August 2023

Sustainability in Action: Volkswagen

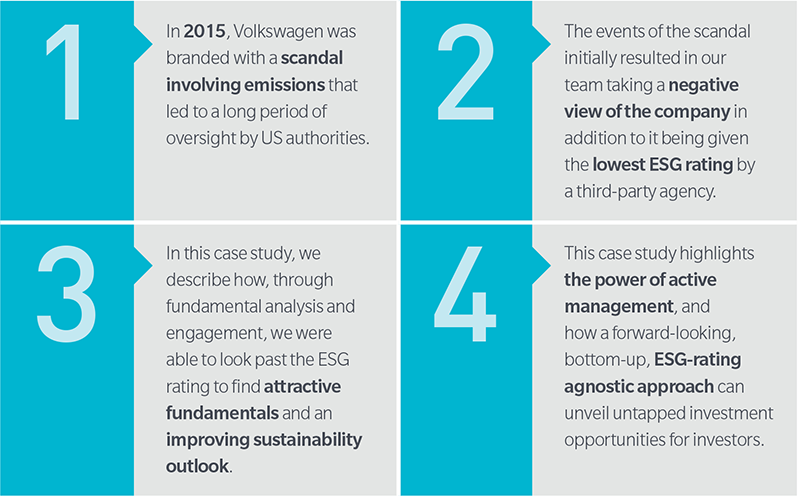

This case study highlights the power of active management, and how a forward-looking, bottom-up, ESG-rating agnostic approach can unveil untapped investment opportunities for investors.

In 2015, Volkswagen was branded with a Clean Air Act violation after emissions violations and poor governance practices were unearthed.

The scandal initially progressed as follows:

While the Volkswagen case raised concerns for us, we also recognized that wider spreads caused by the scandal presented an opportunity to enhance returns for investors.

VW makes up a significant part of the automation sector and Euro Corporate Bond Index, and excluding it could constrain our ability to outperform the benchmark for our clients. We believe a combination of traditional credit analysis alongside sustainability considerations and thorough engagement reveals relative value opportunities. Critical to this analysis is a sound understanding of the company’s strategic path forward. When seeking to drive returns and effectively manage risk, understanding whether VW would be able to remain relevant and generate cash flows over the long term was critical.

After tracing the company’s recovery efforts over the past few years, we have begun to take a more positive view.

Environmental leadership

Over time, these observations have positively reinforced our investment thesis, and our view has now changed. Our fundamental analysis revealed that VW’s environmental strategy is the most comprehensive within its sector. We believe its renewed commitment to sustainability potentially enhances its reputation and may increase its resilience in the marketplace over the long term.

Rethinking corporate governance

Some of VW’s greatest conflicts have been internal and governance-related due to family and state ownership, lack of independence and the long-term nature of board membership. Our research has revealed that company leadership is aware of its governance issues and has recently introduced management changes across all divisions in 2020 as board members sought to shake off a reputation tarnished by Dieselgate. We expect to see governance concerns gradually easing as strategic reform based on sound principles gains traction.

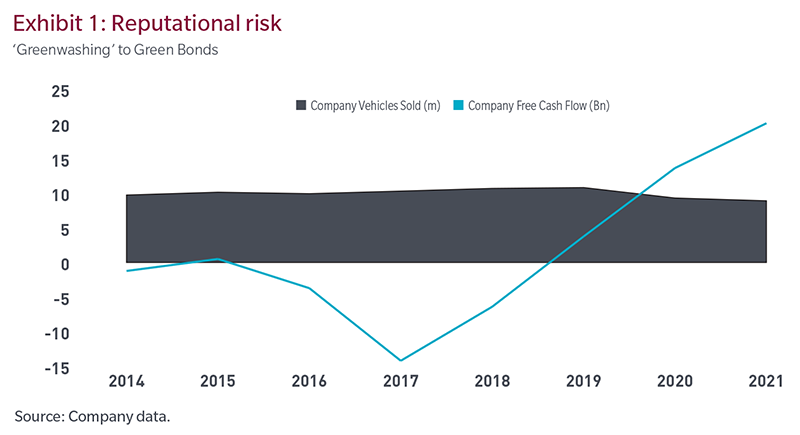

Dieselgate appears to have impacted investors more than consumers, with VW’s reputational risk having less impact on unit sales and free cash flow. In our view, free cash flow is one of the strongest indicators of the health of a company. Exhibit 1 shows how despite the scandal, VW’s sales remained steady and its free cash flow generation reverted to strong positive flows after the company paid billions in fines.

