A Century of Active Experience Built into Our Approach

-

our philosophy

Active Solutions, Global Platform

Backed by more than a century of experience, our active solutions are designed to help clients across the globe invest through changing markets. With the long term always in mind, we’re guided by these principles:

-

our fixed income story

The Evolution of Fixed Income at MFS

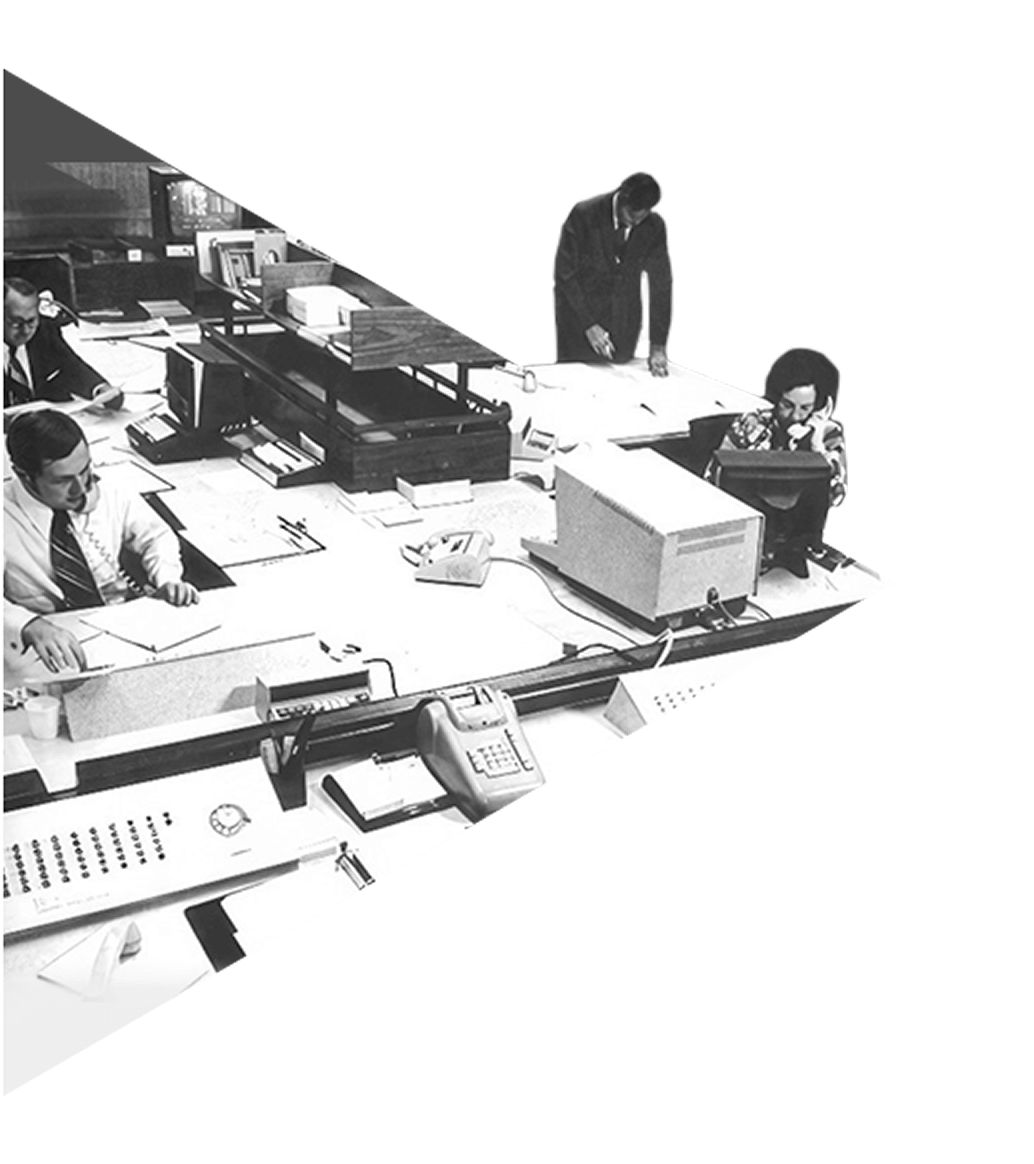

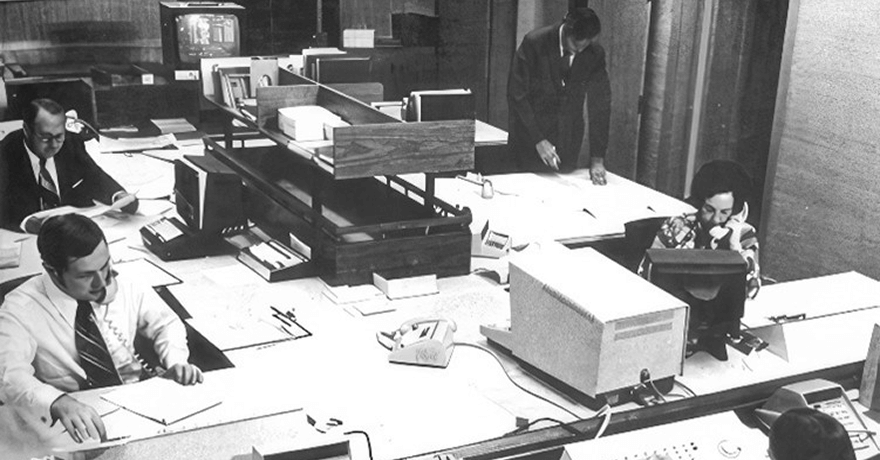

MFS pioneered active investing in 1924, and starting in 1970, became one of the first investment firms to actively trade bonds like any other security — providing another path to long-term value for fixed income investors.

EVOLUTION OF MFS ACTIVE FIXED INCOMEScrollSwipe to explore

Bonds are typically

Bonds are typically

bought and heldwith investors collecting interest

until bond’s maturityInflation significantly

downgrades the value

of bondsand traditional buy-and-hold

strategiesMFS hires one of the

first portfolio managers

to trade bonds activelyusing credit and duration analysis,

helping transform bond investing

to better serve investorsMFS’ newly formed fixed income team includes one

of the first womenin the bond investing industry and launches the first balanced fund,

MFS® Total Return Fund.1

Standing at the forefront of bond innovationthe team launched MFS® Corporate

Standing at the forefront of bond innovationthe team launched MFS® Corporate

Bond Fund, one of the earliest actively

managed bond portfolios.1

MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund.1MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund, and later launching MFS® Meridian Funds.

MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund.1MFS expands fixed income strategies globallyintroducing the first global fixed income fund in the US, MFS® International Bond Fund, and later launching MFS® Meridian Funds. MFS integrates

MFS integrates

fixed income, equity,

and quant teamscreating the unified global investment

platform we have today. Located across the globe, our 134 fixed income professionalsare integrated into a 327-member investment team.2GLOBAL FOOTPRINT1970

Located across the globe, our 134 fixed income professionalsare integrated into a 327-member investment team.2GLOBAL FOOTPRINT1970

Our history shows that we are an organization built to evolve with and for investors. Today, we continue to deliver the fixed income solutions our clients need.

“Our global investment platform is a defining attribute of our approach to delivering for clients.”

Alex Mackey

Co-CIO, Fixed Income -

active solutions

Fixed Income Funds

Fund name (I1 Shares)

ISIN

Benchmark

Investment approach

Bloomberg Global Aggregate Credit Index

Idea generation based on intensive fundamental research with a focus on bottom-up security selection and seeking to avoid adverse credit events. May have limited high-yield, international and/or emerging market debt.

Bloomberg Global Aggregate Index (USD Hedged)

A flexible and adaptable approach to risk allocation seeks to generate attractive long-term risk-adjusted returns. An integrated research approach that strives to identify inefficiencies in global fixed income markets

Bloomberg Euro Aggregate Corporate Index

Idea generation based on intensive fundamental research with a focus on bottom-up security selection and seeking to avoid adverse credit events. May have limited high-yield, international and/or emerging market debt (mostly currency hedged to euros).

