January 2024

2024 6 Key Themes

Forward-looking snapshot of what we believe will be relevant and may influence the markets and economy.

January 2024

2024 6 Key Themes

Forward-looking snapshot of what we believe will be relevant and may influence the markets and economy.

By JONATHAN W. HUBBARD, CFA Managing Director, Investment Solutions Group, BENOIT ANNE Managing Director, Investment Solutions Group, and BRAD RUTAN, CFA Managing Director, Investment Solutions Group.

Summary

As we enter 2024, there are several key themes that will likely influence the macroeconomic and capital markets environment. Last year, US economic growth rebounded and inflation waned, while Europe and several emerging markets countries struggled to reignite healthy growth. The US Federal Reserve’s hawkishness began to fade toward the end of the year, with the central bank contemplating a lower policy path ahead. However, the European Central Bank, the Bank of England and several others appear less likely to ease as soon. Equity market performance surprised many investors in 2023, ending the year considerably higher than anticipated, although not without periods of considerable drama. One such instance occurred in March when a regional banking crisis prompted the Fed to establish a bank funding program that allowed it to address banks’ liquidity issues. It was a precise, and ultimately effective, response that allowed the central bank to contain the issue while also continuing to keep rates elevated. This allowed the bank to address the crisis while continuing its battle against inflation, one which appears to be moving in the Fed’s favor.

Within capital markets, global equities, as measured by the MSCI AC World Index, rose more than 20% while core fixed income, as measured by the Bloomberg Barclays Global Aggregate Index, broke a two-year losing streak, ending in positive territory. A wave of investor enthusiasm, partially driven by the promise of AI, swept over equity markets through mid-year, driven by the Magnificent Seven, a collection of mammoth US technology companies whose earnings power and balance sheet stability paint a picture of invincibility. However, history tells us that such subsets of stocks seldom travel in lockstep over long periods of time, highlighting the importance of analyzing each of these companies on their individual merits. This will be particularly important as we move into a more challenging investment environment, one with the potential for greater geopolitical instability, elevated sovereign debt levels, higher borrowing costs and shifting global supply chains. More than ever, we believe the cross-pollination of research across our Global Research Platform will be critical to the successful allocation of investor capital.

