February 2024

Sustainability in Action: Schneider Electric

This case study demonstrates our bottom-up analysis of Schneider Electric and how we identify investment opportunities in a decarbonizing world.

Pelumi Olawale, CFA

Strategist

Client Sustainability Strategy

Ross Cartwright

Lead Strategist

Investment Solutions Group

1 |

In line with global decarbonization efforts, the race is on to find solutions that will enable the world to meet its decarbonization targets, by driving widespread adoption of energy from cleaner sources, distributed efficiently and consumed responsibly. |

3 |

Schneider is a well-positioned company in line with global megatrends of digitization and electrification. Its portfolio is built around structurally growing areas of electrification, energy efficiency and automation. Its solutions allow customers to reduce their environmental footprint, improve efficiency and stability and save on costs. A good study in double materiality. |

2 |

We believe there are very few cases (at this time) where an issuer is both well positioned to ride the tail winds of decarbonization and is also strategically relevant to the realizing of emission reduction goals. Schneider is one of those cases. |

4 |

Allocating capital responsibly is the corner stone of what MFS does. In light of climate change challenges, there is a need to uncover businesses that not only have attractive fundamentals, but who's products and services will be crucial to achieving carbon reduction targets. |

Schneider is firmly anchored in its mission to “empower all to make the most of our energy and resources,” demonstrating a strategic pivot towards sustainable digitization. Its mission to be the “digital partner for sustainability and efficiency” underscores a targeted approach to integrate top-tier processes and energy technologies, providing a competitive edge in today’s landscape. Schneider’s offerings span a diversified portfolio, encompassing sectors from powering residential homes to industrial automation.

Central to Schneider’s value proposition is an emphasis on electrification, energy efficiency and automation — three growth verticals recognized for their future potential in the investment community. The firm’s solutions promise not just environmental stewardship but also operational efficiency, with a direct impact on bottom-line growth. Their sustainability commitments are backed by quantifiable net zero targets: a push for carbon neutrality by 2025 and net zero operational emissions by 2030, with a strategy to collaborate for a net zero supply chain by 2050.

Our stake in Schneider represents a calculated alignment with the emerging themes of electrification and digitization. In the evolving ecosystem, our focus continues to lean heavily on ESG integration, recognizing the increasing materiality of certain environmental, social and governance factors in valuation and risk assessment. Instead of relying on ex-ante exclusions, we prioritize engagements using our internal tiering system and leverage our position and expertise to drive long-term value creation.

space

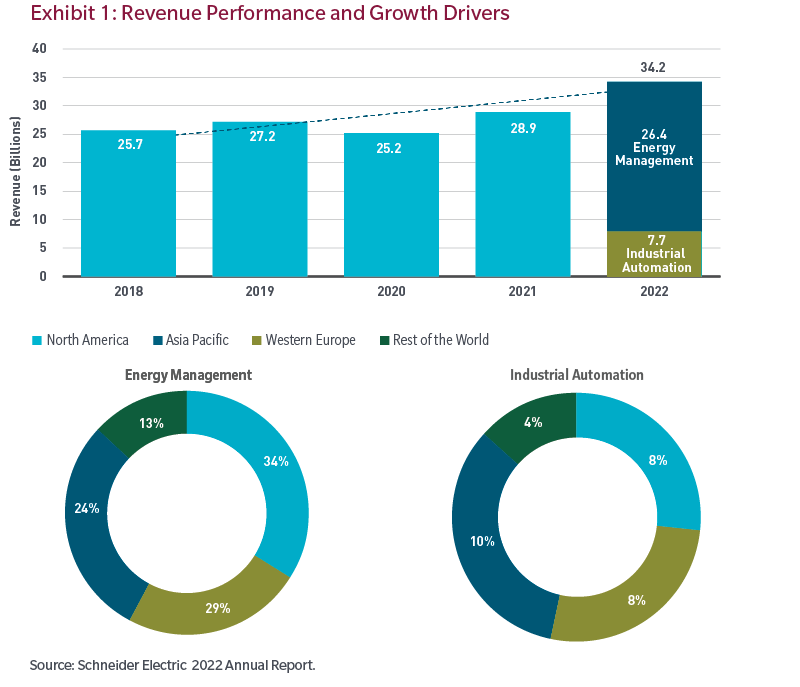

A strength of Schneider is its well diversified regional operations across its two primary segments.

According to it's 2022 annual report, Schneider exhibited strong financial performance, posting a revenue of €34.2 billion, marking impressive organic growth of 12.2% year over year.

According to it's 2022 annual report, Schneider exhibited strong financial performance, posting a revenue of €34.2 billion, marking impressive organic growth of 12.2% year over year.

