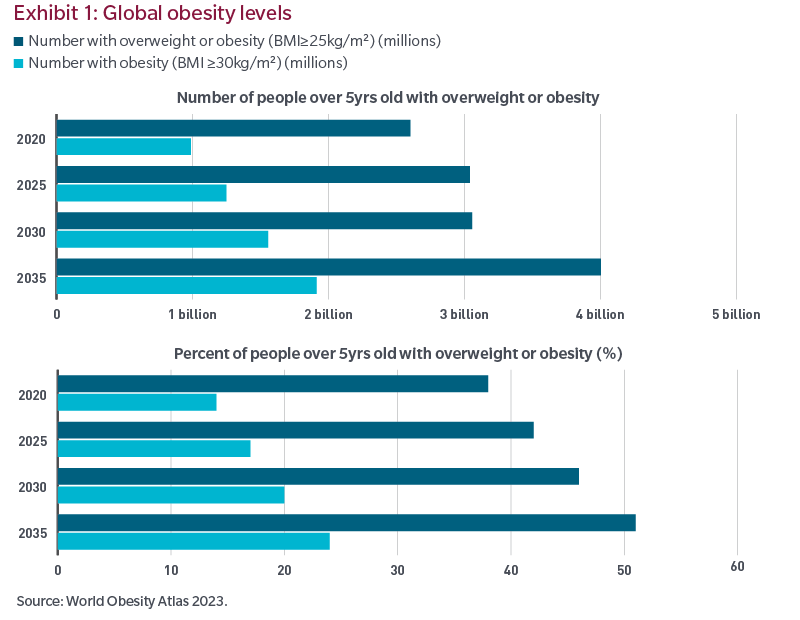

Given their lead in developing GLP-1’s, Novo Nordisk and Eli Lilly have been the early winners and their share prices have reflected the market’s optimism for these drugs. Their success is predicated on the size of the markets for treating diabetes — and more specifically, obesity — and while a stretch, and covering a wide range of potential outcomes, investors’ bullish projections are possible given the sheer magnitude of the potential market.

In theory, if GLP-1 users lose weight and live healthier, longer lives, there are a number of industries that could be long-term beneficiaries. Retirement living real estate and services would be an area of growing demand if people live longer and require care for more years than they otherwise would have. Food and beverage companies that provide low fat, high protein products may also be beneficiaries. Some investors have speculated that airlines could benefit as lighter passengers, on average, could reduce fuel usage. The list is long and varied and the broader impacts will evolve based on uptake and efficacy.

What are the limitations of wide-spread adoption?

Without insurance, high ongoing costs of between $1,000 and $1,300 per month and undesirable side effects are some of the headwinds to growing the user base. Wide adoption will depend on the willingness of insurers to help cover costs and doctors to prescribe these medications for weight loss. The administrative burden for doctors is elevated and insurers have established a variety of requirements such as high BMI plus a comorbidity, or provide coverage only after three months of self-cover. However, insurers are weighing future medical costs that might arise from not seeking treatment for obesity (e.g., heart and artery diseases, sleep apnea, hypertension, etc.) versus paying for GLP-1 treatment today.

Aside from the financial burden, there have been reported cases of undesirable side effects of GLP-1 use. A study published last year followed 4,255 people with commercial health plans who had been given new prescriptions for GLP-1 agonists between January and December 2021 and had a diagnosis of obesity or prediabetes. Of those who began taking GLP-1 drugs during the study, only 32% remained on them for a full year. Part of the reason for a drop-off in users were undesirable gastrointestinal side effects.

In addition, users were put-off by needing to take a weekly injection or coordinating a daily pill that required them to avoid food and drink for 30 minutes before and after.

What are some other concerns with the drugs and their societal impacts?

- These improved GLP-1s and the dosages that have been approved for weight loss are relatively new molecules — launched within the past five years — so their full side effects or long-term efficacy are unknown.

- Patients may experience muscle loss, and muscle mass is important for overall health and maintaining lower fat levels.

