A Century of Active Experience Built into Our Approach

-

our philosophy

Active Solutions, Global Platform

Backed by more than a century of experience, our active solutions are designed to help clients across the globe invest through changing markets. With the long term always in mind, we’re guided by these principles:

-

our fixed income story

The Evolution of Fixed Income at MFS

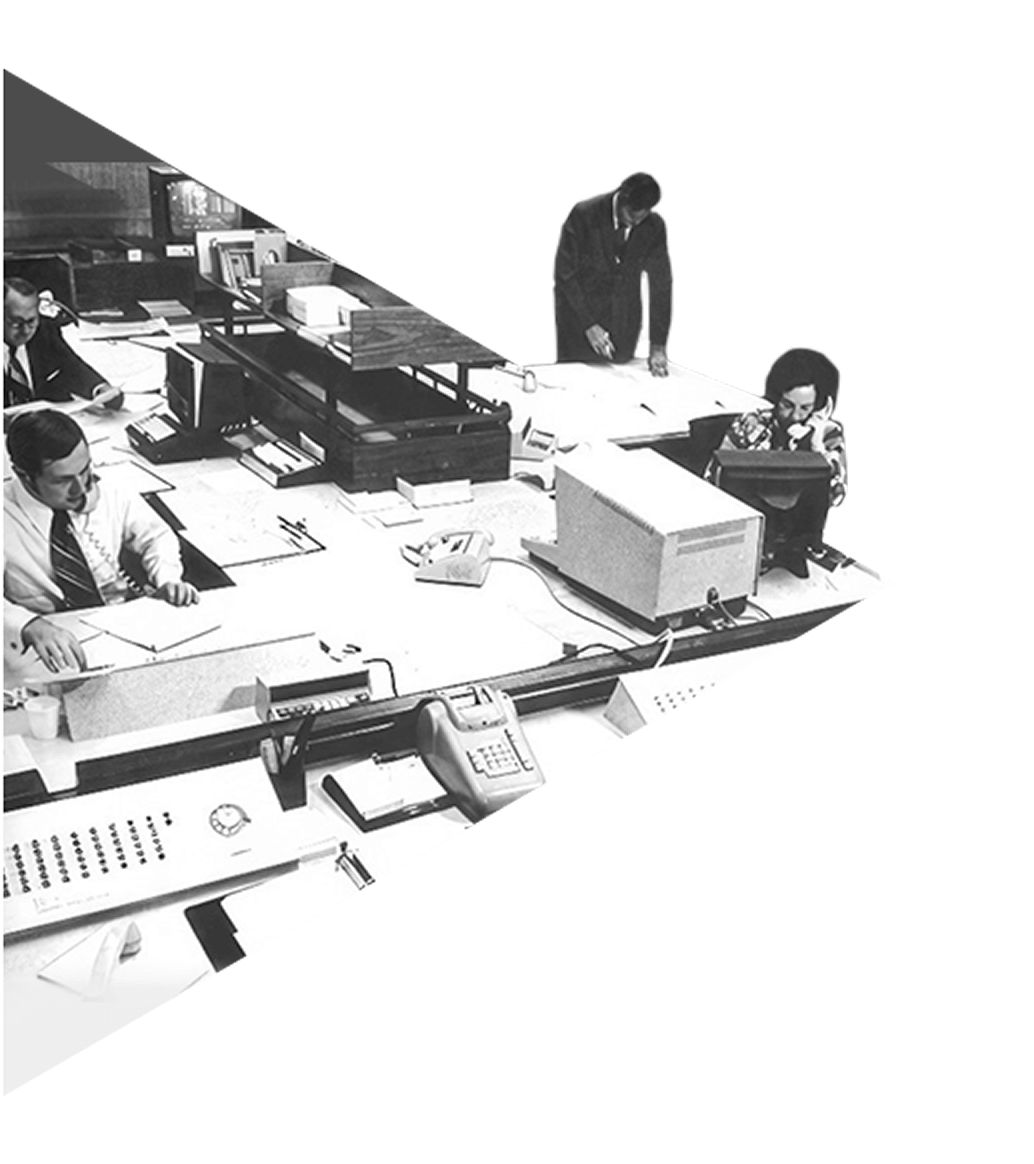

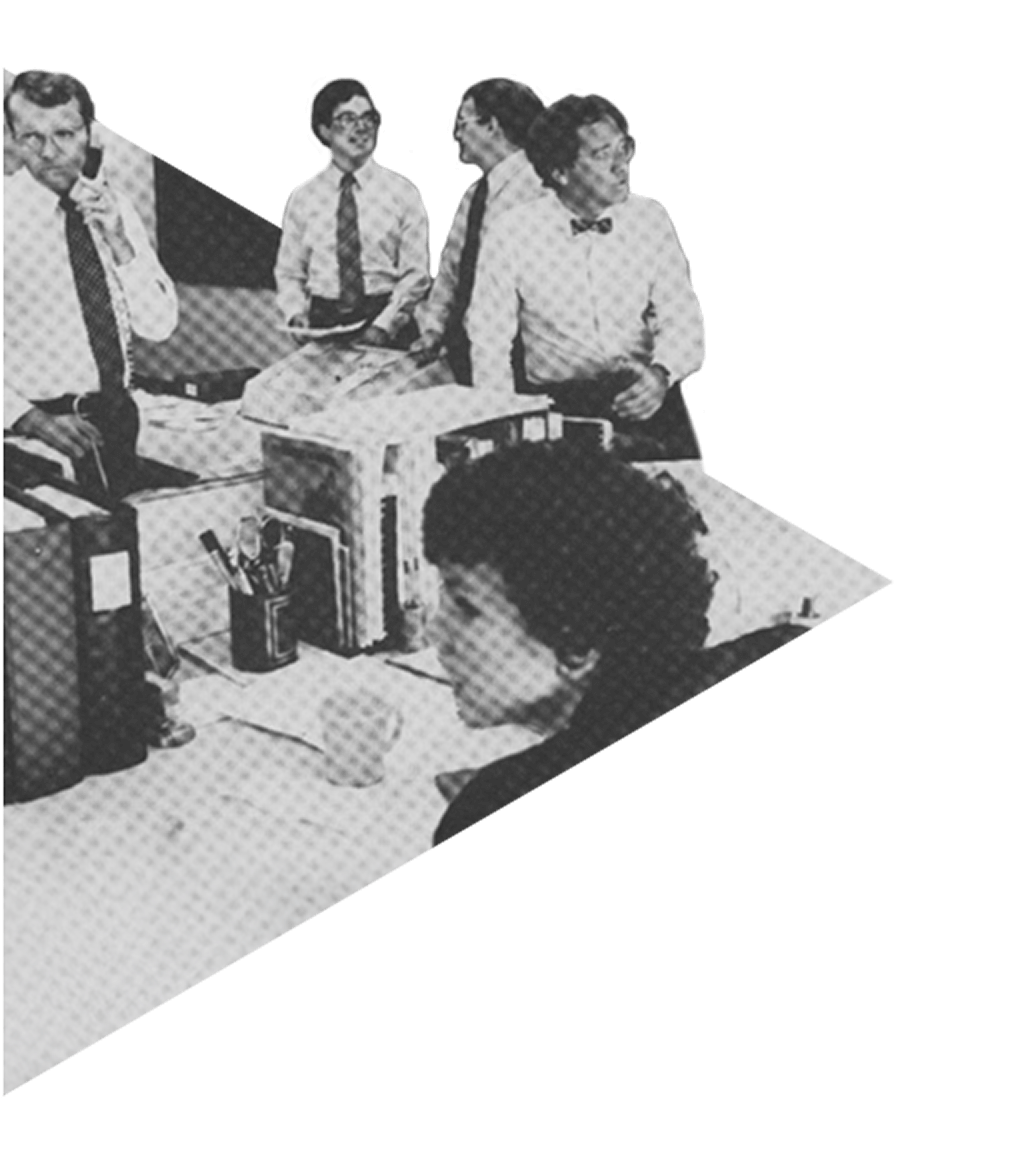

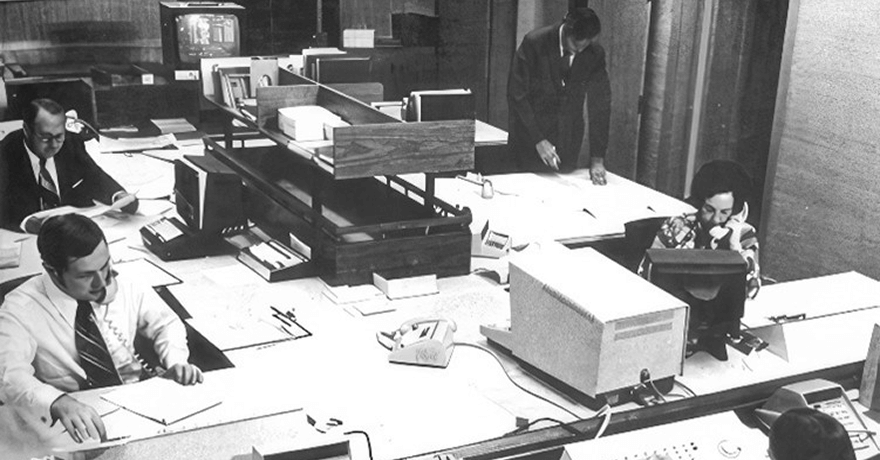

MFS pioneered active investing in 1924, and starting in 1970, became one of the first investment firms to actively trade bonds like any other security — providing another path to long-term value for fixed income investors.

EVOLUTION OF MFS ACTIVE FIXED INCOMEScrollSwipe to explore

Bonds are typically

Bonds are typically

bought and heldwith investors collecting interest

until bond’s maturityInflation significantly

downgrades the value

of bondsand traditional buy-and-hold

strategiesMFS hires one of the

first portfolio managers

to trade bonds activelyusing credit and duration analysis,

helping transform bond investing

to better serve investorsMFS’ newly formed fixed income team includes one

of the first womenin the bond investing industry and launches the first balanced fund,

MFS® Total Return Fund.1

Standing at the forefront of bond innovationthe team launched MFS® Corporate

Standing at the forefront of bond innovationthe team launched MFS® Corporate

Bond Fund, one of the earliest actively

managed bond portfolios.1

MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund.1MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund, and later launching MFS® Meridian Funds.

MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund.1MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund, and later launching MFS® Meridian Funds. MFS integrates

MFS integrates

fixed income, equity,