Dominating the revenue streams, the energy management segment contributed €26.4 billion, accounting for 77% of the company’s total 2022 revenue. A notable driver behind this segment’s success is Schneider's approach to catering to data centers and non-residential buildings. This adeptness in tapping into the electrification megatrend, especially in regions like North America and Western Europe, has fortified its market position.

The industrial automation segment generated €7.7 billion in 2022, accounting for 23% of the group’s total revenue. The segment’s growth was predominantly driven by an expanding footprint in discrete automation markets and the process and hybrid markets, spanning North America, Europe — especially in countries like Italy, Spain and France — and the vibrant Asian markets of India and Japan. This uptrend in revenue is intrinsically tied to the global shift towards digitization of industrial processes.

Despite its commendable financial health and market positioning, Schneider hasn’t been immune to global supply chain challenges. Specifically, procurement issues related to electronic components have posed challenges. Given the burgeoning geopolitical instabilities across specific regions, there is a risk of supply chain disruptions persisting.

Technologies already exist to make companies energy resilient

space

| 70% Co2 emissions can be removed using existing technologies

|

| Energy Demand | Energy Supply | |||

| 25% | 30% | 45% | ||

Save Digitization as disruptor |

Electrify Electricity 4.0 |

Decarbonize Smart grid |

||

Electricity as part of Energy mix |

||||

| 20% in 2020 > | 30% in 2030 > | 50% in 2050 | ||

Source: Schneider Electric Sustainability Research Institute.

Electrification: The process of replacing technologies that use fossil fuels with those that use electricity, thus promoting greener energy usage is central to decarbonization efforts and pivotal to Schneider’s future growth for the following reasons:

Digitization: This involves converting analog information into digital form, enabling the use of data analytics and insights to drive agile and efficient operations and is another driver of growth for Schneider. This transformation contributes to improving resilience by making the once invisible visible, using insights from intelligent systems. The desire for electricity consumers to automate, monitor and gain clarity into how their assets are operating has never been higher. Digitization provides this capability, and Schneider provides the toolkit to increase efficiency by offering integrated software solutions as well as ongoing advice and after-sales support and services.

Electrification and digitization as global themes are being given further momentum as governments and corporations increase spending and commitments. As global efforts to reach decarbonization goals receive greater focus, there is a need to retrofit existing installations for more energy efficiency, invest in new energy efficient infrastructure and “future proof” this infrastructure — all of which constitute potential tailwinds for Schneider’s future growth.

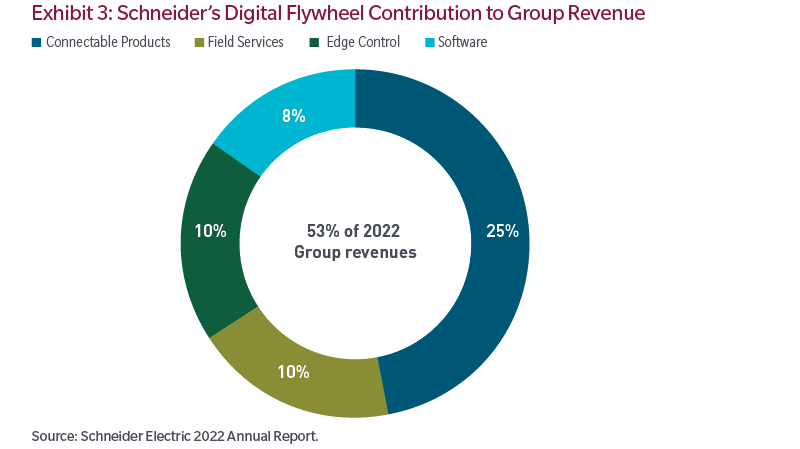

Central to Schneider’s future growth is its focus toward amplifying recurring revenue by cultivating deeper, more integrated relationships with its customer base, enabling them to achieve greater energy efficiency and savings. In line with this objective, Schneider Electric has built EcoStruxture — an IoT-enabled plug and play toolbox for its customers to digitize their enterprise and build a fully digital twin, allowing them to harness insights through data to deliver greater efficiency and savings. In addition to EcoStruxure, Schneider has acquired an agnostic software portfolio called AVEVA. The agnostic nature of AVEVA means that the software is not tied to any particular hardware device or technology platform. With offers across both industrial automation and energy management, Schneider’s customers have a high degree of flexibility in choosing what other appliances to integrate into their home and enterprise systems.

DIGITAL For Efficiency |

+ |

ELECTRIC For Decarbonization |

= |

SUSTAINABLE Smart & Green |

Source: Schneider Electric 2022 Annual Report.

