April 2024

Market Pulse

Leveraging the expertise from the MFS Market Insights team to provide timely perspectives on economic and market dynamics that are top of mind for clients.

April 2024

Market Pulse

Leveraging the expertise from the MFS Market Insights team to provide timely perspectives on economic and market dynamics that are top of mind for clients.

Benoit Anne

Managing Director

Investment Solutions Group

Jonathan Hubbard, CFA

Managing Director

Investment Solutions Group

Brad Rutan, CFA

Managing Director

Investment Solutions Group

KEY TAKEAWAYS

|

Economy & Markets

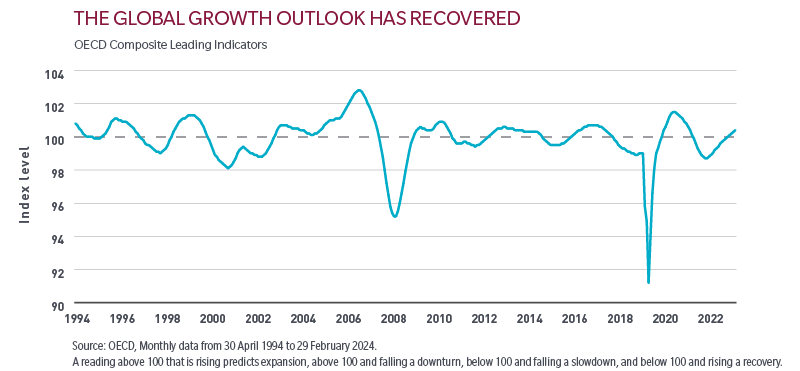

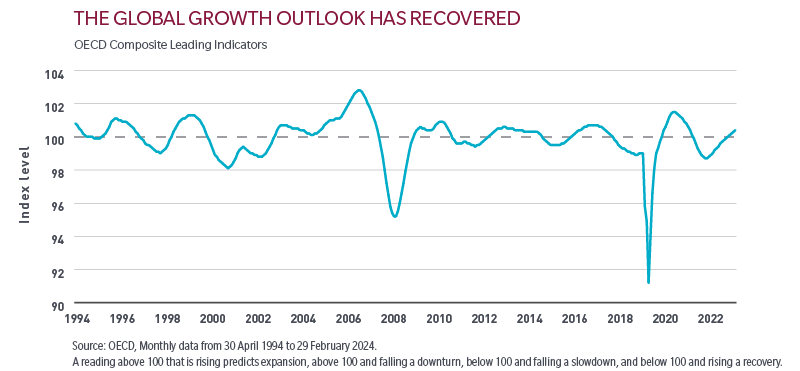

| GLOBAL GROWTH

| Fears of a Global Recession Have Receded |

MFS PERSPECTIVE

|

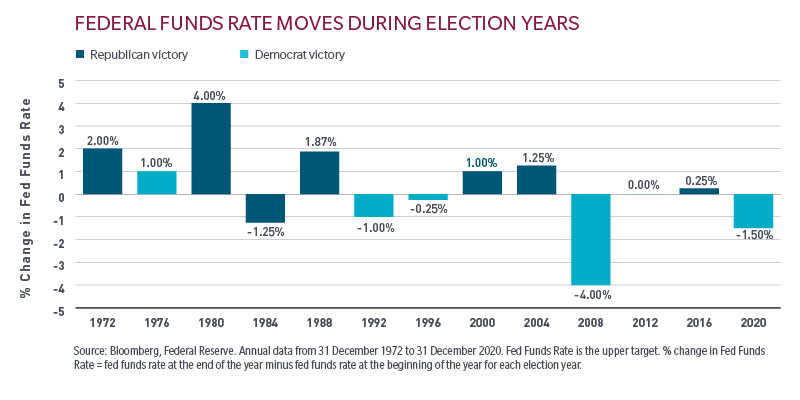

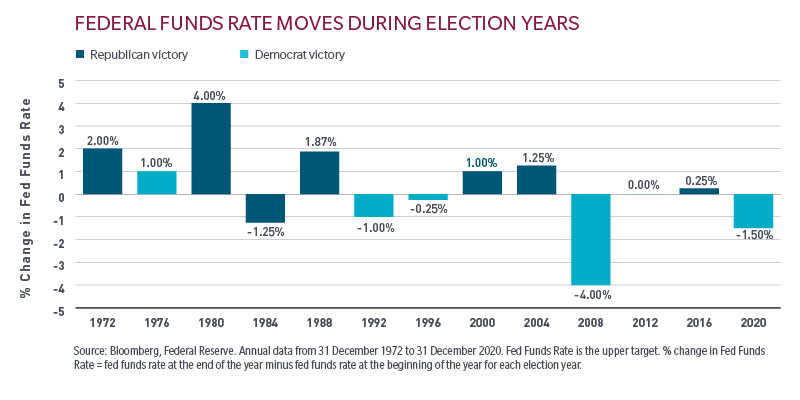

| ELECTIONS

| Election Years Do Not Dictate Fed Policy |

MFS PERSPECTIVE

|

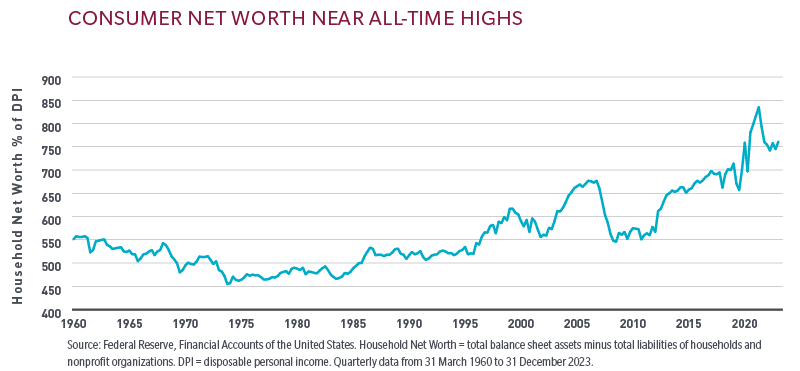

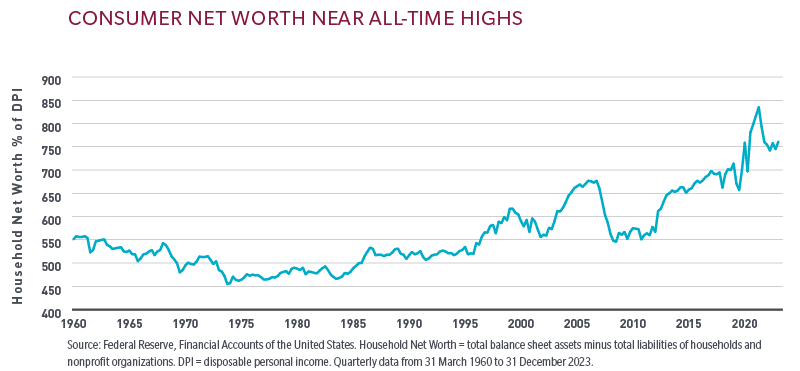

| CONSUMER HEALTH

| The US Consumer is a Key Driver of Robust Growth |

MFS PERSPECTIVE

|

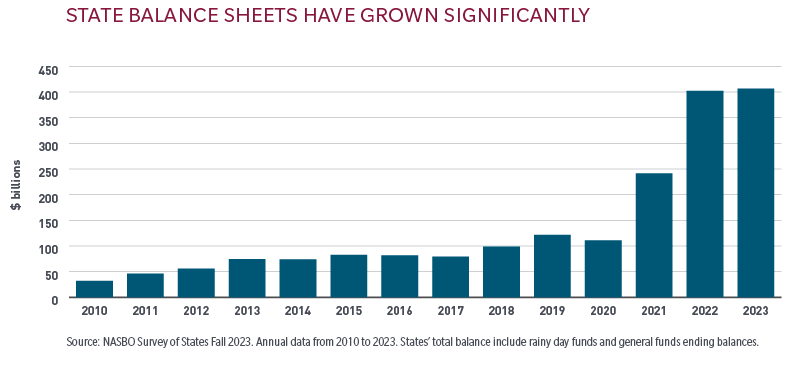

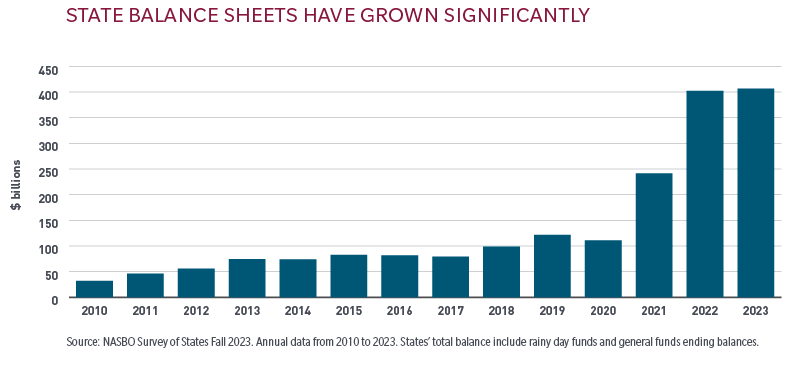

| STATE FINANCES

| State Finances Appear Healthy |

MFS PERSPECTIVE

|

Asset Allocation

• UNDERWEIGHT • NEUTRAL • OVERWEIGHT

A more favorable economic backdrop suggests a move closer to a neutral portfolio positioning, with a slight bias toward fixed income due to the risk adjusted appeal.

MFS PERSPECTIVE

1 |

2 |

3 |

4 |

The overall macro landscape continues to be favorable, with the case for a soft landing getting stronger, inflation decelerating, and some policy easing expected in the second half of the year, all of which is generally positive for both stocks and bonds. |

US equities remain dominant year to date, but several of the largest European equities have seen a significant rally. Emerging Market equities remain a distant third, but are still in positive territory. |

Fixed income continues to offer meaningful yields across the risk spectrum, but credit spread compression is unlikely to be a significant contributor to return. However, the all-in yields supported by the underlying rates component means the income is back in fixed income. |

High-beta stocks drove the rally to date, but we remain convinced that greater breadth and greater attention to individual company fundamentals will provide our investors with the opportunity to add alpha across our investment platform. |

Approach and methodology: The MFS Market Pulse provides an outlook over a 12 month investment horizon for major asset classes as well as considerations of the prevailing market conditions. Views are driven by both quantitative and qualitative inputs including, but are not limited to, macro-economic data, valuations, fundamentals and technical variables.

