Principles of Long-Term Investing Resilience

Market volatility, although upsetting, is a part of investing. Rather than reacting when volatility strikes, learn how a cool head and a well-diversified portfolio can be one way to effectively navigate the market's ups and downs.

Our playbook can help you put market volatility into perspective by explaining market movements and investing basics. These easy to understand takeaways are designed to keep you on track to pursue your long-term goals.

Learn More

-

Market movements

Markets are resilient: History shows declines don’t last.

Markets are always moving — up, down and sideways. While unsettling, market volatility is inevitable and completely normal.

The challenge for investors is to not let market declines get them off track as they seek to achieve long-term goals. Because time after time, stock markets have recovered from the disruptive, but ultimately short-term, declines — and gone on to post gains.In the past 40 years, only 9 declines have led to a down year.

Moving out of stocks could lock in losses and may prevent you from profiting from any subsequent gains.

View Full Flyer

Source: FactSet and S&P US. Daily data as of 31 December 1979 to 31 December 2019. Returns above are in US dollars and calculated based on the S&P 500 Price Return Index. Max drawdown is the largest drawdown (peak-to-trough) within each calendar year.

Intrayear decline is the largest price drop from peak-to-trough during a calendar year.

Past performance is no guarantee of future results. These data are not intended to represent the performance of any MFS® portfolio. For more information on any MFS product, including performance, visit mfs.com.

The S&P 500 Index measures the broad US stock market. Returns for periods noted are price only.

It is not possible to invest directly in an index.

-

Controlling emotions

Remaining in the market

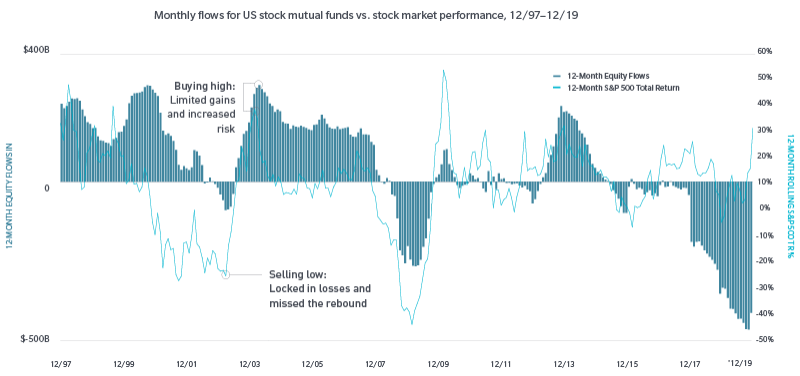

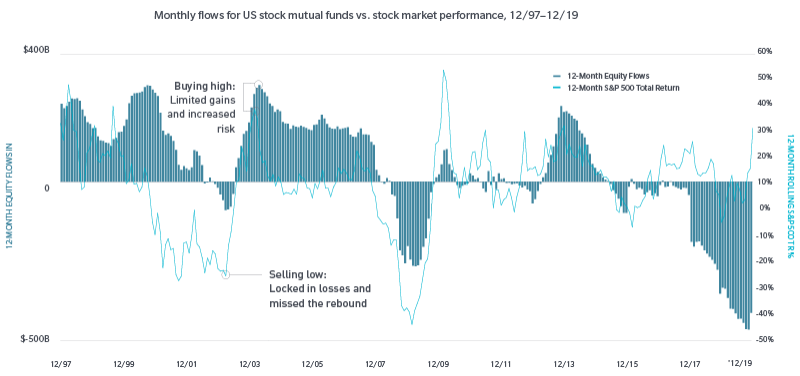

We’ve all heard the phrase “buy low, sell high.” Unfortunately, emotions — anxiety when the market declines or excitement when the market rallies — all too often cause investors to buy when prices are high and sell when prices are low. Poor market timing — selling to avoid declines or buying after a rally —can lessen your portfolio’s long-term potential. Investing for the long term and resisting the urge to time the market may be a better way to work toward achieving your goals.

Counter emotions with a sound long-term investment plan and a good financial coach.

View Full Flyer

Data sources: Strategic Insight Simfund/TD; SPAR, FactSet Research Systems Inc.

Index charts are for illustrative purposes only and not intended to represent future performance of any MFS® product.

Past performance is no guarantee of future results.

The S&P 500 Index measures the broad US stock market. Index performance does not include any investment-related fees or expenses. It is not possible to invest directly in an index.

The investments you choose should correspond to your financial needs, goals, and risk tolerance. For assistance in determining your financial situation, please consult an investment professional.

