In addition to the strategic benefits offered by the taxable municipal asset class outlined in the prior section, there is a persuasive case to be made for a flexible, active approach to maximize the opportunity.

MFS® team and approach

Given the breadth and diversity of borrowers in the asset class, we believe an experienced team with similarly diverse expertise is a prerequisite for success. The MFS team includes fundamental analysts, lawyers and traders, all collaborating and contributing their own perspective. Fundamental analysts offer opinions on primary and secondary market opportunities for index and off-index bonds, with a particular focus on A- and BBB-rated issues where greater inefficiencies exist. Lawyers embedded in the investment team weigh in on complex agreements and advise on which security features to avoid. The quality of traders’ relationships with the street in an inefficient market is key, as is their ability to consult with corporate bond traders in finding relative value in the market. Trading in the municipal bond market is based primarily on person-to-person discussions with national and local firms rather than the electronic trading that is common in the more efficient markets, elevating the importance of traders and their relationships in the municipal market.

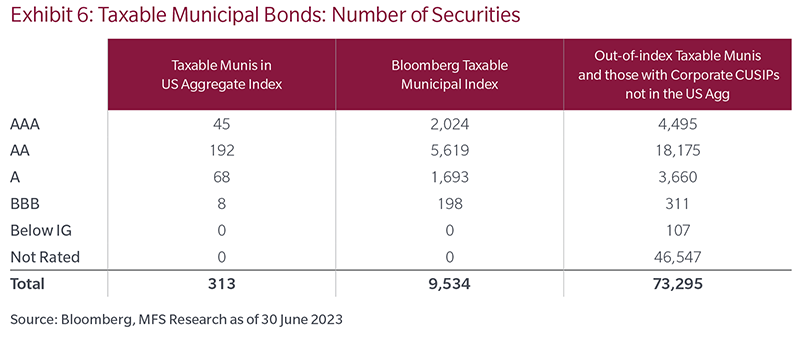

MFS has invested in municipal bonds since the 1970s and in the taxable segment of the market since 2009. Our approach is characterized as active, long term–focused and downside risk aware. We believe MFS portfolios deliver much more efficient exposures to the taxable municipal universe than is represented through indices. For example, the MFS flagship strategy has over 90% active share and has added more than half of excess return from off-index positions historically. A full toolkit of alpha levers, including quality, sector, security, duration and curve, has contributed to relative performance.

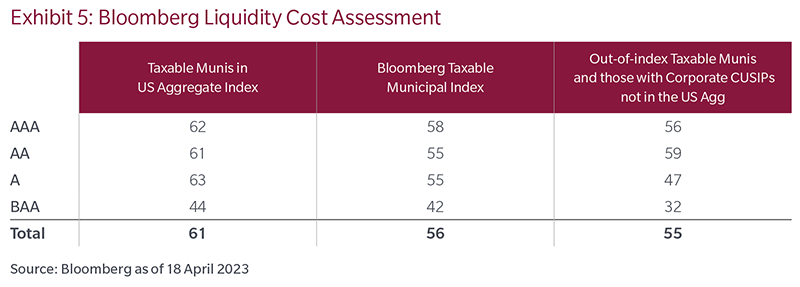

Liquidity is considered in every decision as we seek to ensure a yield premium for smaller bonds that are less actively traded. Where appropriate, liquidity buckets are maintained in portfolios to ensure the ability to adjust the portfolio to reflect changing views. Importantly, while we recognize that achieving excess return or yield targets are primary goals, we manage with a keen eye to mitigating downside exposure given clients’ desire for taxable municipal bonds to provide high quality diversification.