Equity

• UNDERWEIGHT • NEUTRAL • OVERWEIGHT

|

| MFS CONSIDERATIONS |

| LARGE CAP |

|

| SMALL/MID CAP |

|

| GROWTH |

|

| VALUE |

|

BLANK

• UNDERWEIGHT • NEUTRAL • OVERWEIGHT

| DEVELOPED INTERNATIONAL EQUITY |

| M F S C O N S I D E R A T I O N S |

BLANK

| EMERGING MARKET EQUITY |

| M F S C O N S I D E R A T I O N S |

Fixed Income

• UNDERWEIGHT • NEUTRAL • OVERWEIGHT

| UST/DURATION |

| M F S C O N S I D E R A T I O N S |

| MUNICIPALS |

| M F S C O N S I D E R A T I O N S |

| SECURITIZED (MBS) |

| M F S C O N S I D E R A T I O N S |

BLANK

| US INV-GRADE CORP |

| M F S C O N S I D E R A T I O N S |

| US HIGH YIELD |

| M F S C O N S I D E R A T I O N S |

| EMERGING MARKET DEBT |

| M F S C O N S I D E R A T I O N S |

Index data source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Frank Russell Company (“Russell”) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

“Standard & Poor’s® ” and S&P “S&P® ” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS’ Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such products. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith The views expressed are subject to change at any time.

These views should not be relied upon as investment advice, as portfolio positioning, as securities, recommendations or as an indication of trading intent on behalf of the advisor. No forecasts can be guaranteed.

| GLOBAL GROWTH

| Fears of a Global Recession Have Receded |

MFS PERSPECTIVE

|

| ELECTIONS

| Election Years Do Not Dictate Fed Policy |

MFS PERSPECTIVE

|

| CONSUMER HEALTH

| The US Consumer is a Key Driver of Robust Growth |

MFS PERSPECTIVE

|

| STATE FINANCES

| State Finances Appear Healthy |

MFS PERSPECTIVE

|

• UNDERWEIGHT • NEUTRAL • OVERWEIGHT

A more favorable economic backdrop suggests a move closer to a neutral portfolio positioning, with a slight bias toward fixed income due to the risk adjusted appeal.

MFS PERSPECTIVE

1 |

2 |

3 |

4 |

The overall macro landscape continues to be favorable, with the case for a soft landing getting stronger, inflation decelerating, and some policy easing expected in the second half of the year, all of which is generally positive for both stocks and bonds. |

US equities remain dominant year to date, but several of the largest European equities have seen a significant rally. Emerging Market equities remain a distant third, but are still in positive territory. |

Fixed income continues to offer meaningful yields across the risk spectrum, but credit spread compression is unlikely to be a significant contributor to return. However, the all-in yields supported by the underlying rates component means the income is back in fixed income. |

High-beta stocks drove the rally to date, but we remain convinced that greater breadth and greater attention to individual company fundamentals will provide our investors with the opportunity to add alpha across our investment platform. |

Approach and methodology: The MFS Market Pulse provides an outlook over a 12 month investment horizon for major asset classes as well as considerations of the prevailing market conditions. Views are driven by both quantitative and qualitative inputs including, but are not limited to, macro-economic data, valuations, fundamentals and technical variables.

• UNDERWEIGHT • NEUTRAL • OVERWEIGHT

|

| MFS CONSIDERATIONS |

| LARGE CAP |

|

| SMALL/MID CAP |

|

| GROWTH |

|

| VALUE |

|

BLANK

• UNDERWEIGHT • NEUTRAL • OVERWEIGHT

| DEVELOPED INTERNATIONAL EQUITY |

| M F S C O N S I D E R A T I O N S |

BLANK

| EMERGING MARKET EQUITY |

| M F S C O N S I D E R A T I O N S |

• UNDERWEIGHT • NEUTRAL • OVERWEIGHT

| UST/DURATION |

| M F S C O N S I D E R A T I O N S |

| MUNICIPALS |

| M F S C O N S I D E R A T I O N S |

| SECURITIZED (MBS) |

| M F S C O N S I D E R A T I O N S |

BLANK

| US INV-GRADE CORP |

| M F S C O N S I D E R A T I O N S |

| US HIGH YIELD |

| M F S C O N S I D E R A T I O N S |

| EMERGING MARKET DEBT |

| M F S C O N S I D E R A T I O N S |

Index data source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Frank Russell Company (“Russell”) is the source and owner of the Russell Index data contained or reflected in this material and all trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

“Standard & Poor’s® ” and S&P “S&P® ” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS’ Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such products. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith The views expressed are subject to change at any time.

These views should not be relied upon as investment advice, as portfolio positioning, as securities, recommendations or as an indication of trading intent on behalf of the advisor. No forecasts can be guaranteed.