MFS Meridian Funds is an open-ended investment company established in Luxembourg which is available for sale in certain jurisdictions only. The Funds are not available for sale in the U.S. or to U.S. persons. MFS Investment Management Company (Lux) S.ar.l. is the management company of the Funds. Subscriptions in The Funds are valid only if made on the basis of the current Prospectus, the most recent financial reports and the Key Information Document or in the U.K. Key Investor Information Document which are available under the “Resources” tab. Information on this Web site should not be considered a solicitation to buy, an offer to sell, or a recommendation for any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorised. In addition, investments may not be made via this Web site. In certain jurisdictions, investments may be made only through authorised intermediaries. Please check with MFS for more complete information about whether the securities discussed are available or authorised in your jurisdiction.

You should read the offering documents carefully before investing as they contain complete information on the fund’s investment objective(s), the risks associated with the investment in the fund, the fees, charges, and expenses involved. These elements, as well as other information contained in the offering documents, should be considered carefully before investing. You may also order the offering documents by mail or download them. Unless otherwise indicated, logos, product and service names are trademarks of MFS and its affiliates and may be registered in certain countries.

You May Be Interested In

Active Solutions, Global Platform

Backed by more than a century of experience, our active solutions are designed to help clients across the globe invest through changing markets. With the long term always in mind, we’re guided by these principles:

The Evolution of Fixed Income at MFS

MFS pioneered active investing in 1924, and starting in 1970, became one of the first investment firms to actively trade bonds like any other security — providing another path to long-term value for fixed income investors.

bought and held

until bond’s maturity

downgrades the value

of bonds

strategies

first portfolio managers

to trade bonds actively

helping transform bond investing

to better serve investors

of the first women

MFS® Total Return Fund.1

Bond Fund, one of the earliest actively

managed bond portfolios.1

fixed income, equity,

and quant teams

platform we have today.

Our history shows that we are an organization built to evolve with and for investors. Today, we continue to deliver the fixed income solutions our clients need.

“Our global investment platform is a defining attribute of our approach to delivering for clients.”Alex Mackey |

Fixed Income Funds

Fund name (I1 Shares) |

ISIN |

Benchmark |

Investment approach |

Bloomberg Global Aggregate Credit Index |

Idea generation based on intensive fundamental research with a focus on bottom-up security selection and seeking to avoid adverse credit events. May have limited high-yield, international and/or emerging market debt. |

||

Bloomberg Global Aggregate Index (USD Hedged) |

A flexible and adaptable approach to risk allocation seeks to generate attractive long-term risk-adjusted returns. An integrated research approach that strives to identify inefficiencies in global fixed income markets |

||

Bloomberg Euro Aggregate Corporate Index |

Idea generation based on intensive fundamental research with a focus on bottom-up security selection and seeking to avoid adverse credit events. May have limited high-yield, international and/or emerging market debt (mostly currency hedged to euros). |

MFS Meridian Funds is an open-ended investment company established in Luxembourg which is available for sale in certain jurisdictions only. The Funds are not available for sale in the U.S. or to U.S. persons. MFS Investment Management Company (Lux) S.ar.l. is the management company of the Funds. Subscriptions in The Funds are valid only if made on the basis of the current Prospectus, the most recent financial reports and the Key Information Document or in the U.K. Key Investor Information Document which are available under the “Resources” tab. Information on this Web site should not be considered a solicitation to buy, an offer to sell, or a recommendation for any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorised. In addition, investments may not be made via this Web site. In certain jurisdictions, investments may be made only through authorised intermediaries. Please check with MFS for more complete information about whether the securities discussed are available or authorised in your jurisdiction.

You should read the offering documents carefully before investing as they contain complete information on the fund’s investment objective(s), the risks associated with the investment in the fund, the fees, charges, and expenses involved. These elements, as well as other information contained in the offering documents, should be considered carefully before investing. You may also order the offering documents by mail or download them. Unless otherwise indicated, logos, product and service names are trademarks of MFS and its affiliates and may be registered in certain countries.