Schneider Electric’s strategic positioning is underpinned by its belief that an all-digital, all-electric world is instrumental in limiting global temperature rises.

Its portfolio of software solutions bridges processes, power and buildings data to deliver contextualized, data-driven insights throughout the asset lifecycle. Its EcoStruxture platform embodies this integration — its IoT-enabled, plug and play architecture equips customers with tools for enterprise digitization.

Schneider Electric’s climate strategy is attuned to its resource strategy, and both are aimed at minimizing environmental footprints while maximizing product benefits. As a pioneer in its sustainability commitments, its net zero road map received validation from the science-based targets initiative, echoing the stringent standards set in August 2022. Schneider is not only committed to being net zero ready in its operations but also aims to slash its value chain emissions by 25% by 2030 and achieve net zero across its value chain by 2050, with an intermediate goal of full carbon neutrality by 2040.

In addition to its core value proposition, Schneider also offers consulting services to its customers, including:

Further up the chain, Schneider Electric’s suppliers’ code of conduct mandates adherence to sustainability, human rights and social commitments. Launched in 2021, its five-year engagement plan with suppliers encompasses objectives which include enhancing circular supply chains, maintaining responsible sourcing and promoting decent work standards. This is bolstered by a robust governance mechanism that proactively identifies and mitigates supplier-related sustainability risks. The expansion of Schneider Electric into diverse global markets brings varied human rights and safety challenges. The company’s “duty of vigilance” program is a response to these complexities, involving oversight by the ethics and compliance committee and the legal and corporate citizenship departments.

As the world intensifies its efforts towards decarbonization, there’s a pressing need for innovative solutions that align with these environmental goals. Electrification and digitization are emerging as pivotal forces in this race towards a more sustainable future. These twin pillars are not just ancillary trends — they are fundamental to the paradigm shift required to meet global decarbonization objectives.

In this dynamic landscape, Schneider Electric stands as a key player, strategically positioned at the confluence of digitization and electrification. The company’s focus on structurally growing areas places it in a prime position to capitalize on these mega trends. Through its offerings, Schneider enables its customers to significantly reduce their environmental footprint, while simultaneously enhancing efficiency and cost savings. This dual impact — benefiting both the planet and the bottom line — amplifies the concept of double materiality where environmental responsibility and financial performance are intertwined.

For active investment managers, we believe the responsibility extends beyond generating returns. To this end, we consider climate risks and opportunities where we believe they are financially material and could fundamentally affect our clients holdings. In the context of the defining challenges of this era, particularly climate change, it becomes imperative to identify and invest in businesses that not only demonstrate robust fundamentals but also contribute actively to achieving decarbonization goals. Companies like Schneider, with their focus on sustainability, efficiency and digital innovation, represent ideal candidates for such investments.

MFS may incorporate environmental, social, or governance (ESG) factors into its fundamental investment analysis and engagement activities when communicating with issuers. The examples provided above illustrate certain ways that MFS has historically incorporated ESG factors when analyzing or engaging with certain issuers, but they are not intended to imply that favorable investment or engagement outcomes are guaranteed in all situations or in any individual situation. Engagements typically consist of a series of communications that are ongoing and often protracted and may not necessarily result in changes to any issuer’s ESG-related practices. Issuer outcomes are based on many factors and favorable investment or engagement outcomes, including those described above, may be unrelated to MFS analysis or activities. The degree to which MFS incorporates ESG factors into investment analysis and engagement activities will vary by strategy, product, and asset class, and may also vary over time. Consequently, the examples above may not be representative of ESG factors used in the management of any investor’s portfolio. The information included above, as well as individual companies and/or securities mentioned, should not be construed as investment advice, a recommendation to buy or sell or an indication of trading intent on behalf of any MFS product.

Please keep in mind that a sustainable investing approach does not guarantee positive results.

This material is directed at investment professionals for general information use only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. Any securities and/or sectors mentioned herein are for illustration purposes and should not be construed as a recommendation for investment. Investment involves risk. Past performance is not indicative of future performance. The information contained herein may not be copied, reproduced or redistributed without the express consent of MFS Investment Management (“MFS”). While the information is believed to be accurate, it may be subject to change without notice. MFS does not warrant or represent that it is free from errors or omissions or that the information is suitable for any particular person’s intended use. Except in so far as any liability under any law cannot be excluded, MFS does not accept liability for any inaccuracy or for the investment decisions or any other actions taken by any person on the basis of the material included. MFS does not authorize distribution to retail investors.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed. Past performance is no guarantee of future results.