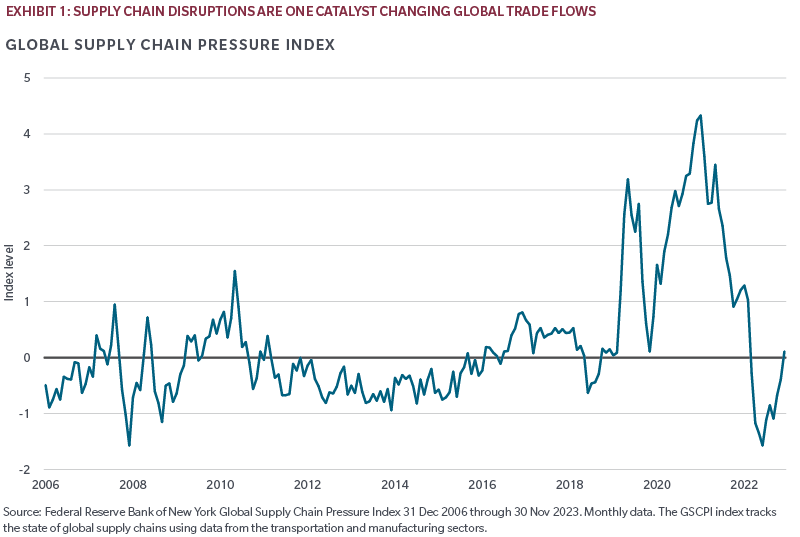

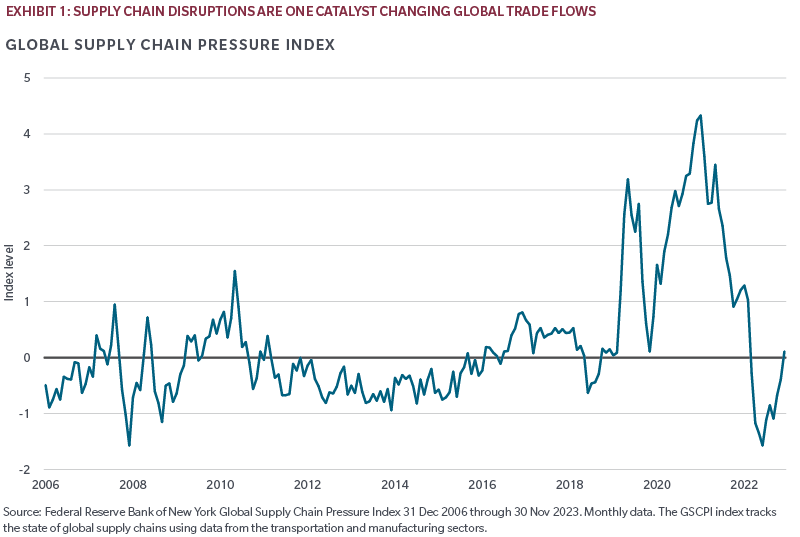

“Reglobalization,” Not Deglobalization

The global trade ecosystem is in a constant state of change, driven by country-to-country relations, specialization in certain industries and myriad economic factors. There have been significant turning points in history that have made a lasting impact on global trade, turning points such as the creation of the Bretton Woods system in 1944, the establishment of the European Economic Community in 1957 and China’s ascension into the World Trade Organization in 2001. More recently, Britain’s exit from the European Union, the passage of the USMCA and US tariffs on certain Chinese imports catalyzed major shifts in trade. The pandemic and Russia’s invasion of Ukraine, both of which dislocated supply chains, disrupted energy flow and stranded corporate assets, further accelerated these shifts. In addition, in key areas such as semi-conductor manufacturing trust among trading partners is on the decline as concerns over national security trump economic efficiencies.

Will the confluence of these events lead to a deglobalized world where comparative advantages are discounted in the name of self-sufficiency and protectionism? We don’t believe so. The benefits of global trade are too great to disregard. However, we see a trend toward reglobalization, where trading partners, supply chain logistics and sovereign alliances shift to a new mix of reshoring, automation, friend-shoring and supply chain redundancies. In the US, corporations are further incentivized to make these shifts through federal financial and policy incentives, most notably the Inflation Reduction Act and the Chips and Science Act. In Europe, policymakers are considering how to best support and incentivize strategic trade relationships to prevent fragmentation. The true beneficiaries of these seismic shifts could be those emerging market economies once left in China’s shadow.