Attractive entry point

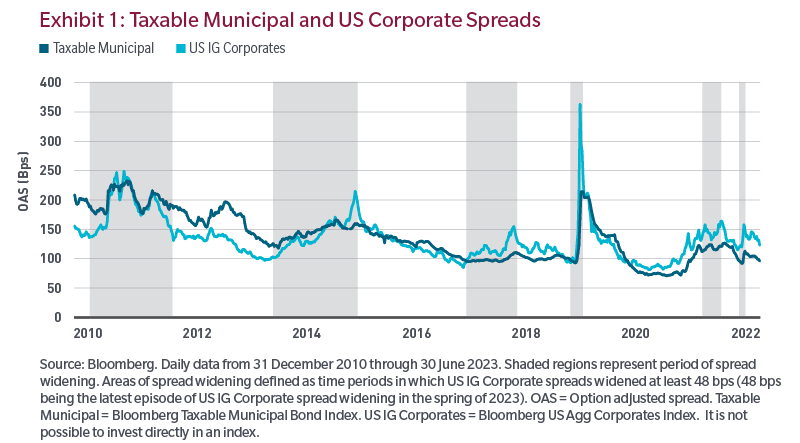

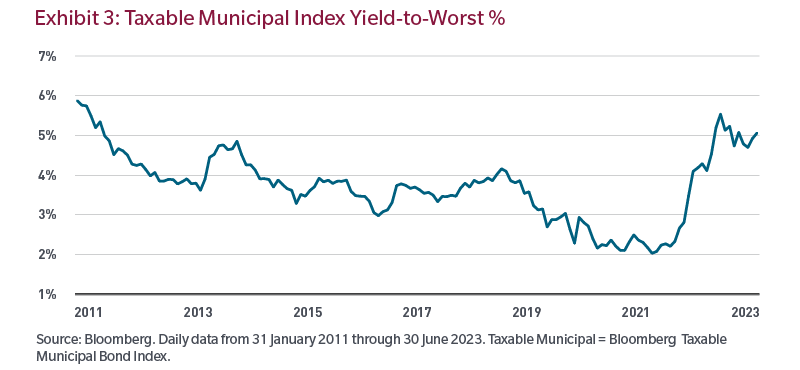

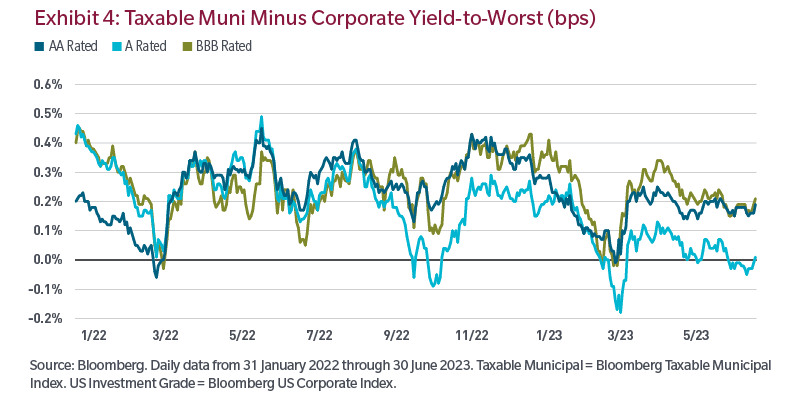

This is an opportune time to enter the taxable municipal bond market based on current yields and the defensive attributes of the asset class, particularly with many indicators pointing to a potential economic slowdown in the United States. Yields are at their highest level in 10 years, presenting an attractive entry point for yield-sensitive, long-term holders seeking high-quality fixed income exposure.

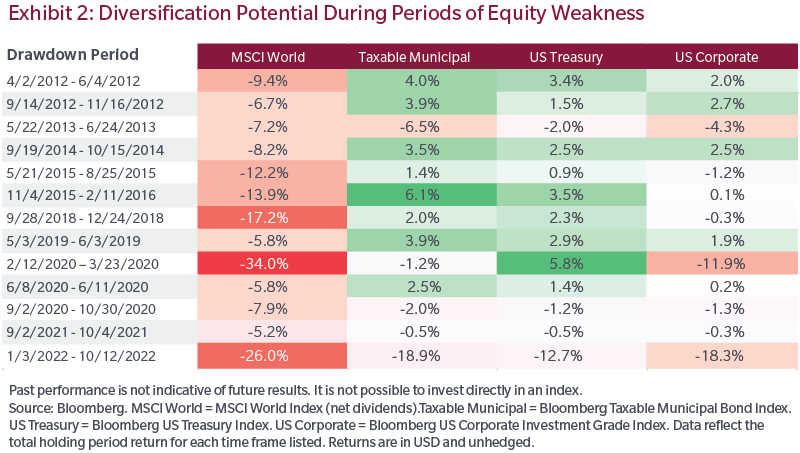

The essential services that make up many of the revenue sectors in the municipal market typically have demonstrated defensive characteristics in recessionary environments. While current fundamentals of municipal bonds are peaking at very strong levels, we believe any slowing in the economy should have minimal broad impact on municipal credit ratings.

Conclusion

The taxable municipal bond asset class has furthered its foothold around the world as a surge in supply over the past five years and a very attractive combination of quality and yield have captured increasing interest from global institutional investors. In our view, index construction methodologies limit the usefulness of indices as guides for portfolio construction and a flexible, active approach helps maximize the diverse opportunity available in the asset class. Now may be a time to consider an allocation, as historically high yields augur attractive subsequent returns and a defensive sector orientation may offer resilience in an economic downturn.

Endnotes

1 Source: Bloomberg, MFS Research, 30 June 2023. Includes taxable municipal bonds and municipal bonds issued with corporate cusips not in any index.

2 Source: Board of Governors of the Federal Reserve System, Financial Accounts of the US Z.1 Table as of 8 June 2023.

3 Source: Bloomberg as of 3 July 2023.

4 Source: Bloomberg, MFS Research, 30 June 2023

5 Source: Bloomberg, MFS Research, 30 June 2023.

6 Source: Bloomberg as of Feb 2023.

7 Source: Bloomberg as of 30 June 2023. Taxable Municipal = Bloomberg Taxable Municipal Bond Index. US IG Corporate = Bloomberg US Aggregate Corporate Index.

8 Source: Municipal default rates from Moody’s Public Finance Report “US Municipal Bond Defaults and Recoveries.” Annual data from 31 December 1970 through 31 December 2021 (latest available). US Corporate default rates from Moody’s Default and Ratings database. Annual data from 31 December 1970 through 31 December 2021.

9 Taxable Municipal = Bloomberg Municipal Index Taxable Bonds. US IG Corporates = Bloomberg US Aggregate Corporate Index. Correlation based on trailing 5 years of historical monthly data as of 31 March 2023.

10 Source: Bloomberg. Daily data from 1 January 2022 through 30 June 2023. Taxable Municipal = Bloomberg Taxable Municipal Index. US Investment Grade = Bloomberg US Corporate Index.

11 Source: Bloomberg, MFS Research, 30 June 2023.

12 Source: Bloomberg as of Feb 2023.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.