Markets in Motion: Shifts Transforming Economies and Markets

-

Strategist's Corner

Strategist's Corner

Market observations and investment outlook by MFS' Global Investment Strategist Rob Almeida

Strategist's CornerAs the Paradigm Shifts, Liquidity is Here to Stay

September 19, 2025History teaches us that governments struggle to rein in liquidity once it’s been unleashed. We’re entering a new paradigm in which tangible fixed investment is replacing financial engineering. In this new environment, the disruption of profit pools may advantage active managers.Strategist's CornerThe Wisdom of Earnings: Why EAFE’s Past Holds Lessons for its Future

August 26, 2025In the latest Strategist's Corner, Rob Almeida examines the role of earnings as the primary driver of market performance, contrasting the MSCI EAFE Index's outperformance during 2000-2008 with its lag over the past 15 years due to weaker earnings. Highlights include how economic shifts, including higher spending, input costs, and investment demands, may set the stage for future EAFE outperformance and underscores the importance of focusing on earnings fundamentals amidst changing global conditions to identify market opportunities.Strategist's CornerWhat Astronauts Can Tell Us About Passive Investing

August 19, 2025Global Investment Strategist and Portfolio Manager, Rob Almeida, comments on how active management’s underperformance may stem from suppressed market breadth, how suppressed interest rates distorted capital allocations on the economy and how higher costs and increasing market breadth are now creating opportunities for skilled active managers to differentiate themselves.

-

Market Insights

Market Insights

Market InsightShutdowns and Markets: Historically, Business as Usual

October 1, 2025Perspective on the historical market impacts of US Government shutdowns, noting their typically short-lived effects on GDP and market indices, while suggesting potential opportunities for active investors in sectors reliant on government funding.Market PulseMarket Pulse

September 3, 2025Leveraging expertise from the MFS Market Insights team to provide timely perspectives on economic and market dynamics that are top of mind for clients.

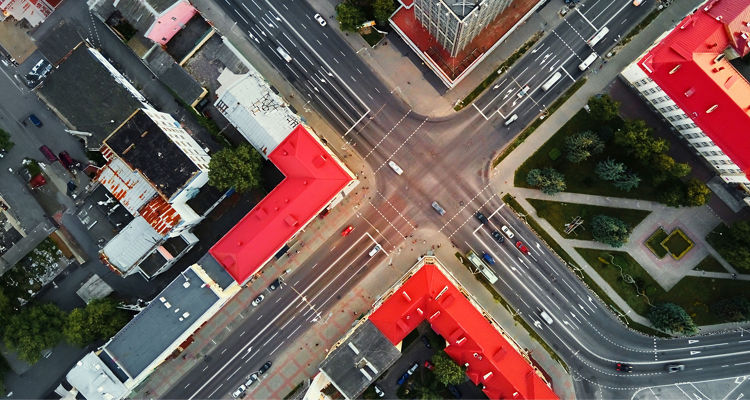

Market InsightThe Inside View Summary - Markets in Motion: Shifts Transforming Economies and Markets

August 27, 2025Our industry experts discuss how accelerating economic and market shifts across the globe have significant implications on asset allocations. In this summary, you'll learn how the structural shifts in today's rapidly evolving economic landscape is critical for long-term portfolio success. -

Long Term Capital Markets Expectations

Long Term Capital Markets Expectations

LTCMEMFS Long-Term Capital Market Expectations - Canada Edition

July 25, 2025Canada regional edition of our Long-Term Capital Market Expectations. These proprietary expectations represent a forward look of risk and return across asset classes and regions in Canadian Dollar terms.

LTCME2025 Expectations: A New Mindset for Portfolio Design

March 6, 2025Summary of the questions and answers from the February 2025 Long-Term Capital Market Expectations webcast.

LTCMEWebcast: 2025 Expectations - A New Mindset for Portfolio Design

February 4, 2025After a year that surprised many of us, what will 2025 bring? Watch the replay of our recent webinar for a discussion of 2024 market shifts and the impact of these changes on expectations for this year.

- English

- Institutions & Consultants

- Insights

- Market Insights

Strategist's Corner

Market observations and investment outlook by MFS' Global Investment Strategist Rob Almeida

As the Paradigm Shifts, Liquidity is Here to Stay

The Wisdom of Earnings: Why EAFE’s Past Holds Lessons for its Future

What Astronauts Can Tell Us About Passive Investing

Market Insights

Shutdowns and Markets: Historically, Business as Usual

Market Pulse

Leveraging expertise from the MFS Market Insights team to provide timely perspectives on economic and market dynamics that are top of mind for clients.

The Inside View Summary - Markets in Motion: Shifts Transforming Economies and Markets

Long Term Capital Markets Expectations

MFS Long-Term Capital Market Expectations - Canada Edition

Canada regional edition of our Long-Term Capital Market Expectations. These proprietary expectations represent a forward look of risk and return across asset classes and regions in Canadian Dollar terms.

2025 Expectations: A New Mindset for Portfolio Design

Summary of the questions and answers from the February 2025 Long-Term Capital Market Expectations webcast.

Webcast: 2025 Expectations - A New Mindset for Portfolio Design

After a year that surprised many of us, what will 2025 bring? Watch the replay of our recent webinar for a discussion of 2024 market shifts and the impact of these changes on expectations for this year.