ACTIONS TO CONSIDER |

Geopolitical Risks Become Increasingly

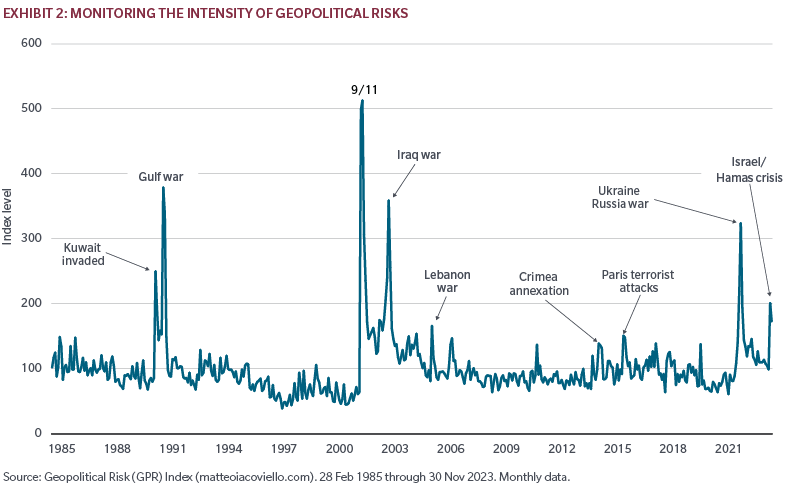

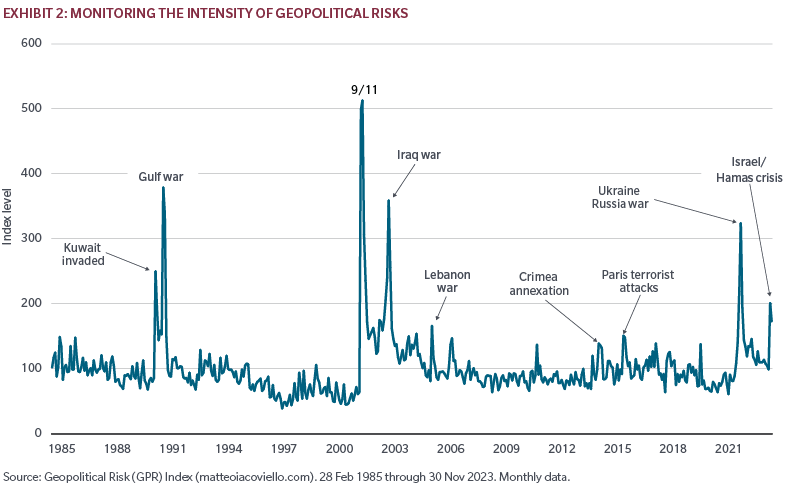

Difficult to Navigate

Following the Ukraine crisis and the Hamas attacks on Israel, the geopolitical backdrop has become more challenging. According to a well-followed geopolitical risk index developed by two Fed economists, illustrated below, the Hamas attack triggered the third largest spike in geopolitical risks since 9/11. Based on this index, risks have risen substantially since the start of the Ukraine crisis, compared to the period from 2004 to 2021. It seems unlikely that geopolitical risks will fade anytime soon. For a start, the current crises are showing few signs of quick resolution and may continue to drag on, particularly considering the historical origins of the conflicts and the lack of obvious paths to resolution. In addition, the continued deterioration of relations between the US and China may be a source of renewed international tensions. Finally, according to the Integrity Institute, 78 countries have elections scheduled in 2024, covering roughly half the world’s population. In a deeply polarized world, that doesn’t bode well for normalization of political or geopolitical risks. Upcoming US presidential and congressional elections could be particularly contentious considering current domestic and global tensions.

Geopolitical risks are highly unpredictable and virtually impossible to position for. First, the probability of a crisis occurring is very difficult to ascertain. Second, the timing, magnitude and duration of any crisis is always uncertain, as are their possible ramifications, many of which can be counterintuitive. With that in mind, we believe it is counterproductive, from a risk management perspective, to position portfolios with the sole objective of protecting against geopolitical risks, simply because they can be likened to “black swan” events — it’s difficult to expect the unexpected, except in hindsight. However, there are strategies that investors can implement to optimize their risk management.

