June 2023

Fixed Income Capacity Management: Striving to Preserve Alpha Generation for Clients

Capacity management is a key component of a client-centric philosophy and an active management approach to fixed income portfolios.

Capacity management is a key component of our client-centered philosophy. We proactively monitor and evaluate asset growth to protect our clients’ interests and close products when necessary. This prudent approach to capacity management enables us to focus on maintaining product integrity and seeking alpha for our clients. Investment team members are compensated based on their ability to generate value-added returns for our clients, not based on their assets under management (AUM).

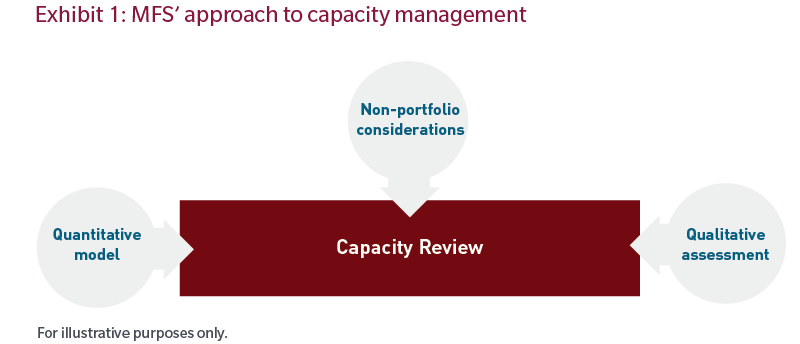

For each product, we systematically analyze and closely monitor capacity using a combination of quantitative analysis and qualitative assessments. In addition, non-portfolio considerations such as business diversification, idea generation and client-servicing requirements are considered. (See Exhibit 1.) Factors and considerations used to generate capacity forecasts and determine capacity constraints include firm ownership limits and holdings across all products, liquidity, trading volumes, transaction costs, style drifts and constraints on our investors’ time.

As a firm, we have a record of product closures that demonstrates our commitment to controlled asset growth. By preserving investment flexibility for our investment teams, we seek to protect the interests of existing and future clients. Our goal is to put investors in the best potential position to generate superior risk-adjusted performance for our clients. Measuring and managing asset capacity contributes to meeting that objective.

Our approach to capacity management is guided by these important principles:

Protecting clients’ interests – Capacity management is an integral part of our client-centered strategy.

We are committed to continually monitoring and prudently managing product capacity consistent with our commitment to maintaining product integrity and adding durable value for our clients. At the core of the strategy is a commitment to ensuring that existing clients are not adversely impacted by the rising costs and declining performance that can result from capacity constraints.

Aligning compensation – Investment team members are not paid based on AUM but rather on their contribution to the firm, viewed through the prism of long-term investment performance and collaboration with colleagues. This ensures that the incentive structure is aligned with clients’ interests and the long-term performance of portfolios. In our view, this alignment of interests is an important principle as it ensures that investors are not incentivized to take on more assets than may be prudent, but rather the reverse.

Considering capacity management as a risk measure – Here capacity management is evaluated under the rubric of risk and, as such, is considered holistically along with other risk measures. A semiannual risk review undertaken across the firm provides a comprehensive risk assessment of each strategy. This review initiates a dialogue between investors and members of the Investment Management Committee (IMC) and serves as a forum where capacity concerns can be raised by any member of the investment team or IMC.

Capacity management enables us to focus on maintaining product integrity and seeking alpha for our clients.

A quantitative framework is an important part of evaluation of capacity in fixed income strategies. Within the framework, product capacity forecasts are generated based on factors such as bond ownership and holdings overlap across multiple products. Sensitivity analysis is performed around all the assumptions inherent in the quantitative analysis to generate a multidimensional grid of capacity estimates.

The capacity model helps to establish the constraints on replicating an existing portfolio at increasing levels of AUM, i.e., determining the aggregate assets that can be managed in the strategy as it is positioned at the time. In the model, we do not attempt to adjust for market appreciation, make portfolio positioning assumptions or account for how managers might react in the face of capacity constraints.

