In brief

- The underperformance of low volatility strategies compared to capitalization-weighted indices has some wondering whether the style has lost its effectiveness, but the performance of volatility is consistent with other market cycles.

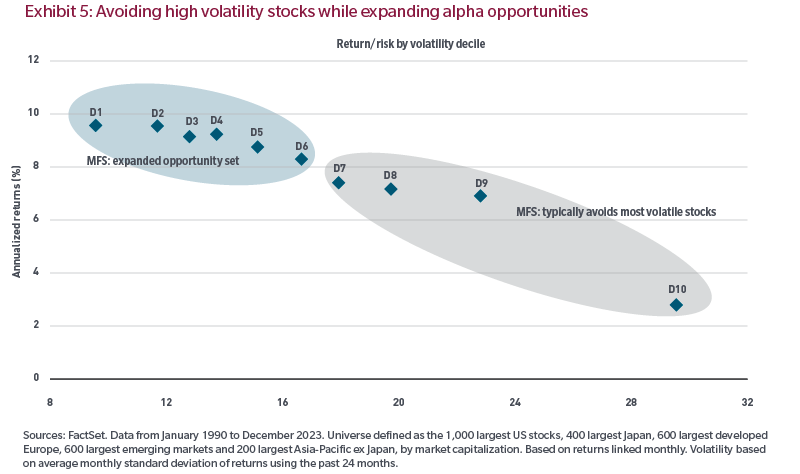

- Our defensive, low volatility strategy seeks to avoid the most volatile stocks and is not driven solely by a small cohort of the least volatile.

- In what can be projected as a higher rate environment, it is reasonable to believe the prospects for low volatility are more positive than they are negative.

During the past decade, low volatility investing has evolved from an academic factor risk premium to an understanding of company fundamentals influenced by market cycles. The evidence demonstrates that historically, low-risk stocks have outperformed high-risk ones, although their performance during the 2020 global pandemic suggests the pattern is not consistent.

In this paper, we will review:

1) The underperformance of the low volatility premium during the Covid melt-up and demonstrate that long term investors can continue to benefit from allocating to lower risk stocks.

2) How our approach to low volatility investing at MFS is uniquely situated to capture the low volatility anomaly.

3) The performance of low volatility stocks through the lens of market cycles and offer our perspective on the outlook for these stocks.

Performance of low volatility during the Covid melt-up

While low volatility stocks have performed remarkably well over the last decade, the three-year period from 2018 through 2020 has demonstrated the factor’s inability to keep up with the cap-weighted index, and low volatility stocks did not provide the expected downside protection during the COVID selloff of 2020, leaving investors wondering whether the factor is indeed broken. We begin by looking at low volatility stocks within market cycles, then provide insight on the recent market selloff and compare the fundamentals of baskets of low volatility stocks with baskets of high volatility ones.

Low volatility and market cycles

The underperformance of low volatility strategies compared to broader market, capitalization-weighted indices in 2020 might lead investors to wonder whether the low volatility style has lost its effectiveness and is in fact a flawed, if trendy, approach. However, when comparing the recent performance of low volatility stocks with their performance in prior cycles, we see that the early stages of cycles favor riskier assets. In these environments, low volatility stocks typically underperform, and often by wide margins compared to high volatility. The 2020 underperformance is not as extreme as what we saw in the early months of 2009 at the end of the global financial crisis, which was the start of a cycle that saw low volatility outperforming in its later phases.

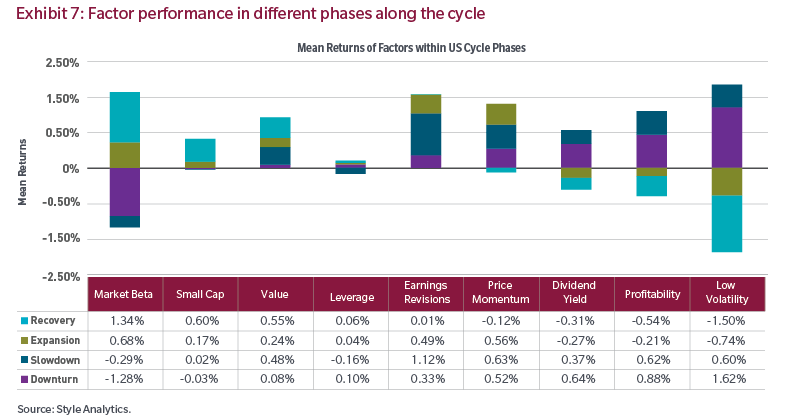

The MFS paper "Factor Dynamics Through the Cycle" (February 2021. Morrison, Stocks, Bryant) explains factor behavior during the four phases of a typical cycle: recovery, expansion, slowdown, downturn. The paper shows how factors such as market beta and small caps tend to drive the early stages of cycles while factors such as profitability and low volatility don’t emerge as drivers until the late stages. Based on the authors’ analysis of US market cycles since 1989, we don’t expect low volatility to be a characteristic of stocks that outperform in the early stages of the cycle.

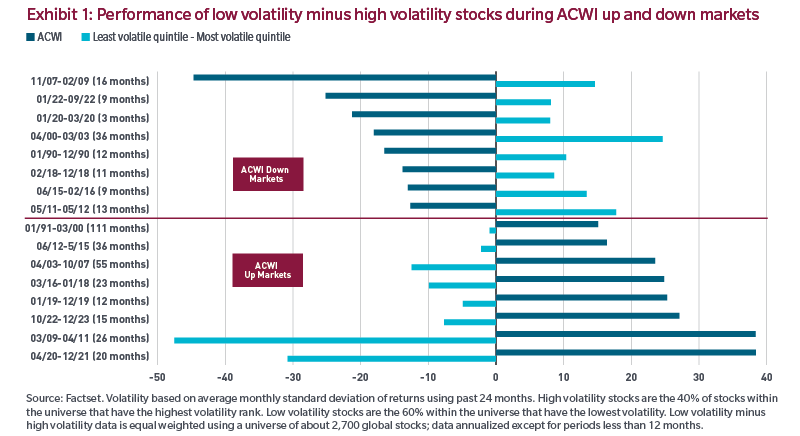

Exhibit 1 compares the returns of up markets (early cycle) to those of down markets (late cycle) from worst to best periods since 1991. For each down market (upper part of illustration), low volatility outperforms high volatility. Conversely, during up markets (lower part of illustration), high volatility typically outperforms, and sometimes dramatically.

The last period on the right demonstrates that during the most recent up market (starting in April 2020), higher volatility stocks have had exceptionally strong relative performance compared to lower volatility ones. The illustration shows, for investors interested in low volatility strategies, what to expect during early-cycle periods and what to expect in later ones. It is worth noting that up markets can last several years while down markets are often shorter but just as steep in magnitude. The up market periods below had an average duration of 40 months while the down markets experienced lasted for an average of 14 months.