19 January 2024

UK Pensions Landscape 2024

It’s set to be another busy year for DB schemes, sponsors and advisers. Read our 2024 guide to the UK Pensions Landscape for details about pension reforms, sustainability, regulations, pooling and more.

Jonathan Barry, FSA, CFA

Managing Director

Jeri Savage

Lead Retirement Strategist

Elaine Alston

Managing Director,

UK Relationship Management

Kelly Tran, CFA

Managing Director,

UK Relationship Management

There are several themes for scheme sponsors to consider in 2024, including consolidation in the pensions space, declining retirement confidence among scheme members, and the next phase in sustainability. In this paper we delve into the following:

UK investors saw glimmers of hope in 2023, after a difficult 2022. Interest rates and inflation continued to dominate headlines, with the Bank of England raising rates five times before announcing a pause in September. This helped cool inflation, with the consumer price index receding below 5% from a high of over 11% but still well above the BOE’s target of 2%,i and market observers continue to see a high likelihood of recession in the United Kingdom in the next 6 to 12 months.

As we approach 2024, investors are focused on whether BOE policy will be effective in containing inflation and averting recession. We believe we are in a new market regime that will include higher-for-longer interest rates, inflation and volatility. The cost of capital will be higher for most companies, making it difficult for those that are not fundamentally sound to consistently grow earnings at the same pace as in the past.

Our MFS® Long Term Capital Market Expectations for January 2024 estimates that equity returns will likely be lower than what has been seen over the past decade. Fixed income, on the other hand, may present opportunities, with central banks nearing the end of their hiking cycle. The coming decade will be in stark contrast to the past several years, during which low interest rates and unprecedented fiscal and monetary policies distorted asset prices for many companies. We believe that in this new market regime fundamentals will reassert themselves and active management will play a critical role in uncovering companies that are well positioned to weather this complex economic backdrop.

Mansion House reforms sought to improve outcomes for pension savers while also aligning pension investments with UK economic growth.ii The reforms could have wide ranging implications for the pension landscape, as shown in Exhibit 1. A common thread is the government’s desire to increase and accelerate consolidation initiatives.

| Defined Contribution | Defined Benefit | |

| Encouraging schemes to invest at least 5% of their default funds to unlisted equities by 2030 | Creating a permanent superfunds regulatory regime for DB schemes | |

| Exploring the role of the government in establishing investment vehicles | Revisiting the role of the of the Pension Protection Fund and the part DB schemes play in productive finance | |

| Revisiting the Value for Money framework | Making it easier for employers to access scheme surpluses | |

| Enabling consolidation of small pension pots to a default provider | Outlined a deadline of March of 2025 for all LGPS funds to transfer their assets into the LGPS pools | |

| Encouraging further establishment of Collective Defined Contribution (CDC) schemes and extending the CDC regime to promote further consolidation of DC schemes |

After a tumultuous 2022, DB schemes saw continued funded status improvements in 2023, with the aggregate surplus of schemes increasing from £376 billion at year-end 2022 to £441 billion as at the end of October 2023.iii

Accordingly, the market has seen record levels of annuity buyout activity, with over £20 billion of transactions in the first half of the year and the expectation of even higher levels in the future.iv This raises the question of whether the insurance market has the capacity to handle the volume. While insurers have been busier than ever improving technology and hiring staff to help meet demand, actual capital capacity has not changed significantly.

The Prudential Regulatory Authority has voiced concerns about the rapid growth of bulk-purchase-annuity insurers and issued a consultation that could have wide-ranging implications for the marketplace.v The combination of insurer capacity and these potential reforms could mean that not every scheme that wants to execute a buyout will be able to do so at a time and cost that suits its needs. Accordingly, schemes should consider endgame strategies beyond buyout, such as consolidation or self-sufficiency.

The consolidation space is still in its infancy, with only one superfund in operation, and was dealt a setback in 2023 when the Pension SuperFund withdrew from the marketplace.vi We expect slow growth in the space.

