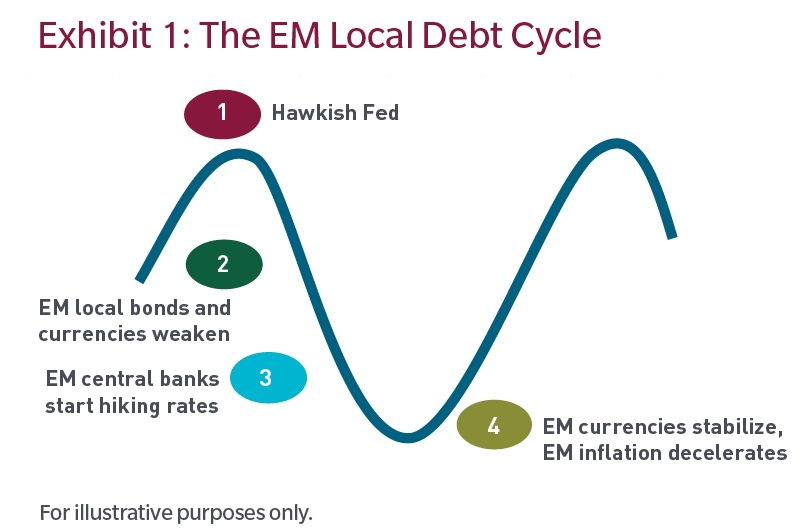

The fourth stage of current EM local debt cycle is approaching, in our view. This stage has generally been associated with robust performance for EM local debt. We believe that it may be true in the current cycle as well. However, given some of the differences in this cycle with past cycles, we believe that scaling up EM local debt exposure ahead of the fourth stage of the cycle may be an attractive option.

Appendix 1: The Past EM Local Debt Cycles

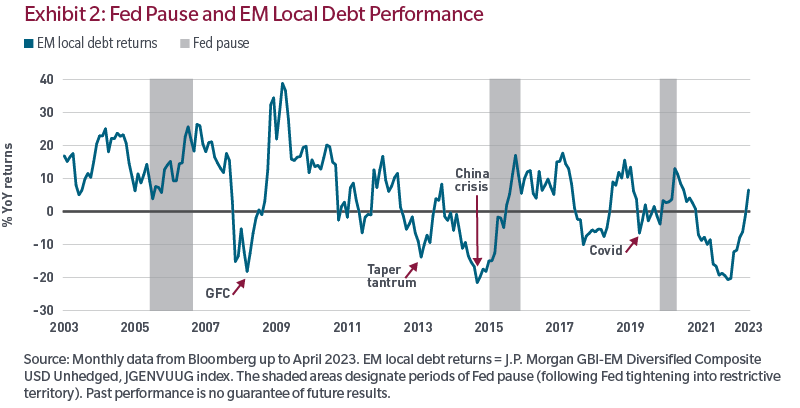

- The 2004 to 2006 Fed hiking cycle: While EM local debt performance was initially well supported by the strong global growth backdrop in 2004, tighter Fed policy began to impact EM local debt returns substantially starting in mid-2005. The Fed paused for 14 months before easing in 2008, which laid the foundation for a local debt recovery in 2009.

- The 2013 taper tantrum: This was not really a cycle but had some similar effects. In May 2013, Ben Bernanke, the Fed Chair at the time, surprised global markets by signaling a forthcoming tapering of quantitative easing. US Treasury yields spiked and EM local debt performance fell sharply by early 2014 before staging a strong recovery once the taper fears had subsided.

- The 2015 liftoff: Over the course of 2015 to 2016, the markets began to price a new Fed hiking cycle. At the same time the US economy was weakening. The Fed delivered the first hike in December 2015 but then quickly went back on hold in January 2016. Markets priced out Fed hikes creating the foundation for double-digit local debt returns in the second half of the year.

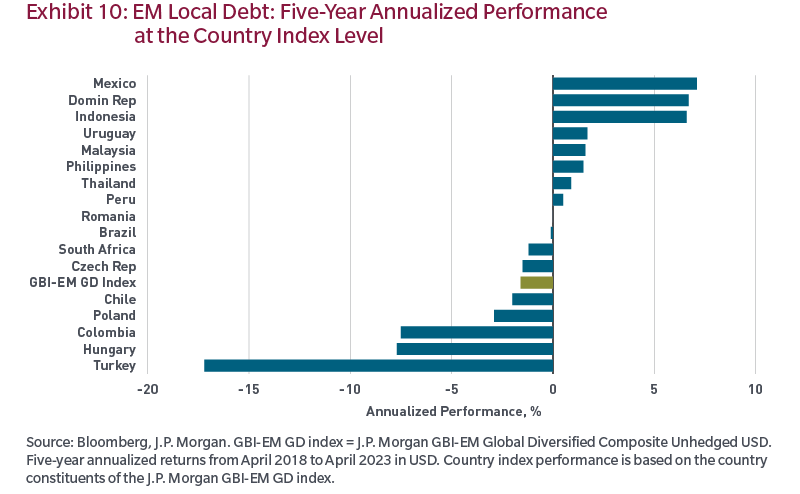

- The 2018 Fed hiking cycle: By 2018, the Fed’s policy rate had moved into restrictive territory. This caused heightened market volatility that mainly reflected mounting fears of a Fed-induced recession. As a result, EM local debt returns dropped to minus 10% year over year by August 2018.2 The Fed began cutting in 2019 which supported the strong rebound in local debt returns to mid double-digit territory.

|

Endnotes

1 Data as of 2 May 2023.

2 Source: Bloomberg, JP Morgan. J.P. Morgan GBI-EM Global Diversified Composite Unhedged USD.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affi liates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Information has been obtained from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2022, J.P. Morgan Chase & Co. All rights reserved.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.