and quant teamscreating the unified global investment

platform we have today. Located across the globe, our 134 fixed income professionalsare integrated into a 327-member investment team.2GLOBAL FOOTPRINT1970

Located across the globe, our 134 fixed income professionalsare integrated into a 327-member investment team.2GLOBAL FOOTPRINT1970

Our history shows that we are an organization built to evolve with and for investors. Today, we continue to deliver the fixed income solutions our clients need.

“Our global investment platform is a defining attribute of our approach to delivering for clients.”

Alex Mackey

Co-CIO, Fixed Income -

active solutions

Fixed Income Funds

Fund name (I1 Shares)

Ticker

Benchmark

Fund approach

Bloomberg US Aggregate Bond Index

A highly flexible core-plus bond fund that integrates bottom-up research with macro and quantitative perspectives

Bloomberg US Aggregate Bond Index

An investment grade core-plus bond fund that integrates bottom-up research with macro and quantitative perspectives

Bloomberg 1–3 Year U.S. Government/Credit Bond Index

An investment-grade fund with an average effective maturity normally not exceeding five years that uses bottom-up research

Bloomberg US Credit Index

A primarily investment-grade fund that also invests in high-yield and emerging market bonds and blends bottom-up research with top-down inputs

Important risk considerations

The fund may not achieve its objective and/or you could lose money on your investment in the fund. • Bond: Investments in debt instruments may decline in value as the result of, or perception of, declines in the credit quality of the issuer, borrower, counterparty, or other entity responsible for payment, underlying collateral, or changes in economic, political, issuer-specific, or other conditions. Certain types of debt instruments can be more sensitive to these factors and therefore more volatile. In addition, debt instruments