September 2023

What’s Old is New Again: Reopening Your Defined Benefit Plan Could Help Solve the Retirement Challenge

We propose that now might be the time for plan sponsors who have closed or frozen their DB plans to give these plans a fresh look.

Jonathan Barry, FSA, CFA

Managing Director

With an aging population, low savings rates and questions about the viability of Social Security, the United States faces a broad retirement challenge. Once a key employee benefit, corporate defined benefit (DB) plans have been on the decline over the past several decades, driven by changes to funding and accounting standards, liability increases due to declining interest rates and mortality improvements, as well as several substantial market declines.

Given the history, one might assume that DB plans are headed towards extinction; however, we propose that now might be the time for plan sponsors who have closed or frozen their DB plans to give these plans a fresh look:

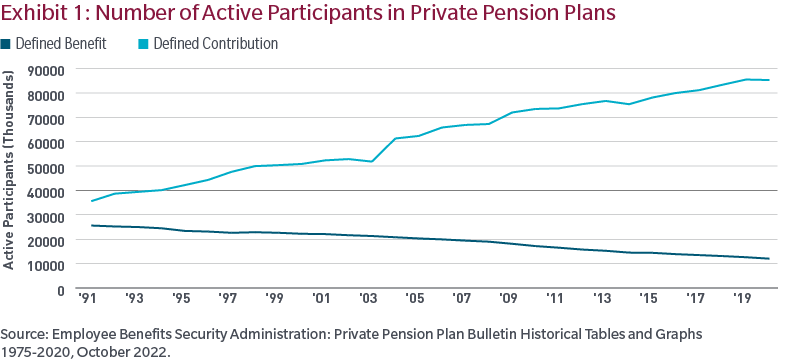

The transition from DB to DC plans in the US has been dramatic, as evidenced by the change in the number of active participants covered under these plans, shown in Exhibit 1.

In 1991, there were roughly 26 million active DB participants, versus 36 million active DC participants. By the end of 2020, active DB membership had declined to 12 million, compared to 85 million DC participants. Furthermore, as of March 2022, only 15% of private sector workers had access to a DB plan.1 Digging deeper, only 23% of workers who participate in a DB plan are in a plan that provides accruals to all members,2 meaning there are millions of workers with a frozen DB benefit.

The decline in DB participation is a result of plan sponsors freezing, closing and terminating plans in response to several trends over the past two decades, including

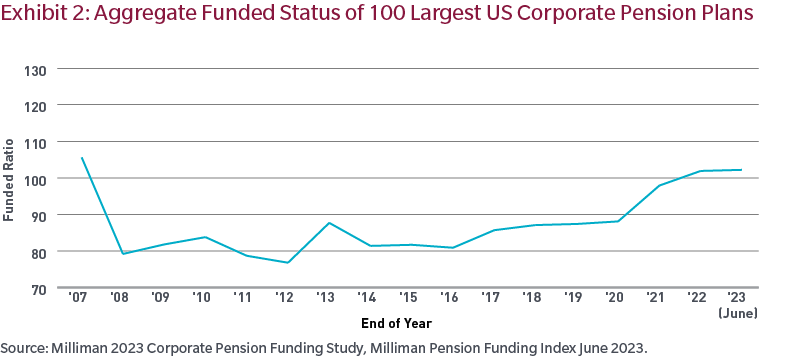

Combine these factors with significant market declines of the early 2000s and the global financial crisis in 2008, and we see that pension funded status has hovered between 80% and 90% for much of the past decade as shown in Exhibit 2.

This market volatility often resulted in unpredictable contribution patterns, balance sheet adjustments and P&L expense for plan sponsors who were not carefully managing these risks. However, despite challenging market returns in 2022, rising interest rates reduced DB plan liabilities, improving funded status for many corporate plans, resulting in many plans now at or above 100% funded status for the first time in years.

As funded status has improved, we have seen significant annuity buyout activity,6 with expectations that this trend will continue and there are still substantial obligations that plan sponsors will need to manage over the coming decades. While the risks noted above that have driven plan sponsors to freeze and close DB plans still exist, we believe that they can be effectively managed, and that now might be the time for some plan sponsors to reconsider how they view their DB plan going forward.