ACTIONS TO CONSIDER |

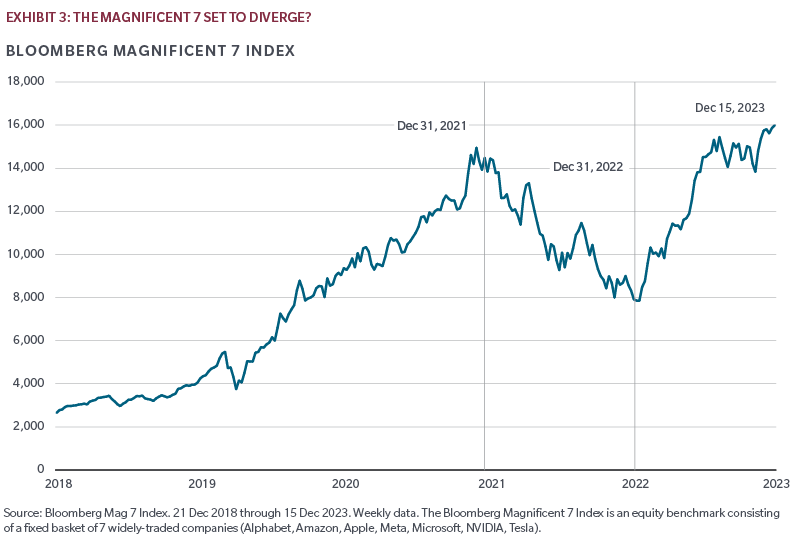

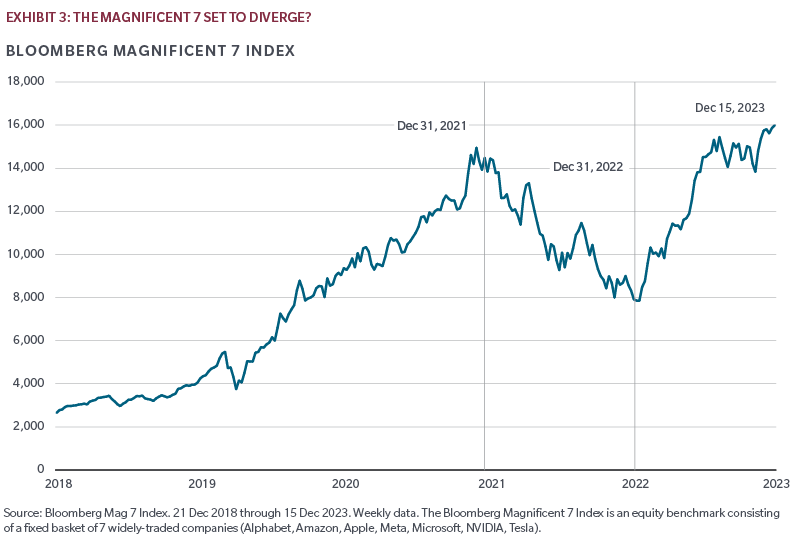

Divergence at the Top

It’s almost as if the Magnificent Seven are minding the calendar — the Bloomberg Magnificent 7 index reached its peak in late December of 2021, bottomed in late December 2022 and has now fully retraced those losses, reaching new highs in late December 2023. This premise, of course, is somewhat far-fetched, but the returns are quite legitimate with the index up more than 100% in 2023. Although this group of stocks have some similar characteristics — they are all large, platform-oriented companies leveraging technology in their businesses — they are also quite different. In fact, they are classified across three different sectors within the global investment classification standards — communications, consumer discretionary and information technology.

Mainstream media is quite fond of grouping them together to create an easy-to-follow narrative, but viewing them as a collective is a myopic view and should not be entertained by investors. We believe there could be substantial divergences among the group in the period ahead and investors would be wise to focus on the individual merits of each company, rather than looking at them monolithically. While several of these companies have been battle tested over decades, possess strong balance sheets and strong future business prospects, others have not and do not. Past monikers of groups of stocks such as the Nifty Fifty in the 1960s and 1970s, Big Media in the 2000s and the FANGs of the late 2010s, had their constituents all ultimately take divergent paths, rendering their media-anointed nicknames moot.

ACTIONS TO CONSIDER |

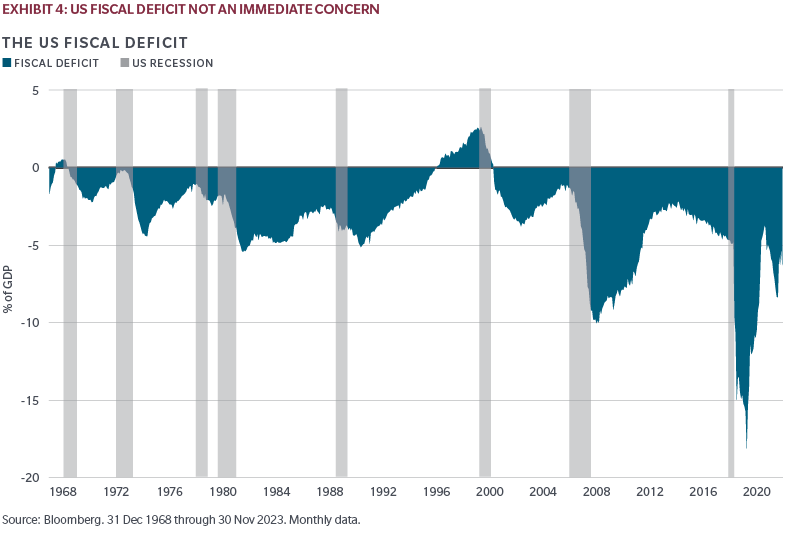

Fiscal Deficits, Higher

for Longer

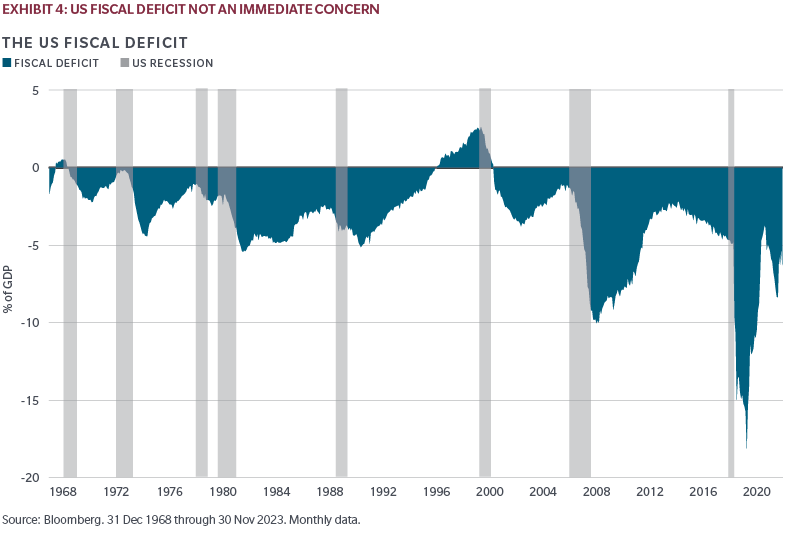

We have a fiscal problem. At over 6% of GDP, there is no denying that the US deficit is abnormally large. Historically, similar fiscal gaps have only been observed during war time or as a policy response to a recession. The long-term average since 1969 for the US deficit in non-recession years stand at 3.5% of GDP, well below the current level. Unfortunately, there is little chance that the US authorities will pay attention to the fiscal issues in the near term, given the upcoming presidential election. Therefore, higher deficits are here to stay for now.

