November 2023

Take the Worry Out of Changing Interest Rates

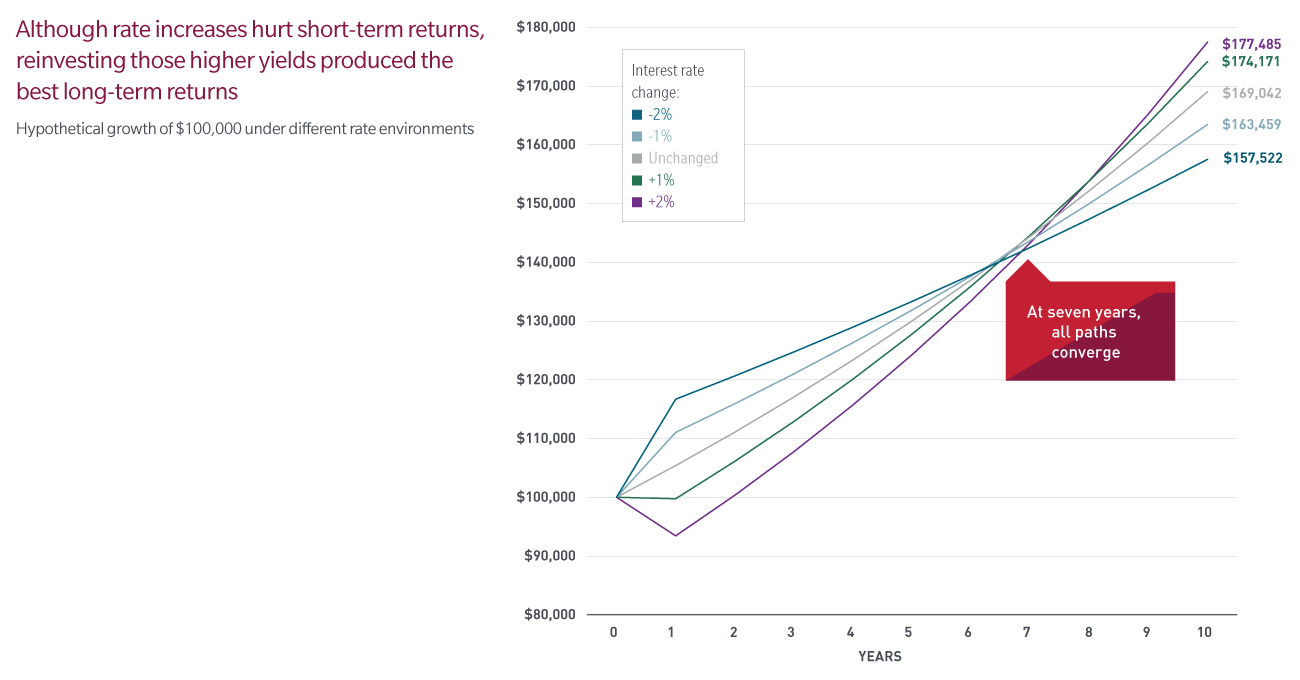

Shows five hypothetical trajectories that a bond portfolio could follow after a move in rates based on the hypothetical performance of a $100,000

Higher, steady or lower? It is easy to get caught up in the drama of interest rate changes, and while moving to the sidelines may relieve some worries, you could also miss out on the potential long-term benefits. While the initial interest rate increases hurt short-term returns, today’s higher interest rates may increase a bond portfolio’s overall return over time. This is because money from coupons and maturing bonds can be reinvested into new bonds with higher yields. In the chart below, we show five hypothetical trajectories that a bond portfolio could follow after a move in rates based on the hypothetical performance of a $100,000 fixed income investment over a 10-year period.

Interest rate change |

-2% | -1% | Unchanged | +1% | +2% |

| Value after 1 year | $116,690 | $111,040 | $105,330 | $99,740 | $94,430 |

| Value after 2 years | $120,646 | $115,915 | $110,071 | $106,113 | $100,334 |

| Value after 7 years | $142,530 | $145,692 | $144,410 | $144,635 | $143,308 |

| Value after 10 years | $157,522 | $163,459 | $169,042 | $174,171 | $177,485 |

| The hypothetical portfolio assumes a starting yield (5.39%) and duration (6.15 years), which reflects the characteristics, yield-to-worst and average effective duration, respectively, of the Bloomberg US Aggregate Index as of 9/30/23. The Bloomberg U.S. Aggregate Bond Index - measures the performance of the U.S. investment grade, fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with at least one year to final maturity.The calculation assumes maturing bond proceeds 100% reinvested at each year’s new starting yield, and holding aside convexity effects for simplicity. The likelihood of spreads and duration remaining constant over 10-year time period is very low. The movement in rates shocked the portfolio initially, and was then left to grow in the given circumstances. The hypothetical interestrate movements (-2% to + 2%) were used as they can be considered a potential range of the 10-Year US Treasury given the historical trend of interest rate movements and ranges the market has experienced over the last 30+ years. Spreads were kept constant to highlight the potential impact of an interest rate shock on a bond portfolio given the aforementioned circumstances/environment. Hypothetical examples are for illustrative purposes only and are not intended to represent the future performance of any MFS portfolio or investment. | |||||

Focus on the long view As the rate hiking cycle winds down, it’s natural to wonder about the direction of rates. But as you can see in the illustration, the higher interest payments can potentially benefit performance — if you reinvest maturing bond proceeds. |

Consider the unique nature of bond strategies Although returns over the short term may be adversely affected by periods of rising rates, those losses could be offset by reinvesting maturing bonds at higher rates. |

Keep in mind the role bond strategies play Regardless of the rate environment, having an appropriate allocation to bonds rather than an all-equity portfolio may help reduce portfolio volatility and help manage downside losses over time. |

Investments in debt instruments may decline in value as the result of, or perception of, declines in the credit quality of the issuer, borrower, counterparty, or other entity responsible for payment, underlying collateral, or changes in economic, political, issuer-specific, or other conditions. Certain types of debt instruments can be more sensitive to these factors and therefore more volatile. In addition, debt instruments entail interest rate risk (as interest rates rise, prices usually fall). Therefore, the portfolio’s value may decline during rising rates.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.