That leaves self-sufficiency as an option for sponsors that hope to manage the scheme over the long term while minimising future funded status volatility and contributions. With the liability-driven investment (LDI) crisis highlighting the risk of derivatives, schemes moving towards self-sufficiency may look to reduce swap positions and increase their allocations to physical bonds. These could include liability-aligned buy-and-maintain strategies as well as non-domestic fixed income including European credit or taxable US municipal bonds.

Since October 2023, DC schemes have been required to disclose their policy on investing in illiquid assets.xi Trustees must supply the particulars on illiquid assets in default arrangements and on any plans for future illiquid investments or say why the scheme does not invest in illiquid assets. |

In the wake of the LDI crisis, the government launched a call for evidence to ensure scheme trustees have the skills to operate in a complex and evolving environment.vii At the same time, the pension industry has seen more appointments of independent trustees to boards, particularly for larger schemes, with more than half having put a professional independent trustee in place, a figure projected to increase significantly over the next five years. Consolidation is occurring in this space too, with the 10 largest independent trustees representing over 2,100 schemes worth over £1.1 trillion in assets under management.viii Despite consolidation, the market remains competitive, with smaller firms vying for market share alongside large ones.

Employers are increasingly appointing only one independent trustee for their scheme, replacing member-nominated and company trustees. Sole trusteeship accounted for approximately 40% of new appointments in 2022, a figure that we anticipate will rise.

Amid concerns over valuations, the Financial Conduct Authority (FCA) announced it would launch a review into the potential risks associated with private assets. Specifically, the FCA raised concerns about the valuations of private assets such as real estate, which have remained high despite higher interest rates and inflation. Private assets tend to be valued periodically, often with a significant time lag, so assets held on pension schemes’ books may not align with the true value of those investments and schemes can be subject to unwelcome surprises when a valuation ‘true-up’ occurs.

This, combined with improved funding levels in DB schemes, is driving many trustees to reduce their exposure to illiquid assets, with a recent study indicating 40% of schemes have reduced illiquid allocations.ix Liquid alternatives such as listed infrastructure and REITs could be an effective way for schemes to access the diversification benefits of alternatives while maintaining needed liquidity.

On the other hand, there are forces compelling schemes to consider higher levels of illiquid assets such as private equities. The government wants LGPS funds to drive towards a 10% allocation to private equity.x Combined with the government’s desire for funds to invest 5% into the ‘Levelling up’ initiative, schemes could face significant allocations to private (and illiquid) assets.

While private equity does have the potential to enhance risk and return for portfolios, it will be difficult for entities without significant AUM to invest in a diversified private equity allocation without the use of a fund of funds, which could result in higher fees. In addition, the private equity space is broad and complex and requires investors to devote significant resources to ensuring that due diligence and sufficient oversight is applied in the selection and monitoring of private equity investments.

While the advent of Mansion House reforms demonstrated the government’s intention to consolidate local government pension schemes (LGPS) in fewer pools, many questions remain. The government’s recent consultation response indicated it does not intend to force mergers in the near term but wants schemes to make progress towards meeting the March 2025 transition date.xii Combine this with the government’s push for LGPS schemes to increase the illiquid allocations noted above, and sponsors will have a full plate in 2024.

