Discover how the MFS Blended Research® strategies leverage the strengths of both fundamental and quantitative research to create a unique and powerful investment approach. Learn why this dual approach provides a more holistic view of the investable universe, balances short-term and long-term perspectives, and enhances portfolio decision-making.

Market Insights

Quarterly Fixed Income Webcast

Wednesday, February 18, 2026

11:00 A.M. EST

Find out how MFS Co-CIO of Fixed Income Pilar Gómez-Bravo is approaching today’s complex and fast-evolving market environment.

Strategist’s Corner

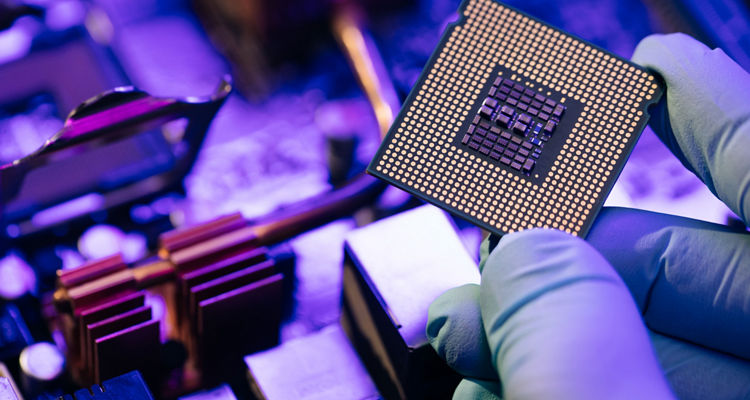

Memory is the New Oil

Week in Review

Feb 27: AI Job Loss Concerns Grow

Investment Insight