Despite a serious breach from an ESG perspective, ongoing engagement with VW unveiled insights on multiple fronts, helping to both inform our clients and support our investment thesis.

Despite VW’s downgrade to a CCC ESG rating by a third-party following Dieselgate, the case highlights key limitations of overrelying on third-party ratings in investment decision making. We believe that ratings can be backward-looking and may not be refreshed often enough to reflect recent progress a company has achieved to improve its ESG profile:

In our view, these decarbonization plans and sector initiatives render the company undervalued. This was reinforced following discussions between MFS analysts and the rating agency. After discussing the company’s sound sustainability strategies and the massive changes made over the years to recover from Dieselgate, VW's MSCI ESG rating was upgraded to B from uninvestable CCC, as of November 2022. This highlights how, in our opinion, third-party ESG ratings are often inadequate when it comes capturing the complexities of sustainability analysis, which is why they are just one component of our broader materiality analysis across companies and sectors.

Bottom-up fundamental analysis and thoughtful issuer engagement are at the heart of our long-term ownership philosophy, and VW presented a strong case. That said, wide spreads, poor ESG ratings and Europe’s move toward electrification showed the need for robust analysis and engagement. Engaging in it allowed for clearer insights into the company’s strategic direction and a reevaluation of its third-party ratings. Volkswagen’s recovery will be a long-term pursuit, and we believe active management will be key. Going forward, fundamental analysis and engagement with the company will remain a vital part of our investment thesis.

1 As of August 2017. MSCI ESG Ratings aim to measure a company's resilience to long-term ESG risks. Companies are scored on an industry-relative AAA-CCC scale across the most relevant Key Issues based on a company's business model.

MFS may incorporate environmental, social, or governance (ESG) factors into its fundamental investment analysis and engagement activities when communicating with issuers. The examples provided above illustrate certain ways that MFS has historically incorporated ESG factors when analyzing or engaging with certain issuers but they are not intended to imply that favorable investment or engagement outcomes are guaranteed in all situations or in any individual situation. Engagements typically consist of a series of communications that are ongoing and often protracted, and may not necessarily result in changes to any issuer’s ESG-related practices. Issuer outcomes are based on many factors and favorable investment or engagement outcomes, including those described above, may be unrelated to MFS analysis or activities. The degree to which MFS incorporates ESG factors into investment analysis and engagement activities will vary by strategy, product, and asset class, and may also vary over time. Consequently, the examples above may not be representative of ESG factors used in the management of any investor’s portfolio. The information included above, as well as individual companies and/or securities mentioned, should not be construed as investment advice, a recommendation to buy or sell or an indication of trading intent on behalf of any MFS product.

Please keep in mind that a sustainable investing approach does not guarantee positive results and all investments, including those that integrate ESG considerations into the investment process, carry a certain amount of risk including the possible loss of the principal amount invested.

The views expressed are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecast can be guaranteed.

This material is directed at investment professionals for general information use only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. Any securities and/or sectors mentioned herein are for illustration purposes and should not be construed as a recommendation for investment. Investment involves risk. Past performance is not indicative of future performance. The information contained herein may not be copied, reproduced or redistributed without the express consent of MFS Investment Management (“MFS”). While the information is believed to be accurate, it may be subject to change without notice. MFS does not warrant or represent that it is free from errors or omissions or that the information is suitable for any particular person’s intended use. Except in so far as any liability under any law cannot be excluded, MFS does not accept liability for any inaccuracy or for the investment decisions or any other actions taken by any person on the basis of the material included. MFS does not authorise distribution to retail investors.