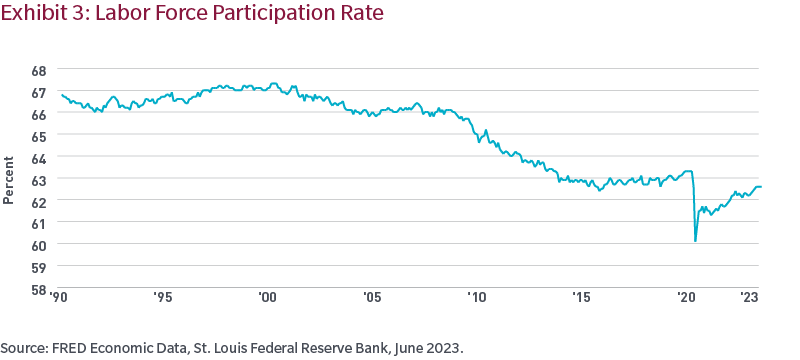

The United States faces a significant labor shortage, that could have long term effects on economic growth and productivity. Recent data indicates there were 9.9 million job openings in the US, but only 5.8 million unemployed workers.8 Job losses, retirements and “quiet quitting” seen during the global pandemic were merely an acceleration of a trend that had been in place for decades, as evidenced in Exhibit 3 which shows labor force participation steadily on the decline. The lower participation rate is a function of several factors, including an aging US workforce, workers staying at home to care for children or aging relatives, as well as health-related issues.

With this as a backdrop, DB plans could play a key role in employee retention. For employers in industries where it is difficult to find workers, restarting a frozen DB plan could help retain experienced employees while also helping to reduce retirement related worries which could impact productivity. This could also help enable a more orderly and predictable workforce transition, which would have a secondary benefit of providing young talent opportunities for advancement as older, experienced workers leave the workforce in a more predictable pattern.

Many sponsors who froze their DB plans have provided their employees with enhanced DC benefits and, given those DC benefits are likely well established as a core employee benefit, we feel it is unlikely that employers would reduce DC benefits to fund a DB accrual. This begs the question as to how plan sponsors might pay for a restarted DB benefit. Sponsors who benefited from last year’s rapid funded status rise may be in a unique position to capitalize on surplus assets, which could be used in part or in whole to fund new benefit accruals, as well as cover certain administrative expenses.

Sponsors may also want to consider cost savings that could arise from higher employee retention rates that might arise with restarting the DB plan. The cost to hire a new and executive hire is estimated to be $4,700 and $28,300 respectively, and many employers estimate the true cost of hiring to be three to four times the position’s salary.9 If the DB plan can help to retain a portion of the workforce who may be at risk of leaving, DB plan accruals could potentially be funded through savings generated from lower hiring costs and avoiding the productivity loss that arises from unplanned turnover.

Our 2023 MFS Global Retirement Survey found that retirement confidence is on the decline with 58% of respondents indicating they would need to work longer than planned and 32% indicating they would not be able to retire at all. Furthermore, the survey showed 75% of respondents ranked “receiving a predictable stream of income payments throughout retirement” as one of the top three elements they want to see in a retirement portfolio.10

There has been a great deal of effort in the retirement industry to develop products that incorporate guaranteed income features, such as annuities, to be offered within defined contribution plans. However, uptake of these solutions has been relatively low, as they tend to be difficult for participants to understand and present administration and governance challenges. Accordingly, many sponsors are hesitant to be first movers.

For sponsors who are thinking about retirement income options in the DC plan, the answer may be staring them in the face with their frozen or closed DB plans. Defined benefit plans are a time-tested way to provide lifetime income, while pooling longevity and investment risk for participants.

Plan sponsors have many options today with regards to the type of DB plan offered to employees. Traditional DB plans tended to have final average pay formulas, where benefit accruals increased in value as participants neared retirement. Other designs, such as cash balance and variable benefit plans have evolved, which offer employers alternatives to deliver DB benefits that can avoid the steep cost increases that come with traditional final average pay formulas.