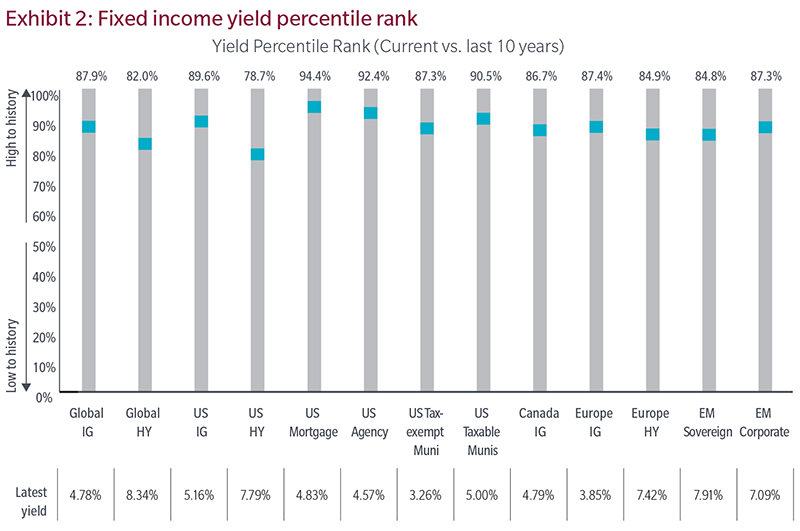

While reforms have shone the LGPS spotlight on private assets, sponsors should not lose sight of opportunities in public assets. LGPS funds have low allocations to fixed income,xiii in part due to the low yields seen across the asset class in the past decade. Today, however, fixed income yields are at the highest levels seen in years, as shown in Exhibit 2.

Gilts and UK corporate bonds could provide opportunities for scheme sponsors, and we believe a global, active approach to fixed income can benefit schemes by employing alpha levers such as asset allocation, geography, quality and sector and security selection.

With so many of LGPS headlines focused on private assets, we encourage sponsors to revisit their existing public allocations to ensure they are positioned for success in the higher-rate environment we anticipate in the coming years.

While there is currently only one authorised collective defined contribution pension scheme (CDC) in the UK (The Royal Mail Collective Pension Plan), Mansion House reforms aim to accelerate their adoption. To date, CDCs can be used only by single employers, posing substantial administrative and regulatory barriers to entry. However, the government’s intention of allowing the provision of CDCs to multiple unrelated employers opens the way for these schemes to be used as industry-wide arrangements or provided commercially through master trusts.

With the growing consensus on the potential benefits of CDCs, we anticipate that some scheme sponsors will explore the option in 2024. That said, we expect the adoption of the schemes to be slow until some employers lead the way, driven by the increasing demand for better retirement income solutions among members.

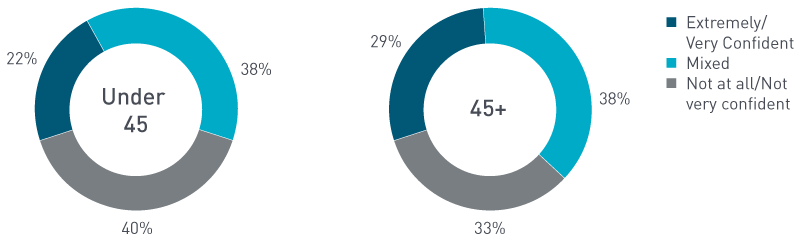

Inflation remains a top concern for DC scheme members. The 2023 MFS Global Retirement Survey found that 61% of members say inflation has caused them to think differently about retirement.xiv Reflecting that concern, 53% are investing more conservatively. Accordingly, our survey revealed that retirement confidence continues to decline, with only 25% of members indicating they are confident they will be able to retire when they want to. In addition, members are changing what retirement will look like, as shown in Exhibit 3.

69% of DC members feel they will need to save more than they planned, and 60% feel they will need to work longer than planned because of the inflationary environment. |

68% A more gradual transition, where you may reduce hours or switch jobs

|

19% A hard stop, where you stop working for pay entirely

|

10% I am not sure

|

2% I won’t be able to retire

|

Source: MFS 2023 Global Retirement Survey, UK respondents. Q1: How confident are you that you will be able to retire at the age you want to? Q2: Do you expect your retirement to be…?

52% of survey respondents plan to retire after age 66, according to our survey. |

Further complicating matters, the survey found 72% of respondents indicate they are either unaware of or not planning to use pension dashboards, which are slowly coming online.

