Survey Methodology

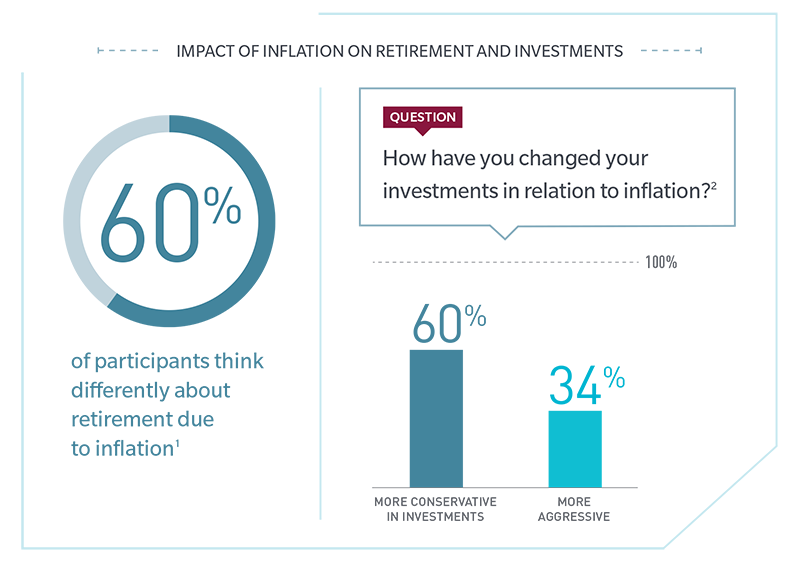

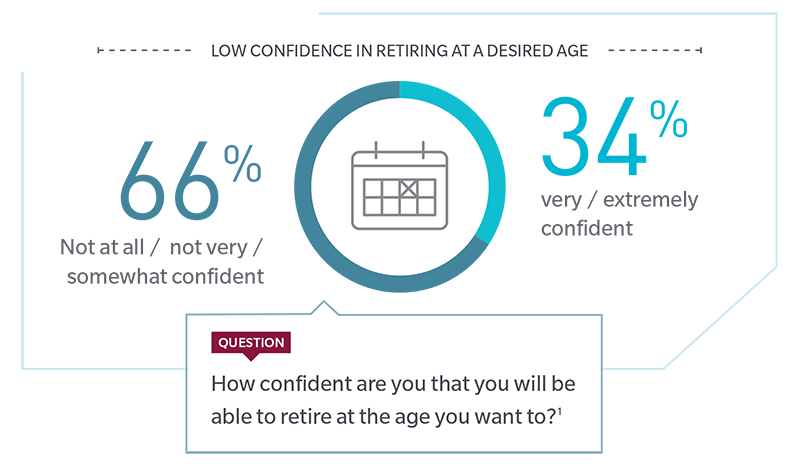

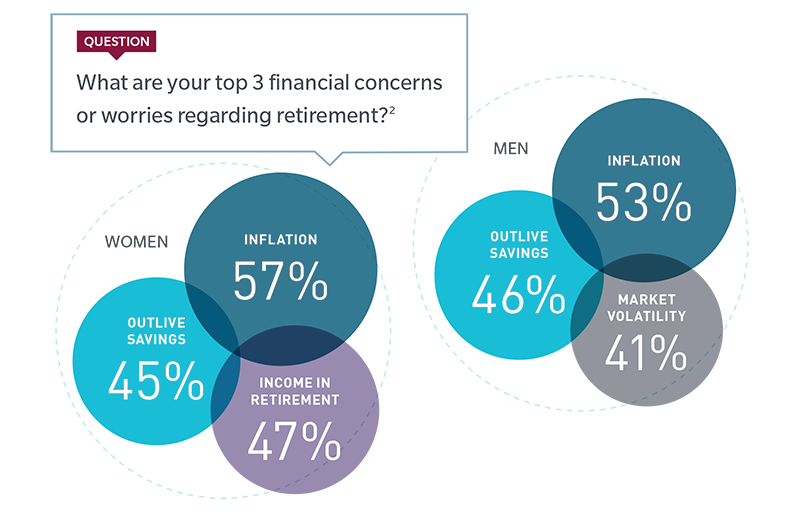

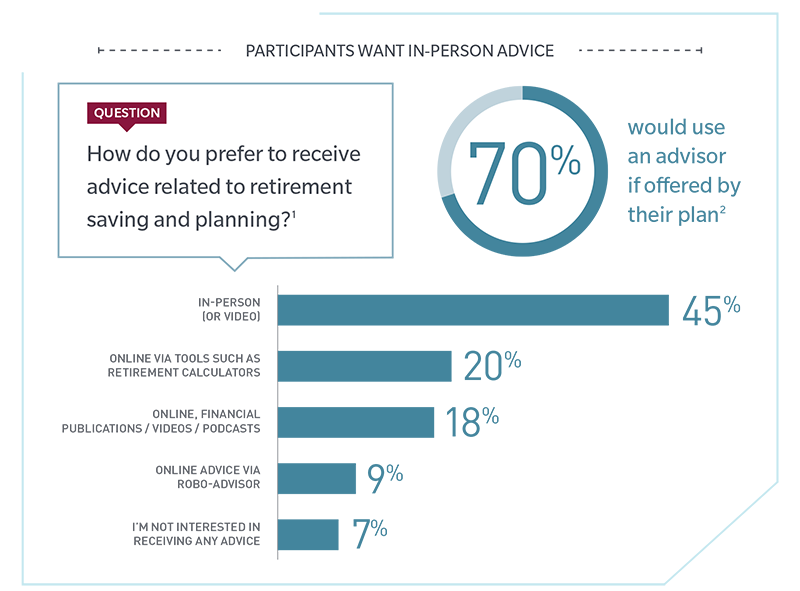

Source: 2023 MFS Global Retirement Survey, US Results.

Methodology: Dynata, an independent third-party research provider, conducted a study among 1,000 Defined Contribution (DC) plan participants in the US on behalf of MFS. MFS was not identified as the sponsor of the study.

To qualify, DC plan participants had to be ages 18+, employed at least part-time, actively contributing to a 401(k), 403(b), 457, or 401(a). Data weighted to mirror the age gender distribution of the workforce. The survey was fielded between March 22 and April 6, 2023.

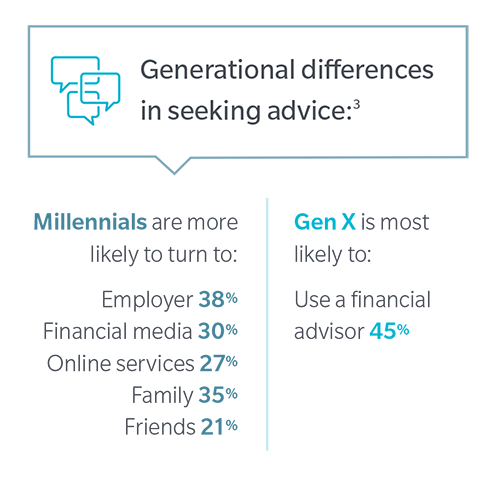

We define generational cohorts as follows: Millennial ages 26–41; Generation X ages 42–57; Baby Boomer ages 58–77.

The views expressed in this material are those of the presenter. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any other MFS investment product.

Please check with your firm's Compliance Department before initiating events to verify that the activity complies with firm policy and industry rules.

MFS does not provide legal, tax or accounting advice. Clients of MFS should obtain their own independent tax and legal advice based on their particular circumstances.

56052.2