-

Long-term view

Building wealth takes time. Think long term.

Historically, investing in stocks has been one of the best ways to build wealth, compared to bonds. That’s because over long periods of time the stock market has generated positive returns. And moving in and out of the market — market timing — to avoid volatility rarely works. Your investment professional can help you build a portfolio that may help you ride out the ups and downs of the stock market and achieve your long-term goals.

As part of an overall portfolio, consider stocks for their long-term growth potential.

The investments you choose should correspond to your financial needs, goals, and risk tolerance. For assistance in determining your financial situation, consult an investment professional.

View Full Flyer

Source: FactSet and S&P US. Monthly data as of 30 December 1949 to 31 December 2019. Price returns are that of the S&P 500 Index in US dollars. The S&P 500 Index measures the broad US stock market. Index performance does not include any investment-related fees or expenses. It is not possible to invest directly in an index.

Common stocks generally provide an opportunity for more captial appreciation than fixed-income investments but have also been subject to greater market fluctuations. Keep in mind that all investments do not guarantee a profit or protect against a loss.

-

Diversification

20 Years of the Best and Worst – A Case for Diversification

Everyone wants to be in the best-performing asset class every year. The thing is, few people are savvy enough to consistently choose the best. That’s why diversification is key. This chart shows annual returns for eight broad-based asset classes, cash and a diversified portfolio ranked from best to worst. Notice how the “leadership” changes from year to year, and how competitively the diversified portfolio performed over 20 years (see the “average” column).

Note that the diversified portfolio’s assets were rebalanced at the end of every quarter to maintain the equal allocations throughout the period. Standard deviation reflects a portfolio’s total return volatility, which is based on a minimum of 36 monthly returns. The larger the portfolio’s standard deviation, the greater the portfolio’s volatility. Diversification does not guarantee a profit or protect against a loss.

View Full Flyer

-

Rebalancing

Don’t make unintended bets. Consider rebalancing your portfolio.

Market performance shifts over time — for example, stocks outperform bonds, value stocks outpace growth or US markets overtake international. These shifts can result in changes to your asset allocation, and in response, your portfolio could take on a more aggressive or conservative tilt. Rebalancing — bringing your portfolio back to its original allocation — can help you avoid this pitfall.

View Full Flyer

1Time periods above, reflecting a strong stock market and a strong bond market, respectively, are based on the performance of the indices defined below: Stocks are represented by the S&P 500 Index, which measures the broad US stock market. Bonds are represented by the Bloomberg Barclays US Aggregate Bond Index, which is the most common index used to track the performance of investment grade bonds in the United States.

-

Working with an advisor

The Benefits of Working With a Professional

An investment professional – who knows your goals, temperament for risk, time horizon and total holdings – could be your most valuable asset in any type of market environment.

The investment professional can

Help you determine your overall comfort level with risk

Allocate, diversify and rebalance your assets accordingly

Create the best possible financial strategy for pursuing long-term financial goals

Your investment professional can also review your overall investment portfolio, at least annually, to help keep you focused and on course with your goals. And as the market and your needs change over time, an investment professional will be right there with you, helping you make changes to your portfolio as necessary.

These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any other MFS investment product. MFS does not provide legal, tax, or accounting advice. Clients of MFS should obtain their own independent tax and legal advice based on their particular circumstances.

-

Market movements

-

Controlling emotions

-

Long-term view

-

Diversification

-

Rebalancing

-

Working with an advisor

Markets are resilient: History shows declines don’t last.

Markets are always moving — up, down and sideways. While unsettling, market volatility is inevitable and completely normal.

The challenge for investors is to not let market declines get them off track as they seek to achieve long-term goals. Because time after time, stock markets have recovered from the disruptive, but ultimately short-term, declines — and gone on to post gains.

In the past 40 years, only 9 declines have led to a down year.

Moving out of stocks could lock in losses and may prevent you from profiting from any subsequent gains.

View Full Flyer

Source: FactSet and S&P US. Daily data as of 31 December 1979 to 31 December 2019. Returns above are in US dollars and calculated based on the S&P 500 Price Return Index. Max drawdown is the largest drawdown (peak-to-trough) within each calendar year.

Intrayear decline is the largest price drop from peak-to-trough during a calendar year.

Past performance is no guarantee of future results. These data are not intended to represent the performance of any MFS® portfolio. For more information on any MFS product, including performance, visit mfs.com.

The S&P 500 Index measures the broad US stock market. Returns for periods noted are price only.

It is not possible to invest directly in an index.