Ownership limits are initially set for the overall organization at the security and issuer level. As a multi-strategy firm with cross ownership among its strategies, exposure needs to be monitored across the complex. This leads to the need for certain product share assumptions. The product share figures are then applied to incremental available securities or the modeled growth in assets.

The capacity analysis described can potentially lead to a wide range of capacity estimates largely because capacity models tend to be driven by the assumptions employed (e.g., number of days to establish or exit a typical position, strategy overlap, etc.). In evaluating capacity for fixed income strategies, qualitative input from portfolio managers and the trading desk regarding the ease or difficulty associated with implementing the strategy and maintaining the investment style is extremely important.

The semiannual risk review process provides a forum where capacity concerns or questions can be raised

by investment team members or senior leaders. The broader risk measures prepared for the review contain additional information that helps put the portfolio in perspective in terms of the risk profile, portfolio characteristics and performance. It is within this context that a qualitative review of the matrix of capacity estimates takes place.

Non-portfolio considerations

The capacity review comprises the quantitative and qualitative portfolio considerations outlined above as well as additional non-portfolio factors such as those listed below.

Idea generation

Business diversification

Investors’ time constraints

Product closure decisions

Based on the various factors described above, product closures are implemented at appropriate asset levels to protect the interests of our clients. The interests of existing and future clients are protected by preserving investment flexibility for our investment teams. Our goal is to put each investor in the best potential position to seek superior risk-adjusted performance for our clients.

In the past, we have adopted a staged approach to managing capacity, with soft close decisions preceding hard closure of the strategy, in part to minimize business disruptions for clients invested in the strategy. When circumstances change, we have also made the decision to reopen strategies or roll back the soft close. This is illustrated in the description of the capacity management decisions made regarding the MFS Emerging Markets Debt strategy, as provided below.

We often adopt a different approach for the retail versus institutional markets to account for the fact that it is much easier to accommodate inflows of smaller amounts of retail assets than it is to absorb larger pools of funds in institutional separate accounts. Also, it is worth noting that a proportion of institutional account redemptions take place on a regular basis for reasons outside the control of the investment manager concerned. In this context, the inflow of retail assets can be seen as replacing some of these institutional outflows.

Fixed Income Capacity Case Study: MFS Emerging Markets DebtIn February 2010, MFS closed the Emerging Markets Debt strategy to new separate accounts while commingled vehicles, including mutual funds, remained open. The goal was to slow the pace of inflows to continue to seek alpha and ensure ample flexibility to accept additional investments from existing clients. In 2014, when capacity in the strategy was reevaluated, it was determined that there was ample capacity to re-open the strategy to institutions. Given strategy assets of $11B in 2014 were higher than the $8B level when the strategy closed in 2010, this decision may seem counterintuitive; however, this speaks to the additional factors considered in the evaluation of capacity beyond strategy AUM. An important factor was a rapid expansion of the EMD opportunity set. Between February 2010 and August 2014, the number of sovereign countries in the J.P. Morgan EMBI Global Index grew from 39 to 62, with the market cap of the index expanding from $360B to $671B. Similarly, the J.P. Morgan CEMBI Broad Index corporate issuer constituents more than doubled from 208 to 532, with market cap expanding from $252B to over $800B (Exhibit 2). During that same timeframe, MFS expanded its investment resources and analyst coverage in emerging markets debt. This expansion of resources allowed for additional breadth and depth of coverage and was another factor increasing strategy capacity in the 2010 to 2014 timeframe. In the time since the strategy was reopened, markets have only continued to grow and expand, and MFS has continued to build the resources within its fixed income platform to bolster research capabilities. The market cap of both sovereign and corporate indices has grown to over $1.0 trillion each, and MFS’ EM and global investment-grade corporate and high-yield research capabilities have continued to expand as well. For these reasons, we view our EMD strategy as having ample capacity at this time. Subject to periodic review, we will continue to welcome new assets with no anticipated degradation of our ability to efficiently manage the strategy or protect our existing clients’ best interests in the MFS Emerging Markets Debt strategy. |

Emerging markets can have less market structure, depth, and regulatory, custodial or operational oversight and greater political, social, geopolitical and economic instability than developed markets.

Information has been obtained from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2022, J.P. Morgan Chase & Co. All rights reserved.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.