Excessive deficits pose many challenges. First, the larger deficit needs to be financed, putting pressure on the US Treasury to issue more debt. More importantly, a larger-than-desirable deficit means that room to maneuver is constrained, leaving policymakers with less ammunition in the event of a macro shock. Finally, strong fiscal stimulus at a time the economy is still doing well may cause it to overheat. Such an outcome could limit the Fed’s ability to normalize its policy stance after its recent aggressive tightening cycle.

For now, the risk to markets from fiscal deficits appears limited. However, investors are growing concerned about the deterioration in the US’s fiscal position and that could contribute to an upward correction in market rates. In other words, after the Fed’s policy action caused rates to rise substantially after March 2022, the fear is that the US Treasury may take over as a key upside risk for rates.

While it is important to keep an eye on fiscal dynamics, we don’t believe that fiscal policy represents a major market risk, at least in the near term. However, lack of fiscal discipline could constitute a major risk over the medium term. The relationship between fiscal policy and the market typically follows a tipping point—fiscal policy is not a major market issue until we reach a critical threshold.

ACTIONS TO CONSIDER |

US High Yield: Inspecting Brick by Brick

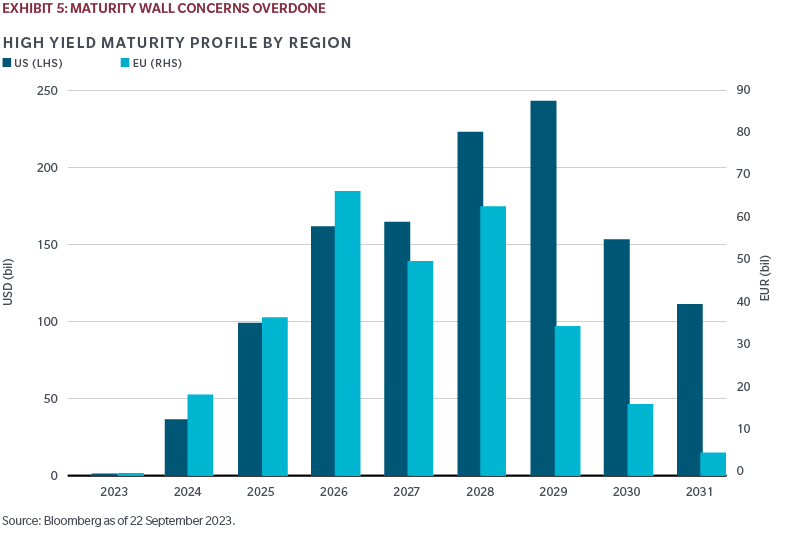

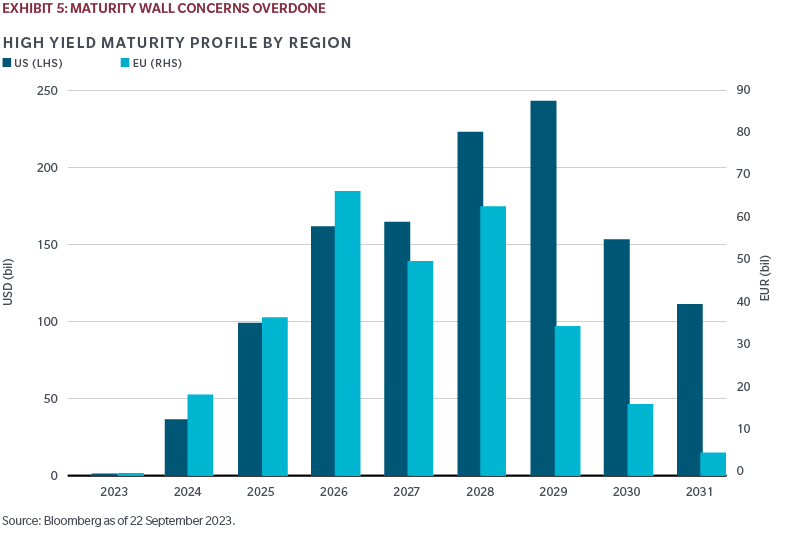

MFS Global Investment Strategist Rob Almeida reminds us that where you stand depends on where you sit. From five blocks away you see a brick building, whereas from five feet away you see bricks. From a distance, the speculative grade bond market is showing obvious signs of cyclical stress. Revenue growth and measures of cash flow have been deteriorating since 2021. Interest coverage peaked over a year ago and has been declining since. US Chapter 11 bankruptcy filings are on the rise, according to the Administrative Office of US Courts. Despite this, we conclude that the building is not in jeopardy of collapsing. The overall credit quality of the high yield market has increased dramatically, thanks to lower-quality companies using bank loans and private markets for financing. Leverage, a measure of debt to earnings, is at 2019 levels. We think that maturity wall mania is overdone given that only a manageable $150 billion is coming due over 2024 to 2025, and cycle-low issuance is supportive.

But rather than focus on the building — the market, in our metaphor — we’re more interested in the bricks — individual companies. In this environment, it’s important to be particularly selective regarding companies in challenged industries such as commercial real estate, wireline telecom and retail, which are in a race against time as higher interest rates take an increasing share of their cash flow. Zombie companies are multiplying and can survive longer than expected like their namesakes on television, yet still suffer the same fate.

ACTIONS TO CONSIDER |

AI: Asking Intently

The term “AI,” short for artificial intelligence, conjures up visions of unlimited opportunity as well as damaging repercussions, but investors may not be asking the right questions. As long-term allocators of investor capital, it’s critical for us to fully understand both the immediate as well as the long-term implications of new technologies such as AI. So, what are we asking companies?