What is a cash balance plan?

|

Liability Driven Investing (LDI) has been a well-established strategy for many years, with 77% of DB sponsors now indicating they employ some form of LDI within their investment policy statement.11 And why not? LDI strategies has demonstrated their effectiveness over the past decade, with glide path strategies systematically reducing risk as funded status improves, and carefully constructed fixed income portfolios moving in line with plan liabilities as interest rates rise and fall.

In a reopened DB plan, LDI will continue to be critical in managing legacy liabilities; however, sponsors may want to consider if adjustments to the overall investment strategy are warranted to cover new benefit accruals. For example, a cash balance plan may have a portion of the asset allocation designed to maximize the likelihood of meeting the interest crediting rate. With yields at the highest levels in years, sponsors may want to consider if there are fixed income asset classes, such as intermediate credit, global bonds or taxable municipals, that could help to improve returns while still retaining liability hedging characteristics of the LDI portfolio. Plan sponsors may also want to focus on optimizing the structure of their equity allocation to try and achieve desired outcomes.

The drive towards freezing and terminating defined benefit plans has been largely focused on savings generated from lower ongoing administrative costs, but employers may also want to consider the potential costs related to hiring workers and the potential impact of lower productivity for workers concerned about their retirement prospects. DB plans provide guaranteed income in retirement, a key desire for participants, and in a historically tight job market, DB plans could help retain experienced workers, lowering hiring costs. LDI has been successful in managing risk and improving predictability of costs and will continue to be the cornerstone of investment strategies for DB plans going forward, but sponsors may have an opportunity to consider other fixed income assets, to try and take advantage of higher yields, while also revisiting their equity allocations, to ensure they are aligned with long-term objectives.

Keep in mind that all investments, including mutual funds, carry a certain amount of risk, including the possible loss of the principal amount invested.

1 Source: Bureau of Labor Statistics, Beyond the Numbers, January 2023.

2 Source: Bureau of Labor Statistics, Beyond the Numbers, Volume 12/No.1, January 2023.

3 Including the Moving Ahead for Progress in the 21st Century Act (MAP-21), the Highway and Transportation Funding Act of 2014, the Bipartisan Budget Act of 2015, the American Rescue Plan Act of 2021 and the Infrastructure Investment and Jobs Act of 2023.

4 FAS 87 introduced the concept that pension liabilities should be valued using discount rates on high quality fixed-income investments. FAS 158 required the measurement of the fair value of assets and liabilities to be reported on the balance sheet. ASC 715 and ASC 960 required further pension disclosures.

5 Source: FTSE Pension Liability Index. Between 12/31/2009 and 12/31/2021 pension discount rates declined by roughly 300 basis points which raised typical pension liabilities by 30% to 50% depending on plan maturity.

6 Source: LIMRA: First Quarter 2023 US Group Annuity Risk Transfer Study. A single premium annuity buyout is a transaction where an insurance company assumes responsibility for the assets and liabilities of a qualified defined benefit plan in exchange for a one-time premium payment.

7 Source: Employee Benefits Security Administration: Private Pension Plan Bulletin Historical Tables and Graphs 1975-2020, October 2022.

8 Source: US Chamber of Commerce: Understanding America’s Labor Shortage, June 9, 2023.

9 Source: Society for Human Resource Management, “The Real Costs of Recruitment”, April 11, 2022.

10 MFS 2023 Global Retirement Survey. Methodology: Audience: Ages 18+, employed at least part-time. Active workplace retirement plan participants/members in the US, Canada, UK, and Australia. (To qualify in each region: US, actively contributing to a 401(k), 403(b), 457, or 401(a)/Canada, actively contributing to DC Pension Plan, Group Registered Retirement Savings Plan, Deferred Profit Sharing Plan, Non-Registered Group Savings Plan, or Simplified Employee Pension Plan/UK, actively contributing to a Defined Contribution Scheme, Master Trust, or Individual Savings Account./Australia, actively contributing to an industry, retail, corporate or public sector super fund or a self-managed super fund.) Data weighted to mirror the age/gender distribution of the workforce in each country. Methodology: Mode: 15 min. online survey. MFS not revealed as the sponsor. Field period: March 22 – April 6, 2023. Key Topics of Inquiry: Impact of market events, retirement confidence and advice, target date funds, retirement income and sustainability.

11 Source: Vanguard 2022 Pension Sponsor Survey.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.