2024 MFS Global Retirement Survey: The Road to Better Outcomes

Our 2024 survey highlights how members are taking charge of their financial futures. Discover key insights into retirement readiness, investment behavior, and the gap between expectations and reality.

Our latest survey highlights how members are taking charge of their financial futures. Discover key insights into retirement readiness, investment behavior, and the gap between expectations and reality.

Source: MFS 2024 Global Retirement Survey, Canadian members. Q: What, if any, competing financial priorities do you have that are preventing you from adequately saving for retirement? Percentages represent the sum of respondents who selected each option. *Percentage of respondents who did not select “I do not have competing financial priorities.”

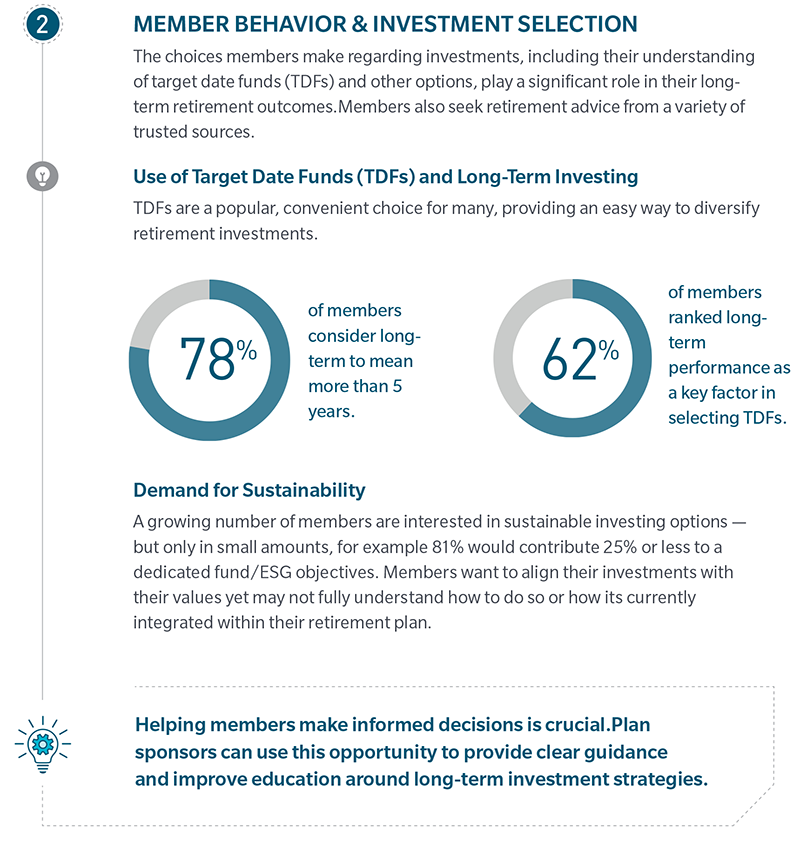

Source: MFS 2024 Global Retirement Survey, Canadian members. Q: What are the most important characteristics of a target-date fund? Please rank order the top 3 characteristics that are most important to you.Q: If you are interested in ESG how much of your retirement assets would you be willing to put toward ESG objectives? Question was asked of respondents who answered that they are willing to give up “some” or “significant” return potentialto invest in funds that reflect their personal values.

Source: MFS 2024 Global Retirement Survey, Canadian member & retiree respondents Q: (Member) Do you expect your retirement to be… Q: (Retiree) When you retired, was it… Q: (Retiree) Was your retirement date…? Q: (Retiree) Why was your retirement date earlier than expected? Q: (Retiree) Why was your retirement date later than expected? Q: (Members) If your workplace retirement plan offered access to an advisor/planner to help with planning for retirement, would you use this resource?

Contact your MFS representative for the full survey results.

MFS may incorporate environmental, social, or governance (ESG) factors into its investment decision making, fundamental investment analysis and engagement activities when communicating with issuers. The statements or examples provided above illustrate certain ways that MFS has historically incorporated ESG factors when analyzing or engaging with certain issuers but they are not intended to imply that favorable investment, ESG outcomes or engagement outcomes are guaranteed in all situations or in any individual situation. Engagements typically consist of a series of communications that are ongoing and often protracted, and may not necessarily result in changes to any issuer’s ESG-related practices. Issuer outcomes are based on many factors and favorable investment or engagement outcomes, including those described above, may be unrelated to MFS analysis or activities. The degree to which MFS incorporates ESG factors into its investment decision making, investment analysis and/or engagement activities will vary by strategy, product, and asset class, and may also vary over time, and will generally be determined based on MFS’ opinion of the relevance and materiality of the specific ESG factors (which may differ from judgements or opinions of third-parties, including investors). Any examples above may not be representative of ESG factors used in the management of any investor’s portfolio. Any ESG assessments or incorporation of ESG factors by MFS may be reliant on data received from third parties (including investee companies and ESG data vendors), which may be inaccurate, incomplete, inconsistent, out-of-date or estimated, or only consider certain ESG aspects (rather than looking at the entire sustainability profile and actions of an investment or its value chain), and as such, may adversely impact MFS’ analysis of the ESG factors relevant to an investment. The information included above, as well as individual companies and/or securities mentioned, should not be construed as investment advice, a recommendation to buy or sell or an indication of trading intent on behalf of any MFS product. Keep in mind that all investments, including mutual funds, carry a certain amount of risk including the possible loss of the principal amount invested.

Survey methodology

Source: 2024 MFS Global Retirement Survey, Canadian Results.

Methodology: Dynata, an independent third-party research provider, conducted a study among 1,004 Defined Contribution (DC) plan members in Canada on behalf of MFS. MFS was not identified as the sponsor of the study.

To qualify, DC plan members had to be ages 18+, employed at least part-time, actively contributing to a DC Pension Plan, Group Registered Retirement Savings Plan, Deferred Profit Sharing Plan, Non-Registered Group Savings Plan or Simplified Employee Pension Plan. Data weighted to mirror the age gender distribution of the workforce.

The survey was fielded between March 28 and April 13, 2024.

We define generational cohorts as follows: Gen Z: Ages 18 – 27. Millennials: Ages 28 – 43. Gen X: Ages 44 – 59. Boomers: Ages 60 – 78.

Issued in Canada by MFS Investment Management Canada Limited.

The views expressed are those of MFS, and are subject to change at any time. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any MFS investment product. No forecasts can be guaranteed. Past performance is no guarantee of future results.