Long-term positive correlation explained

Like the fish in the parable, this comes as a surprise to many today because it’s not what their experience has taught them. And it’s not what is taught in business schools (but should be).

Taking a step back, investors bunch varying investments into labels such as stocks and bonds, public and private debt, growth and value equities, etc. While these distinctions are important, material and worthwhile, what often gets lost is that they all ultimately rely on the hope or promise of cash flows.

Every investment requires a commitment of capital from a saver in exchange for future returns that compensates them for not only the commitment of time but also the risk that the project may fail. When viewing sub-asset classes in this way, there is one asset class: cash flows. The more predictable or stable the future cash flows, the lower the volatility that asset should exhibit relative to assets with greater time commitment and cash flow risk. This is where the benefits of diversification normally come from: a portfolio whose sources of returns (i.e., future cash flows) are diversified across time and risk levels.

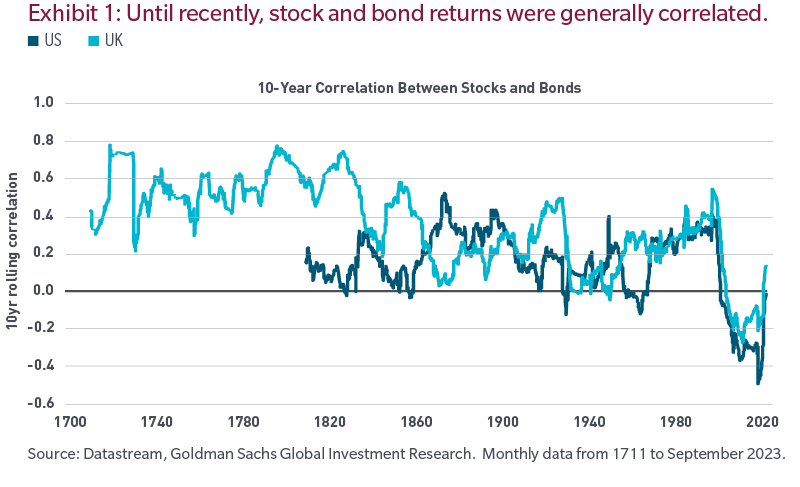

While there have been and will remain diversification benefits between equities and fixed income securities, those benefits have been overstated in recent decades due to low inflation and artificially suppressed interest rates. Investors who were allocated across stocks and bonds not only enjoyed outsized returns with abnormally low volatility, but also uniquely high risk-adjusted returns, in part due to this negative but unsustainable negative covariance.

Why is this important?

The inflation and interest rate shock of 2022 has changed the water.

While we can’t predict the terminal value of real interest rates, we’re certainly closer to a more normal rate environment than before, which would imply a normalization of the long-run stock/bond relationship. Investors who have targeted future Sharpe or information ratios based on the recent past may be set up for underperformance.

What can we do?

As time passes, areas where capital was misallocated will be exposed. For instance, projects and cash flows that were a function of financial gearing will crumble under the weight of high debt burdens and bad projects will need to be recapitalized.

While correlations of asset classes such as stocks and bonds normalize, the importance of security selection and manager allocation will matter immensely, as these not only become drivers of return but also larger drivers of covariance and portfolio diversity.

Conclusion

As a famous investor once said, price is what you pay, but value is what you get.

In our view, while prices are high, the value of some financial assets is too low. The paradigm of suppressed capital costs and low labor expense has changed. There will be fish that will, at best, fall down the food chain and others that, at worst, get eaten. Conversely, the fish with the ability to deliver cash flows to investors that are less dependent on the prior regime may become scarce assets, and why we think the type of fish you have in your portfolio will be what matters in this new, but old, paradigm.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed. Past performance is no guarantee of future results.