For the incumbent megacap tech companies, the questions center around protecting their wide, but not impenetrable, moats to determine the range of outcomes. Will generative AI, improving search engines today, eventually destroy profit pools tied to traditional search results? Will the smartphone remain the preferred consumer device to access the benefits of AI? Will data and computing power become less concentrated?

AI will have also widespread implications in industries beyond technology. So, what other companies and industries will be affected? We believe the industrial applications of AI could be both vast and varied. Pharmaceutical companies may be able to use AI to improve the speed and lower the cost of drug discovery. Financial services companies may be able to use AI to capitalize on troves of customer data. Energy companies may be able to leverage AI to reduce costs and increase efficiency.

Current index weightings, among the most concentrated in history, in large part reflect investor optimism surrounding AI and other new technologies. However, determining the long-term winners and having the conviction to hold them through a period of technological disruption will require deep, fundamental research, intellectual curiosity and discipline.

ACTIONS TO CONSIDER |

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Index data source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

The views expressed herein are those of the MFS Investment Solutions Group within the MFS distribution unit and may differ from those of MFS portfolio managers and research analysts. These views are subject to change at any time and should not be construed as the Advisor’s investment advice, as securities recommendations, or as an indication of trading intent on behalf of MFS. Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.

Summary

“Reglobalization,” Not Deglobalization

Geopolitical Risks Become Increasingly

Difficult to Navigate

Divergence at the Top

Fiscal Deficits, Higher

for Longer

US High Yield: Inspecting Brick by Brick

AI: Asking Intently

As we enter 2024, there are several key themes that will likely influence the macroeconomic and capital markets environment. Last year, US economic growth rebounded and inflation waned, while Europe and several emerging markets countries struggled to reignite healthy growth. The US Federal Reserve’s hawkishness began to fade toward the end of the year, with the central bank contemplating a lower policy path ahead. However, the European Central Bank, the Bank of England and several others appear less likely to ease as soon. Equity market performance surprised many investors in 2023, ending the year considerably higher than anticipated, although not without periods of considerable drama. One such instance occurred in March when a regional banking crisis prompted the Fed to establish a bank funding program that allowed it to address banks’ liquidity issues. It was a precise, and ultimately effective, response that allowed the central bank to contain the issue while also continuing to keep rates elevated. This allowed the bank to address the crisis while continuing its battle against inflation, one which appears to be moving in the Fed’s favor.