While automatic enrollment mandates have helped millions of members get off the sidelines, many savers contribute only at the minimum rate, which is unlikely to generate a pot big enough for a comfortable retirement. Higher minimum rates would help, but that is unlikely to occur in the near term, and sponsors providing education and assistance to help members achieve better retirement outcomes could benefit both sponsors and members.

The incorporation of environmental, social and governance factors in the investment decision making process continues to increase in importance for sponsors. In addition to net zero plans, which have been widely adopted, biodiversity and natural capital are of growing interest to UK pensions.

Considerations related to the Taskforce on Nature-related Financial Disclosures (TNFD) and natural capital broadly differ from those associated with the Task Force on Climate-Related Financial Disclosures (TCFD)xv in that the measurements involved are more challenging to undertake. Thus, these considerations must be looked at closely by investors seeking to incorporate related considerations into investment processes.

With these forces driving asset owners to assert their commitments to various areas of sustainability, we see an increased interest in effective engagement on the part of asset owners, as well as a desire for greater transparency regarding engagement results and milestones.

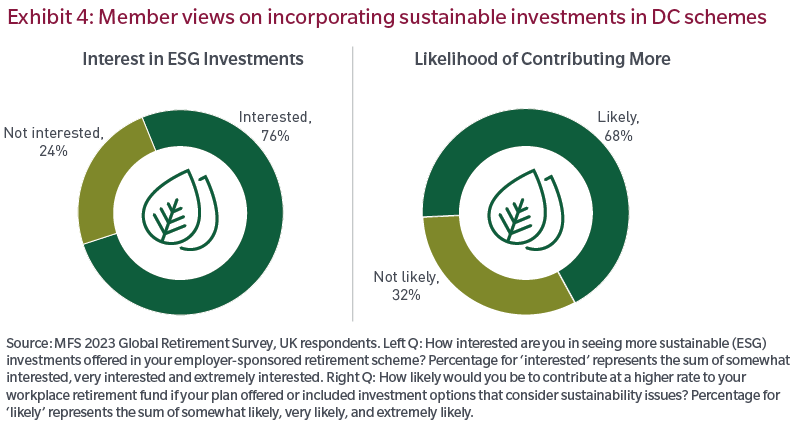

In addition, a key finding from our survey is that as schemes grapple with new ESG initiatives, members remain interested in investments that consider ESG factors. Specifically, 76% of respondents expressed an interest in seeing more investments that consider ESG factors offered in their scheme, and 68% indicated they would be likely to increase their contribution rate if offered investment options that consider these issues. This latter datapoint indicates a positive relationship between offering investments that consider ESG issues and improving savings behaviors.

On the regulatory front, the FCA is expected to publish its final rules relating to the Sustainability Disclosure Requirements (SDR). SDR is a labelling regime that comprises a wide range of anti-greenwashing measures for the sustainable investment market. It is expected to apply initially to asset managers as well as to fund and wealth managers. The regime includes proposals to do the following:

The clarification and expansion of the SDR is integral to the UK’s aim of becoming a leader in green and sustainable investing, and the regime is a key milestone in this effort. In tandem with the SDR, other global sustainability disclosure and labelling regimes are under development, including the EU’s Sustainable Finance Disclosure Regulation (SFDR) and the updated fund naming and fund disclosure rules of the US Securities and Exchange Commission (SEC).

While much attention has been paid to the E in ESG, initiatives focused on the S, such as diversity, equity and inclusion (DEI), are gaining momentum. Schemes are facing growing scrutiny of board composition relating to diversity considerations and expertise. The Pensions Regulator's (TPR) recently published DEI guidance for pension scheme boards and employers is meant to drive diversity in the pension industry.xvi The guidance outlines practical ways to help improve diversity efforts, as well as providing examples. Employers are encouraged to include DEI-related considerations when appointing a chair and are asked to consider widening the pool of candidates to include those in senior management positions.

