What are the opportunities in fixed income as we position our global fixed income portfolios?

With recession viewed as the base case and the recent rate moves, we are looking for cross-country opportunities to gradually add duration in our global fixed income multisector portfolios. We see a stronger case for duration as the year progresses and macro data provides higher conviction. We are focused on finding relative value opportunities in curves and countries as it is unlikely every economy will deliver the rate cuts that are priced into the markets. We have diversified the overweight position and duration in different markets including the US but also in parts of Europe, such as Sweden, and other markets, such as Canada and New Zealand. We are lukewarm regarding duration in China, Australia and parts of Europe.

Idiosyncratic local emerging market currency bond markets are becoming increasingly attractive given the high number of past rate hikes and prospective rate cuts. We are proceeding gradually and selectively because of the tight global financial conditions. We have gained exposure mostly in Latin countries where the real rates have led to an inclination to buy locally, such as Uruguay, Brazil, Mexico and Peru. One of our favorite markets for building duration exposure continues to be Korea. We expect the Bank of Korea to be one of the first banks to start cutting rates.

With regards to FX, we are slightly underweight exposure to the US dollar given that we expect the dollar will weaken on the back of the Fed soon ending its hiking cycle. The-US-versus-rest-of-the-world growth expectations and interest rate differentials will determine the path of the US dollar. The potential for USdollar outperformance in a severely risk-off environment is also a consideration. A serious global recession could make the dollar a more attractive “safe haven”.

In securitized and structured, recent widening in areas such as nonagency mortgages and ABS provides new issue opportunities. Secondary CLOs provide opportunities too. We have been closing a large underweight in mortgage pass-throughs, though valuations are less appealing now than they were in the last quarter of 2022. We have been more inclined to add risk in these traditional mortgage-backed securities. We continue to think that there is value there. It is a high-quality asset class still suffering from the consequences of the regional banking crisis and commercial real estate concerns.

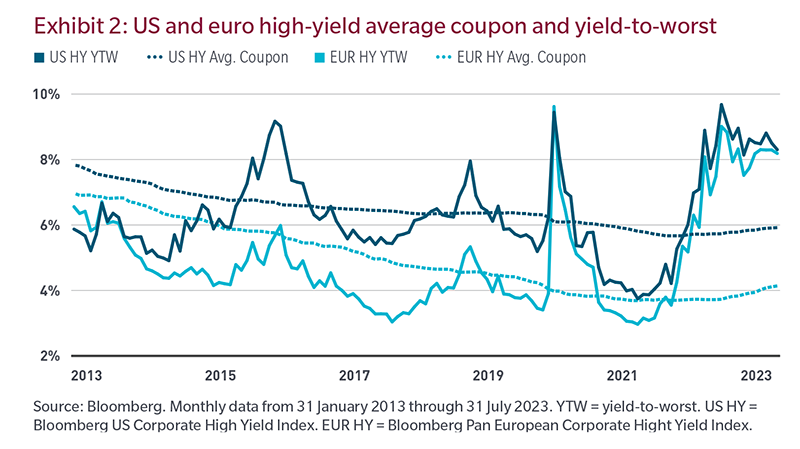

In credit broadly, we continue to favor investment-grade. Some attractive opportunities have emerged in recent weeks. We watch for potential dislocations in the face of likely volatility and new issue market concessions. We favor securities issued in euros and Canadian dollars over US dollars.

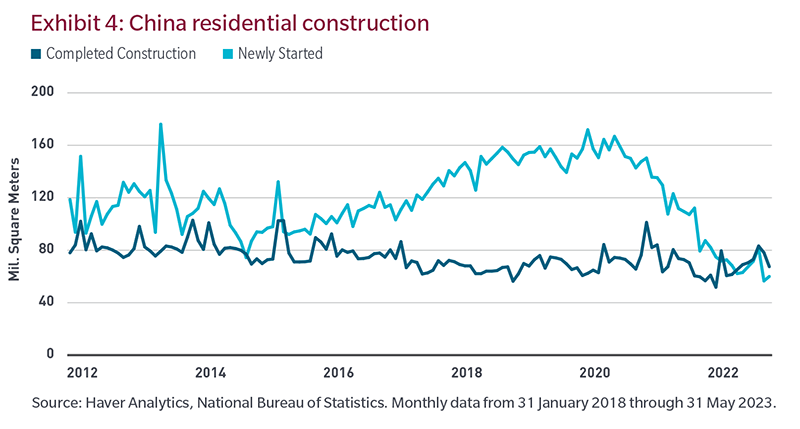

In emerging markets, with a strong fundamental and technical backdrop, compressed valuations mean selectivity will be key. Investment-grade sovereigns and EM corporate debt is less attractive.

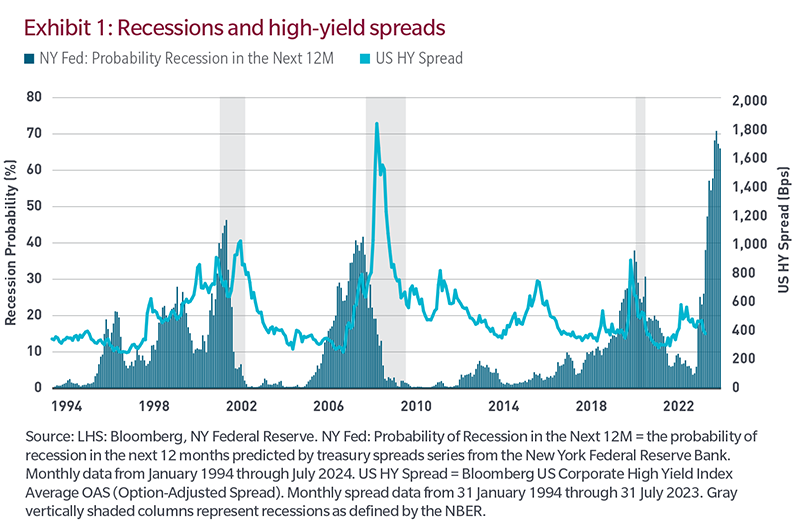

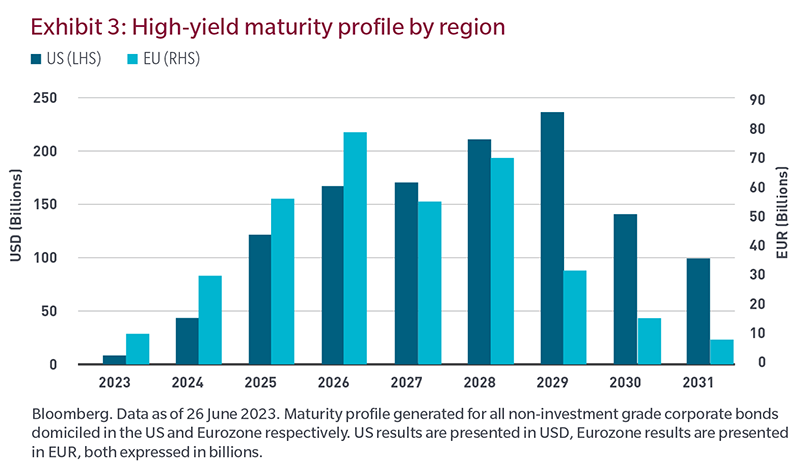

Finally, in high yield, we have reduced exposure, but continue to look for ways to add yield within our allocation. We are identifying opportunities among B-rated securities where we can find good quality names that offer more yield. There is little relative risk-adjusted value outside of specific idiosyncratic research–led ideas.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.