entail interest rate risk (as interest rates rise, prices usually fall). Therefore, the portfolio's value may decline during rising rates. Portfolios that consist of debt instruments with longer durations are generally more sensitive to a rise in interest rates than those with shorter durations. At times, and particularly during periods of market turmoil, all or a large portion of segments oft he market may not have an active trading market. As a result, it may be difficult to value these investments and it may not be possible to sell a particular investment or type of investment at any particular time or at an acceptable price. The price of an instrument trading at a negative interest rate responds to interest rate changes like other debt instruments; however, an instrument purchased at a negative interest rate is expected to produce a negative return if held to maturity. • International: Investments in foreign markets can involve greater risk and volatility than U.S. investments because of adverse market, currency, economic, industry, political, regulatory, geopolitical, or other conditions. • Derivatives: Investments in derivatives can be used to take both long and short positions, be highly volatile, involve leverage (which can magnify losses), and involve risks in addition to the risks oft he underlying indicator(s) on which the derivative is based, such as counterparty and liquidity risk. • High Yield: Investments in below investment grade quality debt instruments can be more volatile and have greater risk of default, or already be in default, than higher-quality debt instruments. • Please see the prospectus for further information on these and other risk considerations.Before investing, consider the fund's investment objectives, risks, charges, and expenses. For a prospectus, or summary prospectus, containing this and other information, contact MFS or view online at mfs.com. Please read it carefully.