The guidance allows the governing body to consider an independent or professional trustee if it is challenging to address diversity gaps, which is contributing to the rise of independent trustees, as described above. In addition to the experience that independent trustees can bring to a board, an independent trustee can address age, race or gender gaps often found in larger boards. We believe that transparency and disclosure in this area will become more important as more independent trustees are appointed.

In the UK, men hold significantly more wealth in pensions than women, with a recent study estimating a gender pension gap of 35%.xvii This gap is slightly lower for those with automatic enrolment and for those who hold some DB pension wealth. Whilst women have increased their pension savings by more than their male counterparts since the introduction of automatic enrolment, men still contribute 17% more than women, exacerbating this gap. Pension gaps also exist for minorities. A recent study by the Social Market Foundation found only 25% of ethnic minorities have a private or workplace pension, compared to 38% of the general population.xviii Many argue that lowering the eligibility age and earnings threshold for auto-enrollment could help close these gaps such that more women and minorities can benefit from employer workplace contributions.

As we reflect on 2023 and contemplate what 2024 might have in store, we expect investing, governance and decision making going forward will be very different than what we have experienced in the past several years. We trust you find this a helpful guide. The UK team at MFS look forward to our continued engagement and partnership with you in 2024.

We welcome the opportunity to discuss key retirement themes further with you. Please contact one of the UK team members and we will be happy to help. |

Endnotes

The MFS Long-Term Capital Markets Expectations (LTCME) for 2021 includes return and risk expectations for equity, fixed income and alternative asset classes across country, regional and global markets. The focus of these expectations is to provide a strategic, long-term, forward-looking view of various global markets. We use a proprietary top-down approach by employing quantitative, country-based models as the foundation for our expectations and then integrating bottom-up fundamental views from our global equity and fixed income investment teams to inform our final expectations. Our expectations are developed across 26 countries comprising 18 developed countries and 8 emerging market countries.

Equity Expectations: MFS equity market expectations are displayed in unhedged, nominal total return and are developed using a building-blocks approach. Elements of market history and mean reversion are incorporated into our models. Reversion speed and target levels are calibrated based on our analysis of historical data and forward-looking expectations. Any return figure should be viewed as the midpoint in that range of outcomes.

Fixed Income Expectations: MFS fixed income market expectations are displayed in nominal total return, hedged to the investor’s home currency. As with our equity model, our fixed income model employs a building-blocks approach. And, again like the equity model, the fixed income model derives its reversion speed and target level parameters from careful historical research as well as forward-looking expectations. In our forecast, we focus on the returns from carry, yield change, roll-down and credit loss (where appropriate). Using this framework, we develop expectations across a range of sovereign, global credit and regional credit markets, while being careful to tune our models in accordance with the unique attributes of the various fixed income markets.

Alternative Expectations: Due to the unique characteristics and varying drivers of return in alternatives, we vary our approach for each category. Our equity and fixed income capital market expectations serve as key variables in our alternatives models.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The views expressed in this material are those of the presenter. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any other MFS investment product.

Please keep in mind that a sustainable investing approach does not guarantee positive results and all investments, including those that integrate ESG considerations into the investment process, carry a certain amount of risk including the possible loss of the principal amount invested.

Issued in the UK by MFS International (U.K.) Limited (“MIL UK”), a private limited company registered in England and Wales with the company number 03062718, and authorised and regulated in the conduct of investment business by the UK Financial Conduct Authority. MIL UK, an indirect subsidiary of MFS®, has its registered office at One Carter Lane, London, EC4V 5ER and provides products and investment services to institutional investors globally. Issued in Europe by MFS Investment Management (Lux) S.à r.l. (MFS Lux) – authorized under Luxembourg law as a management company for Funds domiciled in Luxembourg and which both provide products and investment services to institutional investors and is registered office is at S.a r.l. 4 Rue Albert Borschette, Luxembourg L-1246. Tel: 352 2826 12800.

This material shall not be circulated or distributed to any person other than to professional investors (as permitted by local regulations) and should not be relied upon or distributed to persons where such reliance or distribution would be contrary to local regulation.