- Patients need to adhere to a strict dosage regimen and potentially remain on the drugs for their lifetime to get the full benefit.

- Limited supply is a concern, creating tension between those needing treatment for critical health reasons and those seeking weight loss for non-life-threatening reasons.

Who may face headwinds?

- Medical technology (medtech): Medical device companies initially faced a steep sell-off as investors feared revenues would be negatively impacted as healthier patients would require fewer hip replacements, heart stents, blood glucose monitors and other devices. A counterpoint is that there are instances where patients must reach a lower weight target before a medical procedure may proceed — and these new drugs could allow users to reach those goals. In aggregate, the medical device industry has recovered from that sell-off.

- Food and beverage levels: These drugs take aim at the largest consumers of food and beverages and decreases their overall consumption levels with estimates in the region of 2% to 15% of calorific intake. Consuming less food could impact unit sales for snacks and beverage companies, restaurants, retailers and the hospitality industry.

- Food and beverage mix: Another question is how will people alter the mix of food and beverages that they consume while on these drugs? Anecdotal evidence suggests that patients focus on increasing protein consumption while reducing their intake of added sugars and high levels of fat. They also shy away from heavily processed foods in favor of more basic foodstuffs such as chicken, fish and vegetables, which would be a detractor to snack food, candy, soda and sugary drink companies as well as the fast-food restaurant categories. Recent studies also indicate that users reduced alcohol and tobacco intake when on these medications.

Recent studies highlight the cohort most likely to be GLP-1 patients also tend to be the largest consumers of the food and beverages most likely to be impacted thereby potentially magnifying the effect on these companies.

Investment implications

In some ways, the GLP-1 trade resembles the investor euphoria around the COVID winners and losers that dominated during 2020–2021. During that time, the market got ahead of itself by projecting current trends forever, resulting in the mispricing of some stocks. While some winners justified their positions, many stocks were swept up in the uncertainty only to recover when sanity prevailed. Unlike COVID, however, GLP-1’s are likely to have long-term implications that will evolve as everyone adapts.

Penetration is never 100% and the range of potential outcomes remains wide and difficult to quantify. Each company will likely be impacted differently based on its unique exposures to the implications of GLP-1 drugs. We have assessed the pharmaceutical, food, beverage and medical device companies that may be impacted by changing consumer trends and their ability to adapt and change their products. Our role is to take risk where we think it will be rewarded — and we will continue do so in a thoughtful way. We firmly believe that a disciplined valuation approach of investing in companies where we have greater confidence in the range of outcomes and that can compound earnings through an economic cycle can lead to a long-term winning strategy — especially during this period of uncertainty. Ultimately, valuation still matters, and exposure to GLP-1 risks is not preventing us from finding opportunities and investing in certain industries.

We’re also keeping an eye on what comes next, which consists of four items: (1) Supply ramping higher to meet demand, (2) insurance company coverage and pricing evolution, (3) additional indications of where these drugs can be successfully administered and (4) an oral version of the drug with fewer limitations to its use. An oral pill that can be taken regardless of food and drink intake would allow for easier usage, and pills are much easier to produce than jabs, unlocking a faster ramp to broader distribution. Ultimately, longevity could help health care and food companies by growing their end-user base.

Conclusion

While we remain in the early innings of the adoption cycle for these drugs, the evolution of GLP1’s and their benefits have caused some turbulence across industries. These are proving to be revolutionary for some, but evolutionary for others. The potential size of the GLP-1 market is supportive for the incumbent manufacturers. However, with many questions still unanswered, it is unwise to make heroic assumptions which appear to be driving some of the market volatility around how this evolves across other industries. This backdrop provides both risk and opportunity as we assess the earnings implications of the widespread adoption of these drugs across industries and companies.

The views expressed herein are those of the MFS Investment Solutions Group within the MFS distribution unit and may differ from those of MFS portfolio managers and research analysts. These views are subject to change at any time and should not be construed as the Advisor’s investment advice, as securities recommendations, or as an indication of trading intent on behalf of MFS.