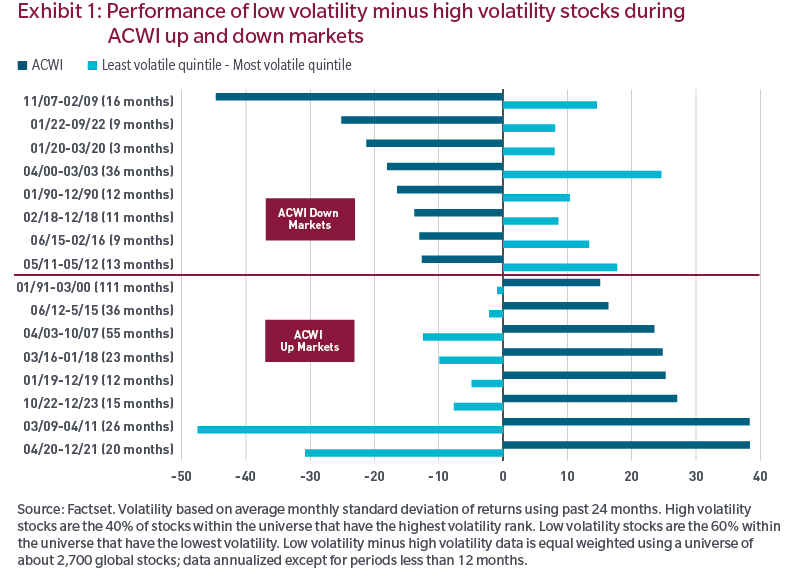

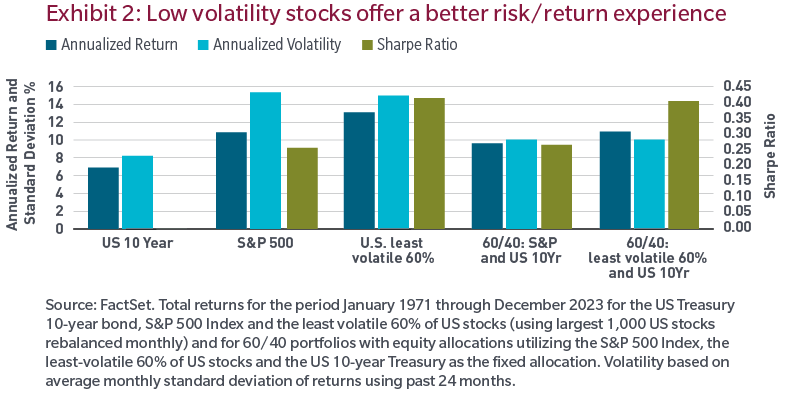

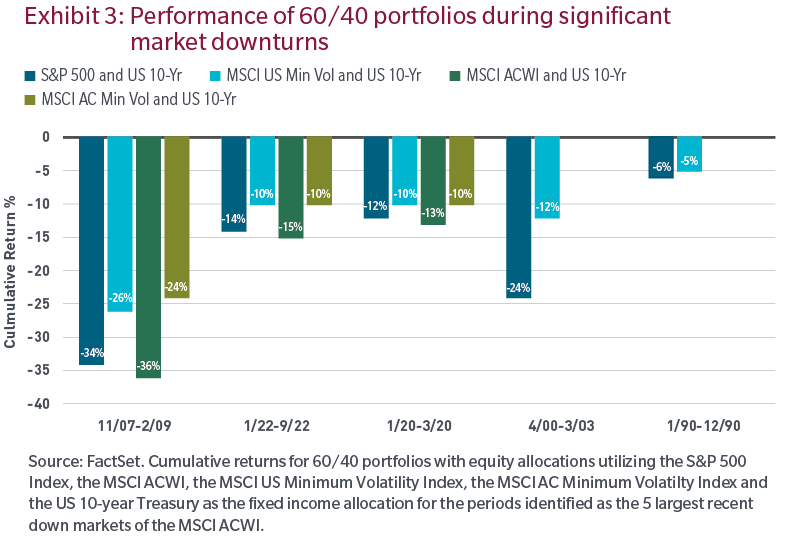

The goal of any investment professional is to insulate against big losses and mitigate risks as they build a diversified portfolio that has the best chance of delivering compelling returns. We cannot be certain whether equity markets in the years ahead will enjoy the strong returns that we saw over the decade ended in December 2021, or when we will see the global economic environment return to the relative stability experienced during that time. Given this uncertainty, we believe an appropriately sized strategic allocation to a low-volatility strategy may allow investors to lose less in a downturn and realize the long-term competitive returns they seek without having to experience extreme swings.

Endnotes

1 Sharpe ratio is a measure of risk-adjusted return. It describes how much excess return you receive for the volatility of holding a riskier asset.

“Standard & Poor’s® ” and S&P “S&P® ” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC and has been licensed for use by MFS. MFS’ Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such products.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report has not been approved, reviewed or produced by MSCI.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed. Past performance is no guarantee of future results.