Within capital markets, global equities, as measured by the MSCI AC World Index, rose more than 20% while core fixed income, as measured by the Bloomberg Barclays Global Aggregate Index, broke a two-year losing streak, ending in positive territory. A wave of investor enthusiasm, partially driven by the promise of AI, swept over equity markets through mid-year, driven by the Magnificent Seven, a collection of mammoth US technology companies whose earnings power and balance sheet stability paint a picture of invincibility. However, history tells us that such subsets of stocks seldom travel in lockstep over long periods of time, highlighting the importance of analyzing each of these companies on their individual merits. This will be particularly important as we move into a more challenging investment environment, one with the potential for greater geopolitical instability, elevated sovereign debt levels, higher borrowing costs and shifting global supply chains. More than ever, we believe the cross-pollination of research across our Global Research Platform will be critical to the successful allocation of investor capital.

The global trade ecosystem is in a constant state of change, driven by country-to-country relations, specialization in certain industries and myriad economic factors. There have been significant turning points in history that have made a lasting impact on global trade, turning points such as the creation of the Bretton Woods system in 1944, the establishment of the European Economic Community in 1957 and China’s ascension into the World Trade Organization in 2001. More recently, Britain’s exit from the European Union, the passage of the USMCA and US tariffs on certain Chinese imports catalyzed major shifts in trade. The pandemic and Russia’s invasion of Ukraine, both of which dislocated supply chains, disrupted energy flow and stranded corporate assets, further accelerated these shifts. In addition, in key areas such as semi-conductor manufacturing trust among trading partners is on the decline as concerns over national security trump economic efficiencies.

Will the confluence of these events lead to a deglobalized world where comparative advantages are discounted in the name of self-sufficiency and protectionism? We don’t believe so. The benefits of global trade are too great to disregard. However, we see a trend toward reglobalization, where trading partners, supply chain logistics and sovereign alliances shift to a new mix of reshoring, automation, friend-shoring and supply chain redundancies. In the US, corporations are further incentivized to make these shifts through federal financial and policy incentives, most notably the Inflation Reduction Act and the Chips and Science Act. In Europe, policymakers are considering how to best support and incentivize strategic trade relationships to prevent fragmentation. The true beneficiaries of these seismic shifts could be those emerging market economies once left in China’s shadow.

ACTIONS TO CONSIDER |

Following the Ukraine crisis and the Hamas attacks on Israel, the geopolitical backdrop has become more challenging. According to a well-followed geopolitical risk index developed by two Fed economists, illustrated below, the Hamas attack triggered the third largest spike in geopolitical risks since 9/11. Based on this index, risks have risen substantially since the start of the Ukraine crisis, compared to the period from 2004 to 2021. It seems unlikely that geopolitical risks will fade anytime soon. For a start, the current crises are showing few signs of quick resolution and may continue to drag on, particularly considering the historical origins of the conflicts and the lack of obvious paths to resolution. In addition, the continued deterioration of relations between the US and China may be a source of renewed international tensions. Finally, according to the Integrity Institute, 78 countries have elections scheduled in 2024, covering roughly half the world’s population. In a deeply polarized world, that doesn’t bode well for normalization of political or geopolitical risks. Upcoming US presidential and congressional elections could be particularly contentious considering current domestic and global tensions.

Geopolitical risks are highly unpredictable and virtually impossible to position for. First, the probability of a crisis occurring is very difficult to ascertain. Second, the timing, magnitude and duration of any crisis is always uncertain, as are their possible ramifications, many of which can be counterintuitive. With that in mind, we believe it is counterproductive, from a risk management perspective, to position portfolios with the sole objective of protecting against geopolitical risks, simply because they can be likened to “black swan” events — it’s difficult to expect the unexpected, except in hindsight. However, there are strategies that investors can implement to optimize their risk management.

ACTIONS TO CONSIDER |

It’s almost as if the Magnificent Seven are minding the calendar — the Bloomberg Magnificent 7 index reached its peak in late December of 2021, bottomed in late December 2022 and has now fully retraced those losses, reaching new highs in late December 2023. This premise, of course, is somewhat far-fetched, but the returns are quite legitimate with the index up more than 100% in 2023. Although this group of stocks have some similar characteristics — they are all large, platform-oriented companies leveraging technology in their businesses — they are also quite different. In fact, they are classified across three different sectors within the global investment classification standards — communications, consumer discretionary and information technology.

Mainstream media is quite fond of grouping them together to create an easy-to-follow narrative, but viewing them as a collective is a myopic view and should not be entertained by investors. We believe there could be substantial divergences among the group in the period ahead and investors would be wise to focus on the individual merits of each company, rather than looking at them monolithically. While several of these companies have been battle tested over decades, possess strong balance sheets and strong future business prospects, others have not and do not. Past monikers of groups of stocks such as the Nifty Fifty in the 1960s and 1970s, Big Media in the 2000s and the FANGs of the late 2010s, had their constituents all ultimately take divergent paths, rendering their media-anointed nicknames moot.