Remaining in the market

We’ve all heard the phrase “buy low, sell high.” Unfortunately, emotions — anxiety when the market declines or excitement when the market rallies — all too often cause investors to buy when prices are high and sell when prices are low. Poor market timing — selling to avoid declines or buying after a rally —can lessen your portfolio’s long-term potential. Investing for the long term and resisting the urge to time the market may be a better way to work toward achieving your goals.

Counter emotions with a sound long-term investment plan and a good financial coach.

View Full Flyer

Data sources: Strategic Insight Simfund/TD; SPAR, FactSet Research Systems Inc.

Index charts are for illustrative purposes only and not intended to represent future performance of any MFS® product.

Past performance is no guarantee of future results.

The S&P 500 Index measures the broad US stock market. Index performance does not include any investment-related fees or expenses. It is not possible to invest directly in an index.

The investments you choose should correspond to your financial needs, goals, and risk tolerance. For assistance in determining your financial situation, please consult an investment professional.

Building wealth takes time. Think long term.

Historically, investing in stocks has been one of the best ways to build wealth, compared to bonds. That’s because over long periods of time the stock market has generated positive returns. And moving in and out of the market — market timing — to avoid volatility rarely works. Your investment professional can help you build a portfolio that may help you ride out the ups and downs of the stock market and achieve your long-term goals.

As part of an overall portfolio, consider stocks for their long-term growth potential.

The investments you choose should correspond to your financial needs, goals, and risk tolerance. For assistance in determining your financial situation, consult an investment professional.

View Full Flyer

Source: FactSet and S&P US. Monthly data as of 30 December 1949 to 31 December 2019. Price returns are that of the S&P 500 Index in US dollars. The S&P 500 Index measures the broad US stock market. Index performance does not include any investment-related fees or expenses. It is not possible to invest directly in an index.

Common stocks generally provide an opportunity for more captial appreciation than fixed-income investments but have also been subject to greater market fluctuations. Keep in mind that all investments do not guarantee a profit or protect against a loss.

20 Years of the Best and Worst – A Case for Diversification

Everyone wants to be in the best-performing asset class every year. The thing is, few people are savvy enough to consistently choose the best. That’s why diversification is key. This chart shows annual returns for eight broad-based asset classes, cash and a diversified portfolio ranked from best to worst. Notice how the “leadership” changes from year to year, and how competitively the diversified portfolio performed over 20 years (see the “average” column).

Note that the diversified portfolio’s assets were rebalanced at the end of every quarter to maintain the equal allocations throughout the period. Standard deviation reflects a portfolio’s total return volatility, which is based on a minimum of 36 monthly returns. The larger the portfolio’s standard deviation, the greater the portfolio’s volatility. Diversification does not guarantee a profit or protect against a loss.

View Full Flyer

Don’t make unintended bets. Consider rebalancing your portfolio.

Market performance shifts over time — for example, stocks outperform bonds, value stocks outpace growth or US markets overtake international. These shifts can result in changes to your asset allocation, and in response, your portfolio could take on a more aggressive or conservative tilt. Rebalancing — bringing your portfolio back to its original allocation — can help you avoid this pitfall.

View Full Flyer

1Time periods above, reflecting a strong stock market and a strong bond market, respectively, are based on the performance of the indices defined below: Stocks are represented by the S&P 500 Index, which measures the broad US stock market. Bonds are represented by the Bloomberg Barclays US Aggregate Bond Index, which is the most common index used to track the performance of investment grade bonds in the United States.

The Benefits of Working With a Professional

An investment professional – who knows your goals, temperament for risk, time horizon and total holdings – could be your most valuable asset in any type of market environment.

The investment professional can

Help you determine your overall comfort level with risk

Allocate, diversify and rebalance your assets accordingly

Create the best possible financial strategy for pursuing long-term financial goals

Your investment professional can also review your overall investment portfolio, at least annually, to help keep you focused and on course with your goals. And as the market and your needs change over time, an investment professional will be right there with you, helping you make changes to your portfolio as necessary.

These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any other MFS investment product. MFS does not provide legal, tax, or accounting advice. Clients of MFS should obtain their own independent tax and legal advice based on their particular circumstances.

Related Insights

Resources and insights to help you navigate market volatility and keep on track to pursue you long-term goals.

How One Dollar Grew Over Time - Fundamental Investing

The Rule of 72 - Fundamental Investing

This site is intended for use by U.S. residents. If you are not a U.S. resident, please visit Other MFS Sites. ©2020 Massachusetts Financial Services Company.

45513.1