Plans May Benefit from Increased and Broadened Exposure to Taxable Municipals

While the features noted above make a strong case for taxable municipals, the opportunity becomes even more compelling when the vastness of the asset class is considered. The municipal bond market, whether taxable or tax-exempt, is fragmented with significant numbers of issuance not included in indices. There are approximately 84,000 issues in the taxable municipal universe, with over 73,000 of those issues not included in an index due to size limits imposed by the index provider. These non-index eligible issues typically receive less research coverage and lower interest by investors, which often results in inefficiency and a yield premium driven by somewhat heightened illiquidity risk.

Increasing exposure to A- and BBB-rated taxable municipals may also allow pension sponsors to use the lower default rate relative to corporates to their advantage. Plans that impose a lower quality limit on corporates might consider raising that limit on taxable municipals given their favorable default rate characteristics. The result may be enhanced yields without sacrificing credit risk.

It is also worth noting the yields represented in Exhibit 3 are based on the taxable municipal index, and we believe it may be reasonable to expect somewhat higher yields when broadening beyond the index. This yield premium would likely come with some incremental sacrifice to liquidity; however, long-term investors such as pension plans and insurers may find this to be a welcome tradeoff.

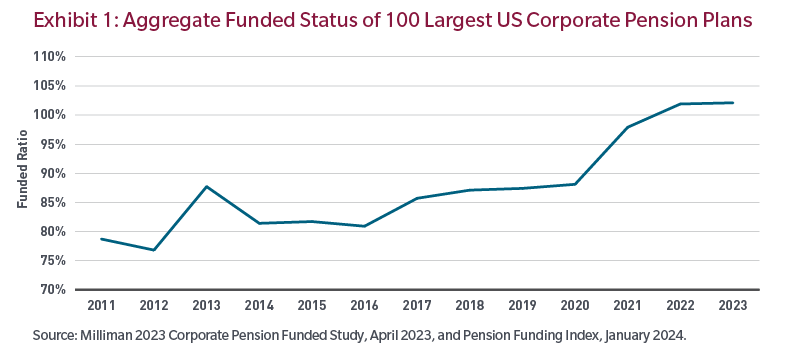

Now May Be the Time to Consider Introducing or Increasing a Taxable Municipal Allocation

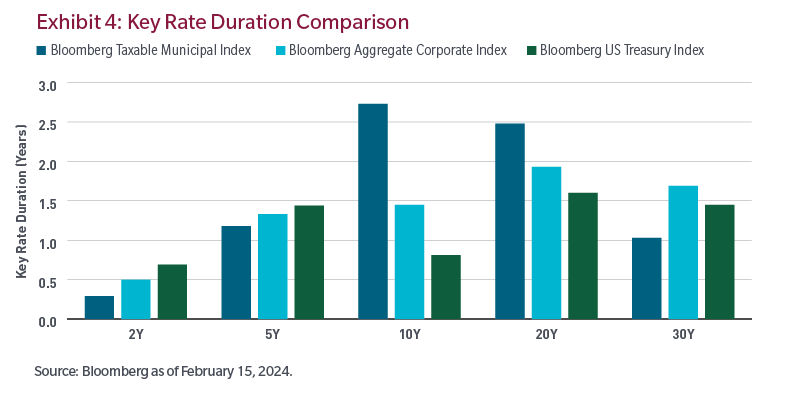

With yields at multi-year highs and a market that has grown from increased supply,2 now may be a good time for plan sponsors and insurers to consider an allocation to taxable municipals within an LDI portfolio. We believe taxable municipals have many advantages compared to corporates, including higher quality, lower historical default rates, higher yields and broader representation in the long portion of the yield curve.

We believe an active approach that takes advantage of the broad universe of issues will benefit investors. An active manager has several alpha levers at their disposal, including accessing illiquidity premia, which we believe is a risk that can be well tolerated by the long holding periods associated with pension plans and insurers.

Endnotes

1 Source: FTSE Pension Discount Curve data as of 30 November 2023. Discount rate for “Intermediate” plan increased from 2.74% on 12/31/2022 to 5.28% on 11/30/2023, while duration decreased from 16.83 years to 13.41 years over the same period. Discount rate for “Short” plan increased from 2.63% to 5.26%, and duration decreased from 13.42 to 10.96 over the same period.

2 The size of the Bloomberg Municipal Index Taxable Bonds increased from $313B as of 12/2018 to $411B as of 12/2023. The total size of the taxable municipal market is $663B as of 12/2023.

Investments in debt instruments may decline in value as the result of, or perception of, declines in the credit quality of the issuer, borrower, counterparty, or other entity responsible for payment, underlying collateral, or changes in economic, political, issuer-specific, or other conditions. Certain types of debt instruments can be more sensitive to these factors and therefore more volatile. In addition, debt instruments entail interest rate risk (as interest rates rise, prices usually fall). Therefore, the portfolio's value may decline during rising rates.

Source FTSE International Limited (“FTSE”) © FTSE 2024. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under licence. “FT-SE®”, “FOOTSIE®”, and “FTSE4GOOD®” are trade marks of the London Stock Exchange Group companies. “Nareit®” is a trade mark of the National Association of Real Estate Investment Trusts (“Nareit”) and “EPRA” is a trade mark of the European Public Real Estate Association (“EPRA”) and all are used by FTSE International Limited (“FTSE”) under licence. The FTSE EPRA Nareit Index is calculated by FTSE. Neither FTSE, Euronext N.V., Nareit nor EPRA sponsor, endorse or promote this product and are not in any way connected to it and do not accept any liability. All intellectual property rights in the index values and constituent list vests in FTSE, Euronext N.V., Nareit and EPRA. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and/or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The views expressed herein are those of the MFS Investment Solutions Group within the MFS distribution unit and may differ from those of MFS portfolio managers and research analysts. These views are subject to change at any time and should not be construed as the Advisor’s investment advice, as securities recommendations, or as an indication of trading intent on behalf of MFS.