ACTIONS TO CONSIDER |

We have a fiscal problem. At over 6% of GDP, there is no denying that the US deficit is abnormally large. Historically, similar fiscal gaps have only been observed during war time or as a policy response to a recession. The long-term average since 1969 for the US deficit in non-recession years stand at 3.5% of GDP, well below the current level. Unfortunately, there is little chance that the US authorities will pay attention to the fiscal issues in the near term, given the upcoming presidential election. Therefore, higher deficits are here to stay for now.

Excessive deficits pose many challenges. First, the larger deficit needs to be financed, putting pressure on the US Treasury to issue more debt. More importantly, a larger-than-desirable deficit means that room to maneuver is constrained, leaving policymakers with less ammunition in the event of a macro shock. Finally, strong fiscal stimulus at a time the economy is still doing well may cause it to overheat. Such an outcome could limit the Fed’s ability to normalize its policy stance after its recent aggressive tightening cycle.

For now, the risk to markets from fiscal deficits appears limited. However, investors are growing concerned about the deterioration in the US’s fiscal position and that could contribute to an upward correction in market rates. In other words, after the Fed’s policy action caused rates to rise substantially after March 2022, the fear is that the US Treasury may take over as a key upside risk for rates.

While it is important to keep an eye on fiscal dynamics, we don’t believe that fiscal policy represents a major market risk, at least in the near term. However, lack of fiscal discipline could constitute a major risk over the medium term. The relationship between fiscal policy and the market typically follows a tipping point—fiscal policy is not a major market issue until we reach a critical threshold.

ACTIONS TO CONSIDER |

MFS Global Investment Strategist Rob Almeida reminds us that where you stand depends on where you sit. From five blocks away you see a brick building, whereas from five feet away you see bricks. From a distance, the speculative grade bond market is showing obvious signs of cyclical stress. Revenue growth and measures of cash flow have been deteriorating since 2021. Interest coverage peaked over a year ago and has been declining since. US Chapter 11 bankruptcy filings are on the rise, according to the Administrative Office of US Courts. Despite this, we conclude that the building is not in jeopardy of collapsing. The overall credit quality of the high yield market has increased dramatically, thanks to lower-quality companies using bank loans and private markets for financing. Leverage, a measure of debt to earnings, is at 2019 levels. We think that maturity wall mania is overdone given that only a manageable $150 billion is coming due over 2024 to 2025, and cycle-low issuance is supportive.

But rather than focus on the building — the market, in our metaphor — we’re more interested in the bricks — individual companies. In this environment, it’s important to be particularly selective regarding companies in challenged industries such as commercial real estate, wireline telecom and retail, which are in a race against time as higher interest rates take an increasing share of their cash flow. Zombie companies are multiplying and can survive longer than expected like their namesakes on television, yet still suffer the same fate.

ACTIONS TO CONSIDER |

The term “AI,” short for artificial intelligence, conjures up visions of unlimited opportunity as well as damaging repercussions, but investors may not be asking the right questions. As long-term allocators of investor capital, it’s critical for us to fully understand both the immediate as well as the long-term implications of new technologies such as AI. So, what are we asking companies?

For the incumbent megacap tech companies, the questions center around protecting their wide, but not impenetrable, moats to determine the range of outcomes. Will generative AI, improving search engines today, eventually destroy profit pools tied to traditional search results? Will the smartphone remain the preferred consumer device to access the benefits of AI? Will data and computing power become less concentrated?

AI will have also widespread implications in industries beyond technology. So, what other companies and industries will be affected? We believe the industrial applications of AI could be both vast and varied. Pharmaceutical companies may be able to use AI to improve the speed and lower the cost of drug discovery. Financial services companies may be able to use AI to capitalize on troves of customer data. Energy companies may be able to leverage AI to reduce costs and increase efficiency.

Current index weightings, among the most concentrated in history, in large part reflect investor optimism surrounding AI and other new technologies. However, determining the long-term winners and having the conviction to hold them through a period of technological disruption will require deep, fundamental research, intellectual curiosity and discipline.

ACTIONS TO CONSIDER |

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Index data source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

The views expressed herein are those of the MFS Investment Solutions Group within the MFS distribution unit and may differ from those of MFS portfolio managers and research analysts. These views are subject to change at any time and should not be construed as the Advisor’s investment advice, as securities recommendations, or as an indication of trading intent on behalf of MFS. Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.