You May Be Interested In

MFS registered investment products are offered through MFS® Fund Distributors, Inc., Member SIPC, 111 Huntington Avenue, Boston, MA 02199.

Active Solutions, Global Platform

Backed by more than a century of experience, our active solutions are designed to help clients across the globe invest through changing markets. With the long term always in mind, we’re guided by these principles:

The Evolution of Fixed Income at MFS

MFS pioneered active investing in 1924, and starting in 1970, became one of the first investment firms to actively trade bonds like any other security — providing another path to long-term value for fixed income investors.

bought and held

until bond’s maturity

downgrades the value

of bonds

strategies

first portfolio managers

to trade bonds actively

helping transform bond investing

to better serve investors

of the first women

MFS® Total Return Fund.1

Bond Fund, one of the earliest actively

managed bond portfolios.1

fixed income, equity,

and quant teams

platform we have today.

Our history shows that we are an organization built to evolve with and for investors. Today, we continue to deliver the fixed income solutions our clients need.

“Our global investment platform is a defining attribute of our approach to delivering for clients.”Alex Mackey |

Fixed Income Funds

Fund name (I1 Shares) |

Ticker |

Benchmark |

Fund approach |

Bloomberg US Aggregate Bond Index |

A highly flexible core-plus bond fund that integrates bottom-up research with macro and quantitative perspectives |

||

Bloomberg US Aggregate Bond Index |

An investment grade core-plus bond fund that integrates bottom-up research with macro and quantitative perspectives |

||

Bloomberg 1–3 Year U.S. Government/Credit Bond Index |

An investment-grade fund with an average effective maturity normally not exceeding five years that uses bottom-up research |

||

Bloomberg US Credit Index |

A primarily investment-grade fund that also invests in high-yield and emerging market bonds and blends bottom-up research with top-down inputs |

Important risk considerations

The fund may not achieve its objective and/or you could lose money on your investment in the fund. • Bond: Investments in debt instruments may decline in value as the result of, or perception of, declines in the credit quality of the issuer, borrower, counterparty, or other entity responsible for payment, underlying collateral, or changes in economic, political, issuer-specific, or other conditions. Certain types of debt instruments can be more sensitive to these factors and therefore more volatile. In addition, debt instruments entail interest rate risk (as interest rates rise, prices usually fall). Therefore, the portfolio's value may decline during rising rates. Portfolios that consist of debt instruments with longer durations are generally more sensitive to a rise in interest rates than those with shorter durations. At times, and particularly during periods of market turmoil, all or a large portion of segments oft he market may not have an active trading market. As a result, it may be difficult to value these investments and it may not be possible to sell a particular investment or type of investment at any particular time or at an acceptable price. The price of an instrument trading at a negative interest rate responds to interest rate changes like other debt instruments; however, an instrument purchased at a negative interest rate is expected to produce a negative return if held to maturity. • International: Investments in foreign markets can involve greater risk and volatility than U.S. investments because of adverse market, currency, economic, industry, political, regulatory, geopolitical, or other conditions. • Derivatives: Investments in derivatives can be used to take both long and short positions, be highly volatile, involve leverage (which can magnify losses), and involve risks in addition to the risks oft he underlying indicator(s) on which the derivative is based, such as counterparty and liquidity risk. • High Yield: Investments in below investment grade quality debt instruments can be more volatile and have greater risk of default, or already be in default, than higher-quality debt instruments. • Please see the prospectus for further information on these and other risk considerations.

Before investing, consider the fund's investment objectives, risks, charges, and expenses. For a prospectus, or summary prospectus, containing this and other information, contact MFS or view online at mfs.com. Please read it carefully.

You May Be Interested In

MFS registered investment products are offered through MFS® Fund Distributors, Inc., Member SIPC, 111 Huntington Avenue, Boston, MA 02199.